Recently Funded Fix And Flip Loan In West Allis, WI

Loan Scenario:

This project features a fix and flip loan for a single-family property in West Allis, Wisconsin. The investor purchased the home for $196,000, with a renovation budget of $7,773. A total loan of $183,396 was secured through American Heritage Lending, resulting in a Loan-to-Cost (LTC) of 90.00% and a Loan-to-After Repair Value (LTARV) of 69.73%. The home is projected to reach an After Repair Value (ARV) of $263,000 upon resale.

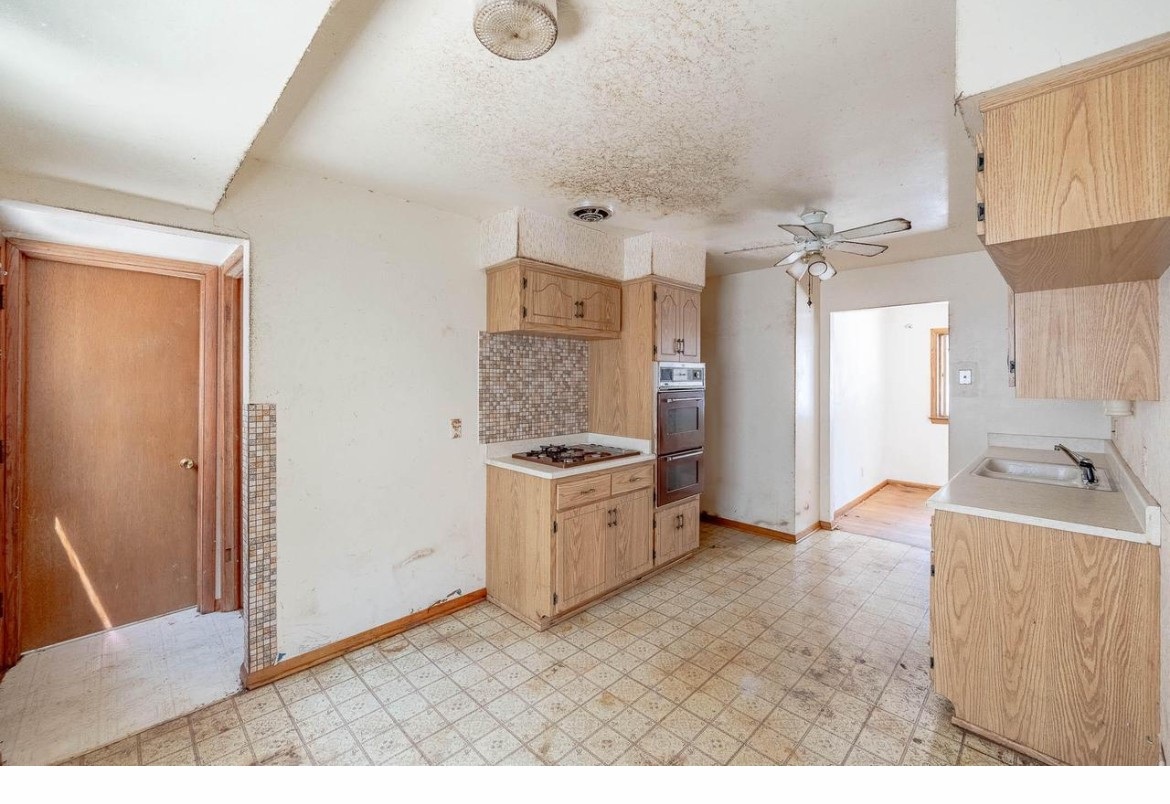

The investor, equipped with prior experience, focused on a fast and effective renovation strategy. Updates included new flooring throughout, fresh baseboards, and a full kitchen remodel featuring modern cabinetry, new countertops, and updated fixtures.

The bathroom was also upgraded with a new tub, vanity, toilet, and contemporary hardware. Fresh paint throughout gave the home a clean, move-in-ready feel, while new interior and exterior doors improved both energy efficiency and visual appeal. Updated lighting and hardware fixtures completed the transformation.

Located just outside Milwaukee, West Allis continues to attract buyers looking for turnkey homes in established neighborhoods. With well-executed updates and smart budgeting, this project was positioned to move quickly on the resale market.

This deal is another example of how American Heritage Lending supports experienced investors with efficient financing for fast-moving flips—providing the flexibility to execute clean, cost-effective renovations in competitive housing markets.

Key Deal Points

| Address | West Allis, WI |

| Loan Type | Fix & Flip |

| Borrower Profile | Experienced Investor |

| Property Type | Single Family |

| Purchase Price | $196,000 |

| Rehab Budget | $7,773 |

| After Repair Value | $263,000 |

| Loan Amount | $183,396 |

| Loan To Cost (LTC) | 90% |

| Loan To ARV (LTARV) | 69.73% |

Additional Images