For seasoned and aspiring investors alike, there’s a new center of gravity forming in the U.S. rental market—and it’s not the 200-unit Class A complex with the rooftop pool or the single-family rental in suburbia. It’s the 5–10 unit multifamily property. This underappreciated segment is quickly becoming a strategic cornerstone for savvy real estate investors looking to combine scale, flexibility, and yield. If you’re serious about building long-term wealth through income-generating property, it’s time to take a closer look at this middle-market niche.

At American Heritage Lending, we’re watching this trend closely. Our team of analysts, underwriters, and capital markets pros are building out one of the most competitive DSCR loan programs specifically for 5–10 unit buildings. Why? Because the fundamentals support it—and because we see where smart capital is going. Let’s walk through the data, the financing, the markets, and the strategy that make this sector such a compelling play.

What’s So Special About 5–10 Unit Properties?

The 5–10 unit segment lives in the gray area between residential and commercial real estate. It’s not quite big enough for institutional investors and often too operationally intensive for part-time landlords. But for professional investors who know what to look for, it’s a sweet spot where the numbers work, the cash flow scales, and the competition thins out. Think of it as the entrepreneurial sweet spot of multifamily investing—small enough to remain agile, large enough to build real wealth.

Here’s what differentiates 5–10 unit multifamily:

Here’s what differentiates 5–10 unit multifamily:

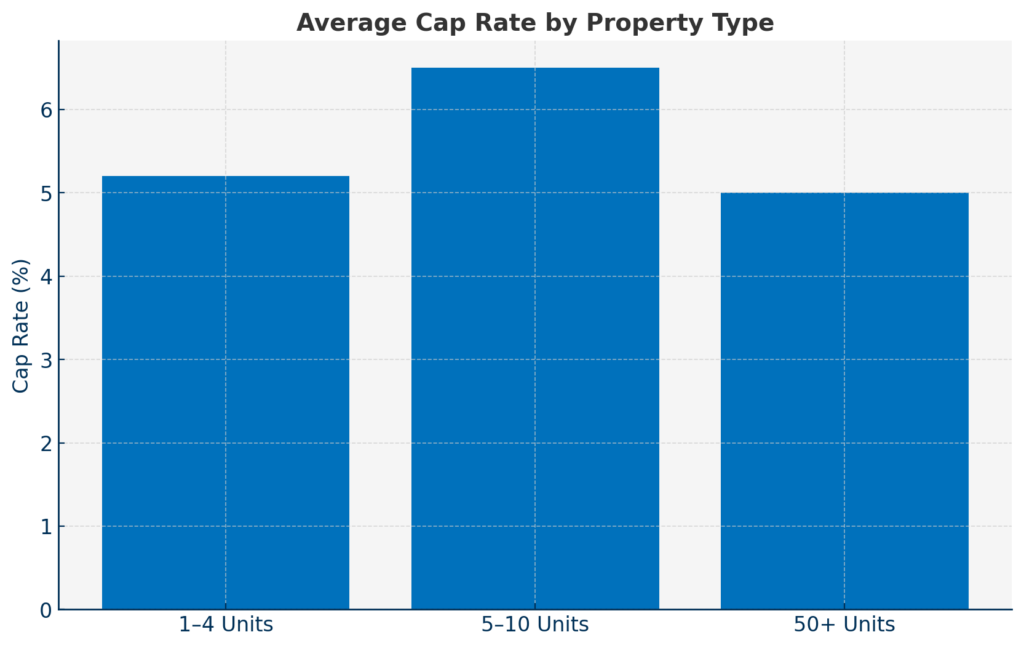

- Higher Cap Rates: While institutional multifamily in top markets trades around 5.0% cap rates, 5–10 unit properties often yield 6.0%–7.0%, providing better cash-on-cash returns.

- Stability Through Diversification: Compared to single-family or duplex investments, a 6 or 8-unit building offers more rental income streams, mitigating vacancy risk.

- Professional Financing Without Institutional Complexity: DSCR-based financing opens the door to long-term, fixed-rate loans with minimal documentation, giving investors institutional-style leverage without red tape.

- Flexible Property Management Options: With fewer than 10 doors, many investors choose to self-manage or use boutique firms, maintaining control without the headaches of larger properties.

The result? You’re in control of your appreciation, your cash flow, and your exit.

Market Fundamentals: What the Data Says

Let’s ground this in the numbers. According to Arbor and Chandan Economics, the small multifamily sector (5–50 units) has consistently outperformed broader multifamily during periods of volatility. As of Q4 2024:

Let’s ground this in the numbers. According to Arbor and Chandan Economics, the small multifamily sector (5–50 units) has consistently outperformed broader multifamily during periods of volatility. As of Q4 2024:

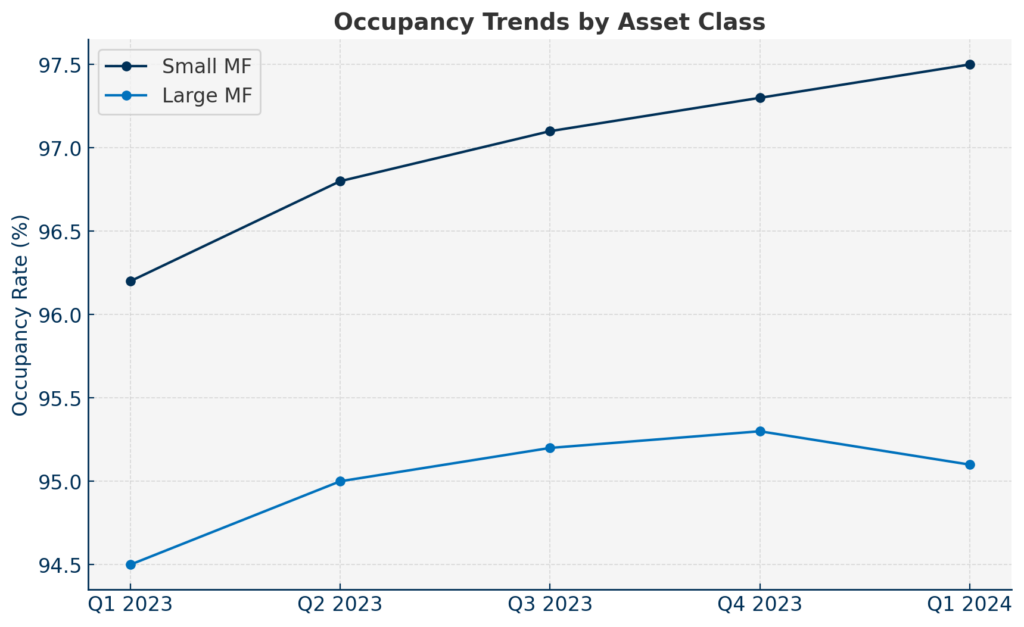

- Occupancy sits at 97.5%, even with national vacancy rising slightly in larger complexes.

- Cap rates for small multifamily have risen to 6.1%, creating a more attractive entry point compared to the peak pricing of 2022.

- Asset values are rebounding, with back-to-back quarterly price gains in late 2024 after a ~15% correction from the previous peak.

Other data points worth noting:

- Rent collection rates remain strong, with collections above 94% across the small multifamily sector.

- Turnover is lower than in large multifamily buildings, particularly in workforce housing segments where tenants value stability.

- Construction of new 5–10 unit buildings is limited, creating a supply/demand imbalance that benefits owners.

The reason for this resilience is simple: demand. The U.S. housing shortage hasn’t gone anywhere. In fact, many would-be homebuyers have been priced out of ownership by high interest rates and home values, turning instead to the rental market. That demand disproportionately supports the “missing middle” product that small multifamily offers—units that are affordable, well-located, and scaled for efficiency.

This trend isn’t just anecdotal. Institutional players like Blackstone and Greystar have quietly begun acquiring portfolios of 5–10 unit assets in select markets—proof that the investment thesis is strong even at scale.

The Financing Advantage: How DSCR Loans Are Unlocking Access

Historically, financing a 5–10 unit deal was a challenge. You were too big for residential loans, but too small for institutional lenders to care. That left investors at the mercy of local banks with full-doc underwriting, short amortizations, and inconsistent terms. Many walked away from good deals simply because the capital stack didn’t pencil.

Today, the rise of DSCR (Debt-Service Coverage Ratio) loans has changed the landscape entirely. These non-QM loan programs are built specifically for rental property investors—and 5–10 unit deals are ideal candidates.

Here’s how it works:

- Qualify Based on Property Income: DSCR loans don’t require tax returns or W-2s. As long as the property’s income covers its debt obligations (typically at a DSCR of 1.10x or higher), the deal is financeable.

- 30-Year Fixed Terms Available: Unlike traditional commercial loans, which balloon after 5–10 years, DSCR loans often offer full 30-year amortization—some with interest-only options.

- 75% LTV on Purchases: Most multi-family programs lend up to 75% on purchases, with 70% or less on cash-out refinances.

- Streamlined Closings: Because qualification is based on rent roll, expenses, and credit score, deals can close in as little as 2–3 weeks.

This is especially valuable in today’s rate environment, where institutional debt has tightened and community bank lending has become more restrictive. The ability to access non-recourse, asset-based lending with favorable terms opens the door to rapid portfolio growth.

At AHL, we’ve tailored our DSCR loan program to give investors flexibility, speed, and certainty. Whether you’re refinancing a 10-unit in Tucson or acquiring a stabilized 6-plex in Tampa, the structure is built to help you scale. Our team works directly with investors to structure the right leverage, lock in competitive rates, and close quickly.

Strategic Comparison: How 5–10 Units Compare

Vs. Single-Family Rentals (SFRs):

- SFR cap rates are lower, especially in competitive metros.

- Managing multiple SFRs across different addresses increases operational drag.

- SFRs are priced emotionally in many cases, meaning your appreciation is at the mercy of the market.

- Loan limits often cap how many SFRs an investor can comfortably finance at once.

Vs. 1–4 Unit Multi (2–4 Plex):

- If using a bank. you’re limited to residential loan caps (usually 10 financed properties max).

- These assets still suffer from lumpy cash flow when a single unit goes vacant.

- DSCR financing is available, but 5+ units open doors to more scalable commercial lending.

- Many markets are seeing intense competition and compression in 2–4 unit pricing, lowering upside.

Vs. Large Multifamily (50+ Units):

- Lower barrier to entry (no syndication needed).

- You maintain operational control and avoid overpaying in bidding wars with institutional buyers.

- Easier to reposition and exit without dealing with massive capital stacks.

- More flexibility on CapEx and tenant strategy; no pressure to meet complex underwriting hurdles.

Put simply, 5–10 units offer an optimal blend of scalability, yield, control, and agility. They work in up cycles and down cycles. They produce income and appreciation. They are, increasingly, the go-to asset class for the modern rental investor.

Where the Opportunities Are: Markets to Watch

With the national spotlight still focused on major coastal metros and large Class A multifamily developments, the 5–10 unit space often flies under the radar. But for investors who dig into the data and local dynamics, there are golden opportunities emerging in cities that offer both yield and upside potential.

We’re tracking dozens of metros where small multifamily is not just viable—it’s thriving. These markets show strong economic fundamentals, favorable regulatory environments, stable or growing populations, and a clear lack of new supply in the 5–10 unit segment. Here’s a deeper look into the ones leading the way:

We’re tracking dozens of metros where small multifamily is not just viable—it’s thriving. These markets show strong economic fundamentals, favorable regulatory environments, stable or growing populations, and a clear lack of new supply in the 5–10 unit segment. Here’s a deeper look into the ones leading the way:

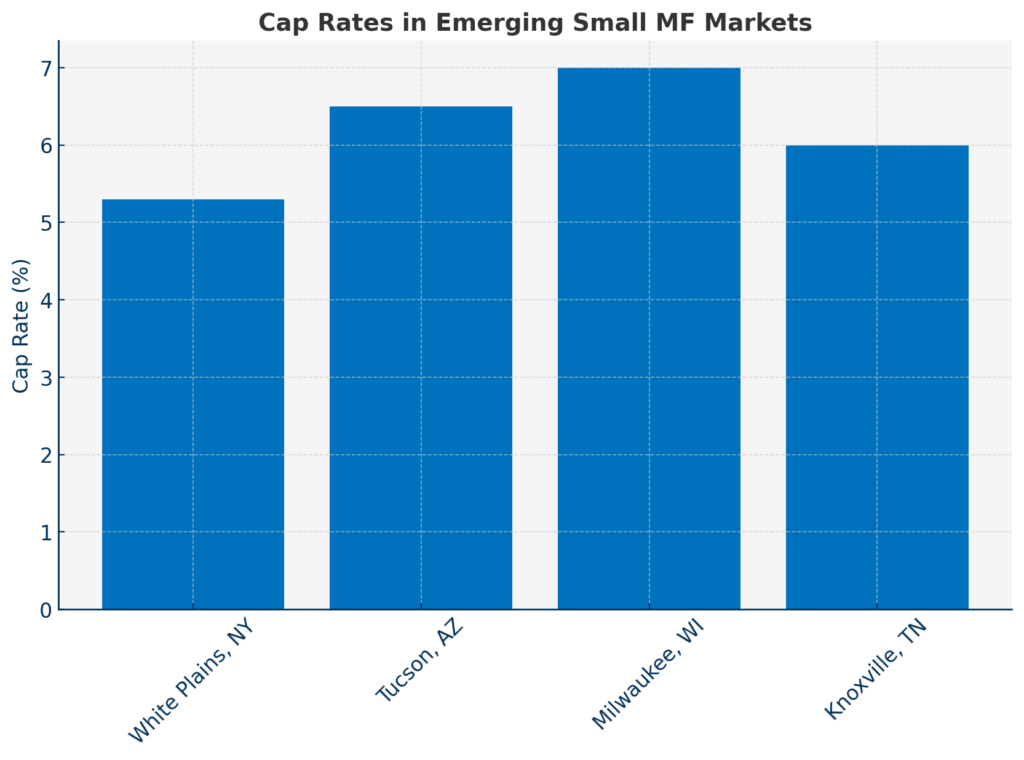

1. White Plains, NY (Suburban NYC)

- Occupancy: 97%

- Average Price/Unit: $389,000

- Cap Rate: 5.3% (higher for older B-class assets)

- Median Rent (2-Bedroom): ~$2,900/month

- Why It Works: White Plains benefits from spillover demand from New York City but offers lower costs, quieter neighborhoods, and excellent rail access into Manhattan. Inventory is tight, zoning is restrictive, and institutional presence is low. The city’s strong healthcare and legal employment base ensures steady demand for workforce housing, making it a landlord-friendly environment for midsize buildings.

2. Tucson, AZ

- Occupancy: 92% (stabilizing)

- Rent Growth: ~2.0% YoY

- Cap Rate: 6.5%+

- Median 5–10 Unit Sale Price/Unit: ~$115,000

- Why It Works: Tucson has consistently ranked among the top secondary markets for population growth, thanks to its appeal to retirees, students, and remote workers. Compared to Phoenix, it offers a lower cost of entry and less development pressure. Investors are finding 1970s-era 6-plexes and 8-plexes in infill neighborhoods with room for moderate renovation and rent bumps. The University of Arizona ensures a constant influx of renters.

3. Milwaukee, WI

- Top National Rent Growth in 2024: ~4.3%

- Cap Rate: 7%+ on older buildings

- Median Sale Price/Unit (5–10 Units): ~$85,000

- Why It Works: Milwaukee is emerging as a sleeper market in the Midwest. A growing med-tech and education sector, strong blue-collar employment, and limited new supply all support investor interest. The city has avoided the overbuilding seen in places like Dallas and Atlanta. Older brick buildings in walkable neighborhoods like Bay View and Riverwest often trade at a discount to replacement cost, with significant value-add potential.

4. Knoxville, TN

- Occupancy: 96%

- Job Growth: 1.8% in 2024

- Cap Rate: 6.0%

- Why It Works: Knoxville is a university anchor market with a strong healthcare and manufacturing presence. The city continues to see inward migration from more expensive metros. Investors are drawn to its affordability, low property taxes, and pro-landlord laws. Neighborhoods near the University of Tennessee or close to downtown are increasingly popular for both young professionals and retirees, creating durable rental demand for small multifamily assets.

Other High-Potential Markets:

- Cincinnati, OH: Strong working-class demand, reinvestment in the urban core, consistent rent performance, and light rent regulation.

- Lexington, KY: Underbuilt rental housing, growing student population, and relatively high cap rates in C-class properties.

- San Antonio, TX (B neighborhoods): Influx of population, pro-growth policies, and limited new supply in small multifamily.

- Worcester, MA: Boston spillover demand, commuter rail access, and pricing ~40% lower than metro Boston equivalents.

In many of these metros, the 5–10 unit inventory is older but structurally sound—ideal for cosmetic value-add strategies or turnkey stabilization plays. The average days-on-market for 5–10 unit listings in these cities has dropped steadily since mid-2023, indicating rising investor demand.

Investors should also consider data from CoStar and Yardi Matrix, which show that in Q1 2025, small multifamily assets (under 50 units) outperformed large multifamily in net operating income growth (2.9% vs. 1.4%), and maintained higher average occupancy by nearly 150 basis points.

The common denominator across these markets? Demand for affordable, walkable, middle-market rentals; relative insulation from luxury overbuilding; and plenty of room for entrepreneurial improvement. In other words: the perfect environment for small multifamily investors looking to buy smart and build equity over time.

What to Watch Out For: Risks and Red Flags

Every asset class has its challenges, and the 5–10 unit multifamily space is no exception. While the fundamentals remain strong, investors must approach this segment with diligence and a clear understanding of the risks involved. Here are the top watch-outs to consider when evaluating deals:

- Oversupply in Sun Belt Markets: Cities such as Austin, Dallas, Charlotte, and parts of Atlanta experienced record-setting multifamily deliveries in 2023–2024. While this new inventory is mostly in the 200+ unit Class A segment, the oversupply can still put pressure on rents across all property types. Look for submarkets with limited new construction, strong population inflows, and wage growth that supports current rent levels. Use tools like Yardi Matrix and local building permit databases to verify the supply pipeline.

- Rent Control Jurisdictions: States like California, New York, and Oregon have implemented or expanded rent control and stabilization laws. In cities like Los Angeles, San Francisco, and New York City, buildings with 5+ units can be subject to limits on rent increases, eviction restrictions, and mandatory registration. Know the thresholds and timelines—some jurisdictions exempt newer buildings or small owners. Consult a local attorney before acquiring any property in a regulated market.

- Underwriting Constraints: DSCR lenders base loan decisions on in-place income, not projected future rents. That means if you’re buying a value-add building with below-market rents, you may not qualify for maximum leverage until you stabilize. For example, a property that operates at a 0.95 DSCR today won’t underwrite, even if post-renovation rents will push it above 1.20. Accurate operating expenses, real rent schedules, and detailed renovation timelines are critical.

- Liquidity Risk: Unlike single-family homes or large apartment complexes, 5–10 unit properties operate in a thin buyer pool. In some tertiary markets, there may only be a handful of qualified buyers at any given time. This can elongate exit timelines or require price concessions if you need to sell quickly. To mitigate this, focus on well-located assets with strong cash flow, and avoid over-leveraging.

- Management Intensity: These properties sit in an operational gray area—too big for hobbyist self-managing landlords, but not always large enough to attract professional third-party management. This means that management quality varies wildly. Poor oversight leads to tenant turnover, maintenance issues, and NOI erosion. Consider working with boutique firms specializing in small multifamily or using tech-forward platforms like Hemlane or Rentec Direct to maintain control.

- Insurance Costs and Regulatory Headwinds: Insurance premiums have surged in many states, especially in Texas, Florida, and parts of California. Higher premiums erode net operating income and complicate underwriting. Investors should budget conservatively and ensure properties meet current safety codes to avoid disqualification or cost spikes during policy renewals.

- CapEx Surprises in Vintage Buildings: Many 5–10 unit assets were built 50+ years ago. Deferred maintenance and aging infrastructure can create unexpected capital expenses. Common culprits include old roofs, galvanized plumbing, knob-and-tube wiring, and outdated HVAC. Always perform thorough inspections, budget for CapEx, and confirm utility separation (or lack thereof) before purchase.

By approaching these risks with eyes wide open, investors can avoid costly missteps and capitalize on the unique advantages this asset class offers. The best deals often involve solving problems others aren’t willing to tackle—but doing so requires preparation, precision, and a solid team.

Final Thought: It’s a Scalable Wealth Vehicle

The 5–10 unit multifamily space has long been a hidden gem—underappreciated by large institutional investors, yet holding immense potential for private individuals and growing investment firms. In today’s real estate climate—marked by economic uncertainty, rising rates, and shifting demand—the fundamentals of this segment shine brighter than ever.

This asset class provides an ideal intersection of scalability and control. For investors looking to grow their portfolio without jumping into the deep end of institutional-sized assets, 5–10 unit properties offer a powerful middle ground. You can build equity through hands-on operational improvements, increase rents without overhauling the building, and expand your footprint without needing capital partners or syndication.

They give investors:

- Institutional-style valuation models that respond to NOI improvements

- Portfolio scalability without sacrificing agility or decision-making power

- Resilience against vacancy and turnover thanks to diversified income streams

- Cash-flow consistency, especially in stable workforce housing segments

- Flexibility in exit options, including refinancing, 1031 exchanges, or long-term cash flow holds

Additionally, the financing landscape is more favorable than ever. With DSCR loans reducing barriers to entry, more investors can now access fixed-rate, long-term, financing on these properties without wading through traditional bank red tape. That means faster execution, less paperwork, and greater leverage on your time and capital.

It’s also important to remember the macro trends underpinning this sector: millennial renters aging into family formation years, Gen Z continuing to delay homeownership, and a shortage of appropriately sized and priced housing in urban and suburban infill markets. The 5–10 unit segment directly serves these renters—offering housing that is more affordable than luxury apartments and more community-driven than large towers.

Whether you’re transitioning from 1–4 units, scaling beyond single-family rentals, or looking to consolidate underperforming holdings into more efficient assets, the 5–10 unit strategy deserves your focus.

The next cycle of real estate winners won’t just be buying big—they’ll be buying smart. In today’s market, buying smart means targeting that scalable, profitable, overlooked sweet spot in multifamily. If you’re ready to grow your wealth with precision, purpose, and real estate fundamentals on your side—the 5–10 unit space is calling.

Frequently Asked Questions

Why are 5–10 unit multifamily properties becoming so popular with investors?

Because they sit in the sweet spot: they offer better cap rates than large apartments, more stability than single-family rentals, and far less competition than institutional-grade multifamily. They scale cash flow quickly without requiring massive capital or complex syndication structures.

How does DSCR financing help investors acquire and scale 5–10 unit buildings?

DSCR loans qualify based on the property’s income, not borrower tax returns—giving investors access to long-term, fixed-rate financing with streamlined underwriting. Deals that used to require local banks and heavy paperwork can now close in 2–3 weeks with predictable terms.

What risks should investors watch out for when buying 5–10 unit properties?

Key risks include aging infrastructure, rent control in certain states, oversupply in select Sun Belt metros, rising insurance costs, and thin buyer pools in tertiary markets. Proper due diligence, conservative underwriting, and strong property management help offset most risks.

Which U.S. markets are currently strongest for 5–10 unit multifamily investing?

Markets like White Plains (NY), Tucson (AZ), Milwaukee (WI), Knoxville (TN), Cincinnati (OH), and Worcester (MA) are seeing strong demand, limited new supply, and attractive cap rates. They combine affordability with tenant stability and fewer competing buyers.

Sources

-

Arbor Realty Trust & Chandan Economics – Small Multifamily Investment Trends Reports (Q4 2024)

-

Yardi Matrix – Rent growth, occupancy, and supply pipeline data (Q1 2025)

-

CoStar – Market-level price per unit, NOI growth, and occupancy rates

-

Zillow & Redfin Market Data – Median rent and home pricing trends by metro

-

U.S. Census Bureau – Demographic migration patterns and housing supply statistics

-

National Multifamily Housing Council (NMHC) – Regulatory updates and rent control legislation

-

Blackstone & Greystar public statements and acquisition records – Investment activity in small multifamily portfolios

-

Local MLS and broker reports – White Plains, Tucson, Milwaukee, Knoxville, etc. (unit pricing and cap rate trends)

-

Rentec Direct, Hemlane, and RentRedi – Property management tech platforms for small landlords

-

HUD and Freddie Mac Multifamily Reports – Affordable housing shortages and construction trends

-

Federal Reserve Economic Data (FRED) – Interest rate trends and mortgage lending conditions