Recently Funded Fix And Flip Loan In High Point, NC

Loan Scenario:

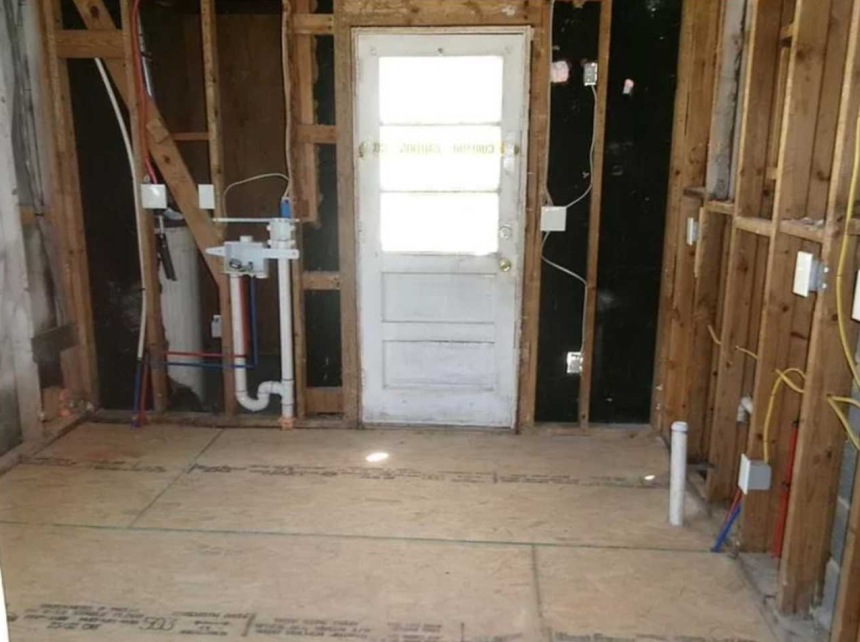

American Heritage Lending funded a Mid‑Renovation Completion Fix & Flip for an experienced investor in High Point, North Carolina. The borrower acquired the single‑family home for $88,500 and needed streamlined capital to complete the remaining scope. We issued a True Zero Point loan of $119,226, which equates to 93% Loan‑to‑Cost and 65% Loan‑to‑After‑Repair Value, based on an ARV of $185,000. The facility uses a digital‑first, flexible, fast, and easy draw process so the borrower can access funds quickly and keep trades moving without delays.

The remaining work focuses on market‑ready completion: plans/permits, garage and driveway finish, interior carpentry/trim, sheetrock and insulation, interior paint, flooring, kitchen completion (cabinets, counters, fixtures), bath refresh, electrical finish, new appliances, yard/landscaping cleanup, and hardware and finish details, with a contingency to resolve any punch‑list surprises. This targeted program provides the leverage and speed needed to bring a partially completed renovation to the finish line and ready it for retail resale in the High Point market.

Key Deal Points

| Address | High Point, NC |

| Loan Type | Fix & Flip – Mid Renovation Completion Loan |

| Borrower Profile | Experienced Investor |

| Property Type | Single Family Detached |

| Purchase Price | $88,500 |

| Rehab Budget | $39,700 |

| After Repair Value | $185,000 |

| Loan Amount | $119,226 |

| Loan To Cost (LTC) | 93% |

| Loan To ARV (LTARV) | 65% |

| Loan Structure | True Zero Point Loan |

Additional Images