CONSTRUCTION TO PERMENENT

Ground Up Construction To Permanent Financing In One Loan

Our Construction to perm RATES & TERMS:

Property Types

SFR 1 – 4 Units, PUD, Condo, Non-Warrantable Condo

Loan Amounts

$75,000 – $2,000,000

Term

12 Month Permanent, or 11 month interest-only loans available.

Loans Available

Loans are available to individuals with or without stated income, trusts, corporations, and limited partnerships.

Discover the future of financing with our groundbreaking construction-to-permanent loan – a revolutionary all-in-one solution for your financial needs. Experience the industry’s first seamless integration of construction and permanent financing in a single loan.

Build your dream investment property from the ground up with ease and confidence. Explore this innovative financial product today!

Real Estate Financing for Property Flippers

Introducing our cutting-edge financial product designed exclusively for forward-thinking real estate investors: the Ground Up Construction-to-Permanent Loan. This groundbreaking solution redefines the landscape of real estate financing, offering a seamless and comprehensive approach to fund your construction projects from inception to completion.

Imagine a single financing solution that combines the power of construction and permanent loans, eliminating the hassles of multiple applications, approvals, and paperwork. With our innovative product, you can embark on your ground up construction journey with confidence and clarity, knowing that your financial needs are comprehensively covered.

Key Features:

- Streamlined Process: Bid farewell to the complexities of managing separate loans. Our product simplifies the process by seamlessly transitioning from construction financing to a permanent mortgage, all in one cohesive package.

- Cost Efficiency: Consolidating construction and permanent financing translates into cost savings. Avoid double sets of closing costs and enjoy more favorable terms, optimizing your investment potential.

- Flexible Terms: Tailor your financing to your project’s unique timeline and needs. With flexible terms and repayment options, you’re empowered to take control of your investment strategy.

- Expert Guidance: Our experienced team of financial professionals stands ready to guide you through every step of the process. From planning to execution, we’re here to ensure your success.

- Accelerated Timelines: The transition from construction to permanent financing is seamless, allowing you to transition smoothly without unnecessary delays.

- Industry First: Our product stands as a pioneer in the industry, introducing a novel approach that reimagines real estate financing. As an industry first, it embodies innovation and progress.

Whether you’re a seasoned real estate investor seeking efficiency or a newcomer embarking on your first construction project, our Ground Up Construction-to-Permanent Loan empowers you to build with confidence. Revolutionize the way you fund your projects and unlock new levels of success in the world of real estate. Embrace the future of financing today.

?

Why choose A CONSTRUCTION TO PERMENENT LOAN WITH US?

Elevate your investment strategy by choosing our revolutionary Ground Up Construction-to-Permanent Loan over traditional alternatives like bridge loans or standalone ground up construction financing. Unlike bridge loans that often come with higher interest rates and short repayment windows, our integrated solution offers a holistic approach from construction inception to permanent financing, eliminating the need for additional refinancing steps.

Choosing standalone ground up construction financing might seem straightforward, but it leaves you facing the complexities of securing a separate permanent lending solution down the line. Our all-in-one solution streamlines the process, saving you time, money, and the hassle of navigating multiple loan applications and transitions.

With our innovative approach, you can confidently embark on your construction journey, knowing you have a comprehensive and efficient financing solution that paves the way for your long-term success in real estate investment.

Construction-to-Permanent Financing:

An Innovative Solution for Seamless Real Estate Investment

Discover a groundbreaking financial solution that reshapes the landscape of real estate financing – our Construction-to-Permanent (C2P) program. Effective from August 15, 2023, this program offers an all-in-one approach to financing your ground-up construction projects while seamlessly transitioning to permanent financing. Designed to streamline the process and eliminate the complexities of multiple loans, our C2P program empowers real estate investors to realize their visions with unmatched ease and efficiency.

Overview of Key Features:

Streamlined Process: Our C2P program offers a unique advantage over conventional alternatives, including bridge loans or standalone ground-up construction financing. With a single application and qualification process, you avoid the need for additional refinancing after construction completion.

Flexible Financing Options: We offer a range of permanent financing programs to suit various borrower profiles, including All Star, Rising Star, and Invest Star options. From full documentation to Debt Service Coverage Ratio (DSCR) qualifying, you have choices tailored to your investment strategy.

Loan-to-Value Ratios (LTV) and Loan-to-Cost (LTC) Ratios: Depending on the program, enjoy competitive LTV and LTC ratios up to 85% and 80%, respectively, facilitating significant leverage for your projects.

- Occupancy and Property Types: Whether you’re investing in a primary residence, second home, or investment property, our C2P program accommodates diverse occupancy needs. Eligible property types include single-family residences, condominiums, and non-warrantable condos.

- Credit and Financial Qualifications: Our program sets qualifying credit scores at a minimum of 680, with credit event seasoning requirements of up to 48 months. We address charge-offs, collections, judgments, and liens, ensuring a comprehensive assessment of financial stability.

- Property Requirements: Property conditions, square footage, and acreage criteria are tailored for each property type, ensuring your investment adheres to established guidelines.

- Appraisal and Seasoning: Appraisal requirements are set within a 120-day timeframe, while large deposits exceeding 50% of qualifying income must be sourced. Additionally, properties are required to be seasoned for 60 days.

- Maximizing Loan Amounts: The C2P program extends a range of loan amounts, with a cap of $2,000,000 for All and Rising Star Permanent Financing, and $1,500,000 for Invest Star Permanent Financing.

Elevate your investment game with our Construction-to-Permanent financing program, where innovation meets efficiency. From flexible terms and competitive ratios to comprehensive credit evaluations and transparent fees, this program encapsulates the future of real estate financing. Secure your success by embracing this innovative solution, tailor-made for forward-thinking investors seeking streamlined excellence.

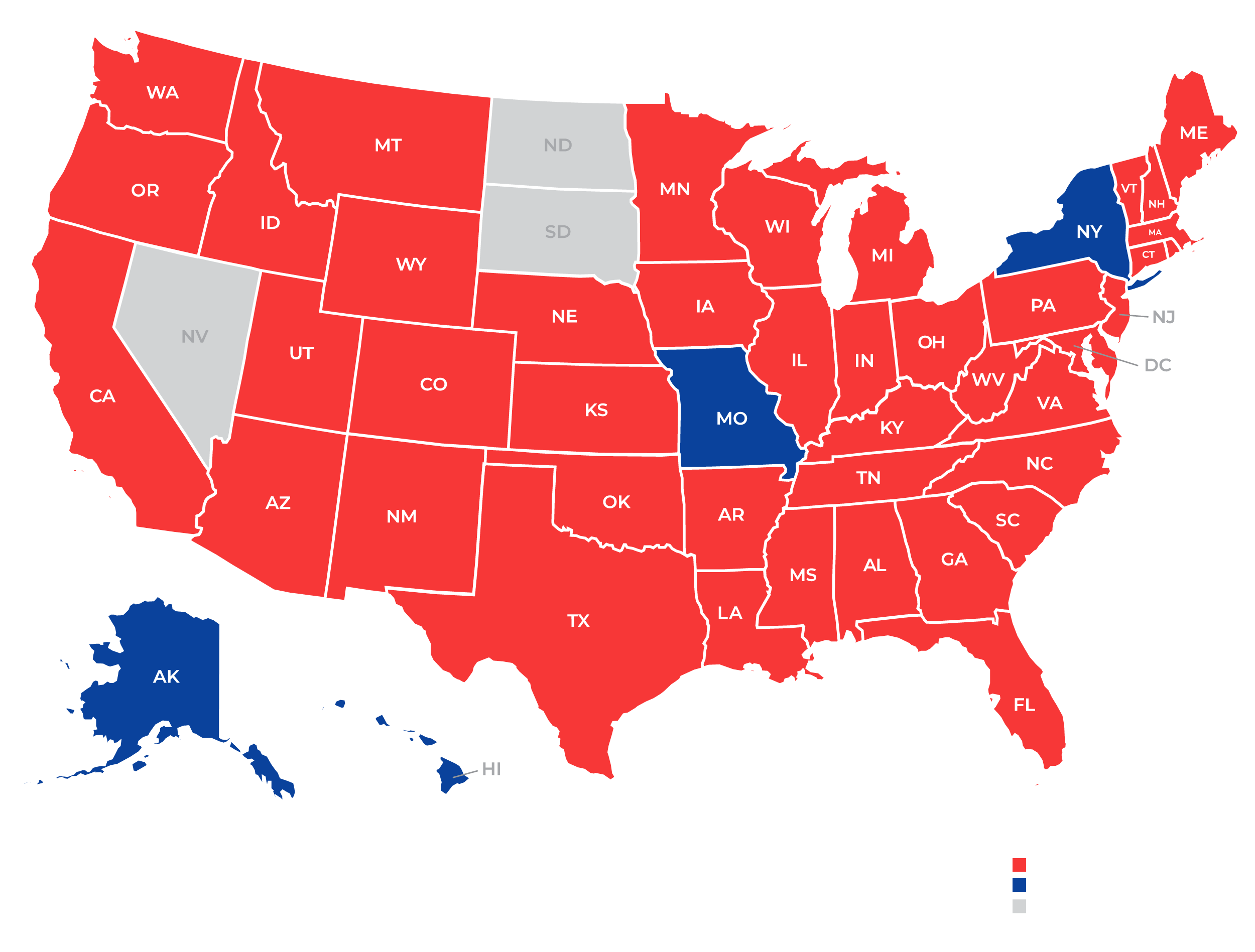

States We Lend In