Introduction to the 2025 Real Estate Investor Market

The real estate investor market in 2025 is shaping up to be a test of adaptability, strategic thinking, and persistence. Investors across the country are contending with a dynamic landscape marked by high interest rates, tight housing inventory, and elevated construction costs. Despite these headwinds, opportunities continue to surface for those willing to adjust their strategies and embrace a data-driven approach. Through careful market analysis and regional targeting, experienced investors are still managing to find profitable deals.

This extended analysis offers a detailed quarter-by-quarter look at the U.S. real estate investor market, focusing on three key segments: fix and flip properties, small rental properties (up to 10 units), and ground-up residential construction. In addition to national trends, we explore notable regional differences, strategic shifts among investors, and what the remainder of 2025—and beyond—may hold

Q1 2025: A Cautious Start with Shifting Dynamics

Fix and Flip Activity

The first quarter of 2025 revealed a market that was both resilient and restrained. Home flipping activity slowed to its lowest level in six years. According to ATTOM Data Solutions, 67,394 single-family homes and condos were flipped in Q1, making up 8.3% of all home sales. Although this share edged up from 7.4% in Q4 2024, it was still below the 8.7% recorded in Q1 2024.

Flippers faced significant margin compression. The median gross profit on a flip was $65,000, translating to a 25% gross ROI before expenses. Rising renovation costs—driven by a 10% tariff on imported building products, adding about $10,900 per project—made it harder to achieve pre-pandemic margins. High home prices reduced the availability of undervalued properties, forcing flippers to focus on smaller, entry-level homes where demand remains strong. Investors relying on financing also faced increased costs due to double-digit hard money rates, with many pivoting to private and institutional lenders like AHL for more competitive terms and faster funding.

Rental Property Market

Rental property investors encountered their own set of challenges. Gross rental yields averaged 7.45% in Q1 2025, down from 7.52% in 2024, reflecting a trend where home prices are rising faster than rental income. Approximately 46,726 homes were purchased by investors, representing 19% of total home sales. While investor activity grew slightly (up 2% year-over-year), overall sentiment remained cautious as buyers sought value-driven markets. The Midwest and Southeast continued to outperform, with Detroit, Cleveland, and Birmingham reporting rental yields above 9%. Many investors turned to private funding partners like AHL to secure DSCR-based loans and short-term rental financing, bypassing conventional lending hurdles.

Ground-Up Construction

Ground-Up Construction

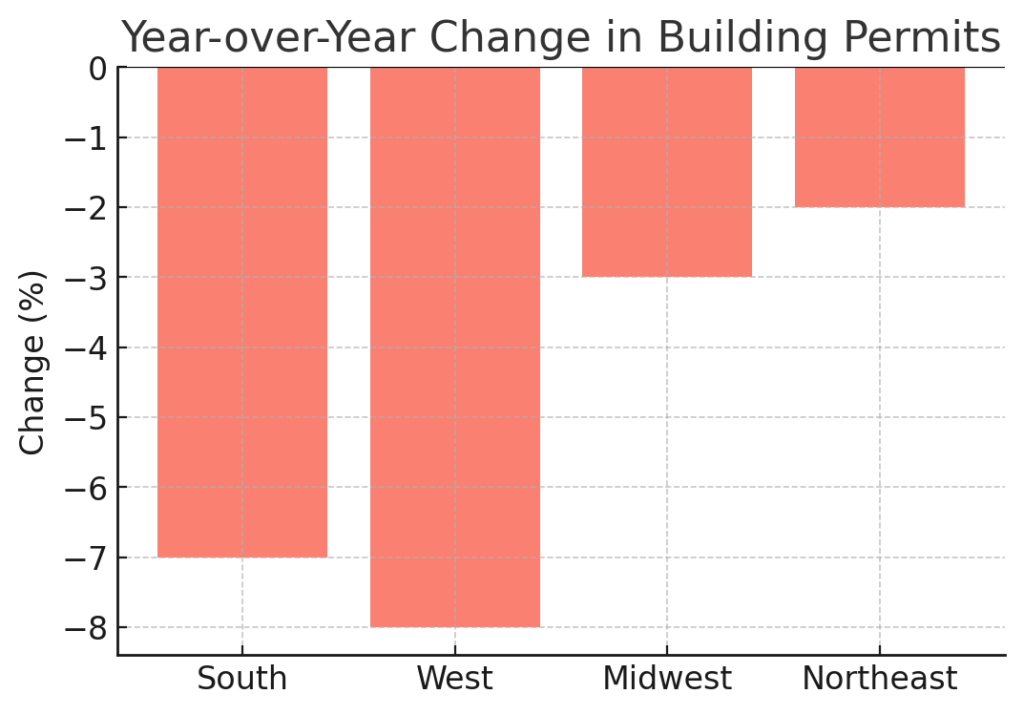

Ground-up construction slowed due to financing constraints and elevated costs. Single-family building permits dropped by 6.1% year-over-year from January to May, with the South and West seeing declines of 7–8%. Small and mid-sized builders found it difficult to compete with large national developers, who leveraged economies of scale and institutional partnerships to stay active. Construction loans pricing and ongoing material tariffs strained margins, prompting smaller developers to explore alternative funding solutions.

Q2 2025: A Landscape of Selective Growth

Fix and Flip Activity

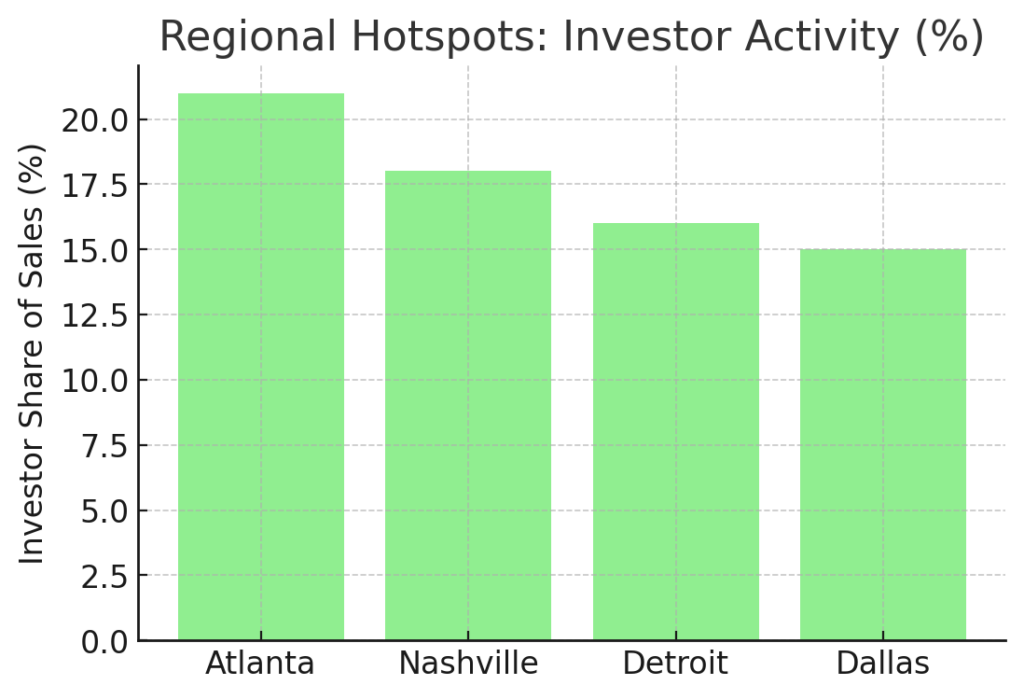

By Q2, flipping activity remained subdued. Gross ROI hovered around 24–25%, and competition for affordable inventory remained fierce. The share of all-cash purchases rose to over 60%, highlighting the challenges of financing flips with double-digit hard-money loan rates. In markets like Atlanta and Memphis, flips still represented more than 10% of total home sales, driven by strong buyer demand and tight supply. Private and institutional lenders, such as AHL, became key partners for investors seeking fast capital to stay competitive, offering bridge loans that allowed flippers to act quickly on distressed properties.

Rental Property Market

For rental investors, Q2 was characterized by stability. Investor purchases held at around 20% of all home sales, with activity strongest in markets offering above-average cash flow. Midwest cities like Pittsburgh and Cleveland saw rental yields exceed 9%, while expensive metros such as San Francisco and Los Angeles offered yields closer to 3–4%, discouraging new investments. Investors increasingly utilized DSCR loans and tailored products from private lenders to scale rental portfolios while maintaining flexibility in their financing structures.

Ground-Up Construction

Construction activity remained muted, especially for small developers who faced rising input costs and limited access to traditional bank financing. Larger builders accounted for 50% of all new-home construction nationally, up from 25% in 2005, as they leveraged capital and incentives to maintain market share. Smaller builders increasingly turned to institutional private lenders like AHL to fund new developments, particularly for build-to-rent projects that could deliver higher long-term returns in tight rental markets.

Regional Trends and Hotspots

Florida

Florida remains a tale of two markets in 2025. While coastal metros such as Miami, Orlando, and Fort Lauderdale have experienced a sharp decline in investor activity—down 19%, 13%, and 12% respectively—due to skyrocketing insurance premiums and property tax hikes, suburban and inland areas like Tampa Bay and Jacksonville have shown pockets of resilience. Investors targeting single-family rentals have shifted their attention to these markets, where entry prices remain relatively lower, and rental demand is supported by ongoing population growth and job expansion. Florida’s new building codes and flood insurance reforms are also reshaping how investors evaluate risk, with a focus on newer construction and elevated homes.

Southeast

Southeast

The Southeast continues to be one of the most active regions for investors in 2025. Cities like Atlanta, Charlotte, Raleigh, and Nashville are benefiting from strong in-migration, particularly from Northeastern and West Coast markets. Atlanta and Macon, GA, stand out for their high flipping activity, accounting for 16–21% of all local sales, driven by affordable inventory and strong resale demand among first-time homebuyers. Nashville’s rental market has remained robust, with average rent growth of 4.2% in Q2 2025, bolstered by a growing tech sector and tourism industry.

Midwest

The Midwest continues to shine for investors seeking high cash-on-cash returns and stable rent demand. Markets like Detroit, Cleveland, Indianapolis, and Kansas City offer rental yields in the 9–11% range, making them particularly attractive for buy-and-hold investors. Cuyahoga County (Cleveland) reported one of the highest average rental yields at 10.1%, while Wayne County (Detroit) remains a hotspot due to both affordability and a steady flow of blue-collar job growth. Investors are also taking advantage of municipal incentives and tax abatements aimed at revitalizing aging housing stock in these areas.

Texas

Texas continues to present mixed signals. While Dallas-Fort Worth and Houston remain high-volume investor markets thanks to population and job growth, Austin’s median flip ROI has plummeted to just 1%, effectively erasing profit margins after renovation expenses. The rapid price appreciation seen during 2020–2022 has leveled off, and investors are finding better opportunities in secondary markets like San Antonio and Waco, where entry prices are more aligned with rental income potential.

West Coast

High-cost markets such as San Francisco, Los Angeles, and Seattle continue to challenge investors due to thin rental yields (3–4%) and elevated acquisition costs. However, there is renewed interest in suburban and exurban areas just outside these metros, where price corrections have created more favorable entry points. Sacramento and Riverside, CA, for example, have seen modest upticks in investor activity, particularly for single-family rentals catering to households priced out of core urban markets.

Mountain West

Markets like Boise, Salt Lake City, and Denver are showing signs of recovery after sharp price corrections in 2022–2023. Investors who focus on mid-priced homes are finding opportunities to acquire properties at 10–15% discounts compared to peak valuations. Denver’s rental demand remains strong, driven by a robust job market in technology and renewable energy sectors, while Salt Lake City’s growing population is fueling both rental and fix-and-flip activity.

Northeast

While not traditionally seen as investor-friendly due to high taxes and regulation, parts of the Northeast—particularly Philadelphia, Pittsburgh, and certain suburbs of New Jersey—are experiencing increased interest. Pittsburgh’s high rental yields (approaching 9.5%) and affordable housing market are attracting small-scale investors, while Philadelphia’s redevelopment zones are creating fix-and-flip opportunities for those willing to take on urban renovation projects.

Investor Strategies in 2025

- Shift to Buy-and-Hold: Many flippers are now prioritizing rentals for stable cash flow. With appreciation rates slowing, building long-term wealth through rental income has become more appealing, particularly in markets with strong rent growth.

- Creative Financing: Traditional financing remains expensive, leading many investors to explore alternative funding sources. Private lenders and institutional private lenders like American Heritage Lending are playing a crucial role by offering flexible loan programs, including DSCR-based products and bridge loans. These financing solutions allow investors to move quickly on competitive deals without being hamstrung by traditional bank underwriting. Partnerships, seller-financed deals, and assumable mortgages are also popular tools for navigating high-rate environments.

- Mid-Term Rentals: Targeting remote workers, healthcare professionals, and corporate clients with 30- to 90-day rentals is becoming a lucrative niche. These rentals generate higher income than traditional leases while avoiding the regulatory hurdles often associated with short-term vacation rentals.

- Value-Add Improvements: Investors are focusing on cost-effective upgrades that enhance both rental income and property value. Popular improvements include adding accessory dwelling units (ADUs), installing energy-efficient systems, and undertaking targeted renovations that appeal to first-time buyers or long-term renters.

- Geographic Diversification: Many investors are spreading risk by building multi-state portfolios. By diversifying into both cash-flow markets (e.g., Midwest) and appreciation markets (e.g., Southeast), investors can balance steady income with potential long-term gains.

Forecast for Q3 and Beyond

Home Price Outlook

As of mid-2025, 30-year mortgage rates remain at 6.7–6.8%, but forecasts suggest a gradual decline to 6.1% by late 2025 and 5.8% by 2026. This anticipated decrease in rates is expected to have a ripple effect on the real estate investor market, potentially unlocking demand among both buyers and investors who have been waiting on the sidelines. Lower financing costs would improve cash flow for rental properties and increase ROI for flippers who rely on financing for acquisitions and renovations.

As of mid-2025, 30-year mortgage rates remain at 6.7–6.8%, but forecasts suggest a gradual decline to 6.1% by late 2025 and 5.8% by 2026. This anticipated decrease in rates is expected to have a ripple effect on the real estate investor market, potentially unlocking demand among both buyers and investors who have been waiting on the sidelines. Lower financing costs would improve cash flow for rental properties and increase ROI for flippers who rely on financing for acquisitions and renovations.

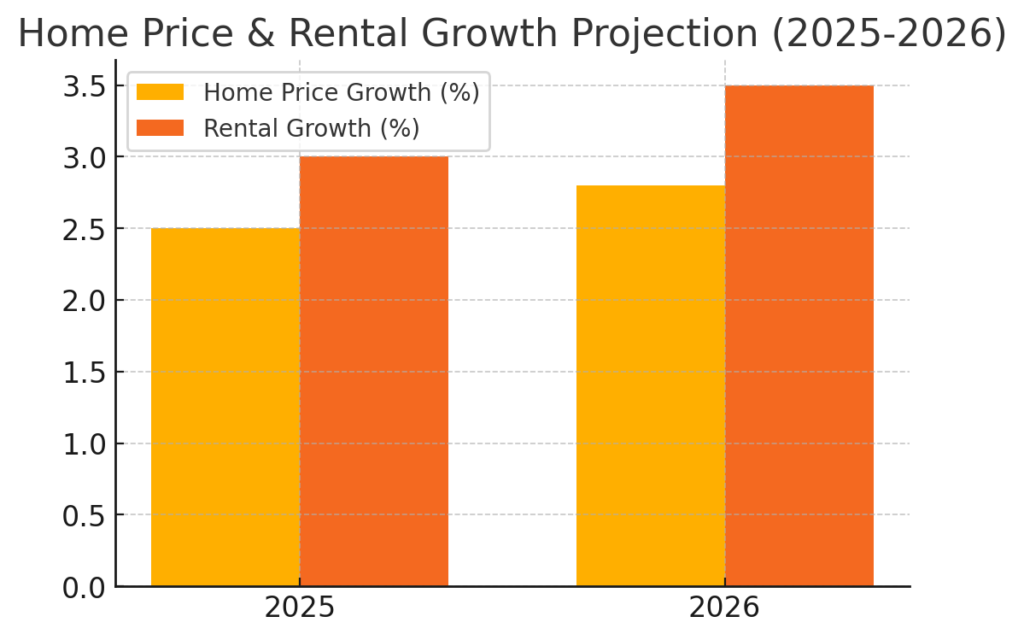

National home price growth is expected to moderate to 2–3% annually through 2026. While this represents a significant slowdown compared to the double-digit growth of 2021 and 2022, it also points to a more balanced and sustainable market. In certain high-growth metro areas, like parts of the Southeast and Midwest, appreciation may remain slightly above average due to persistent housing demand. Conversely, expensive coastal markets may see flat or even slightly declining prices as affordability challenges and economic uncertainty weigh on buyers.

Rental Market Forecast

Rental demand is projected to remain robust, particularly as affordability challenges continue to keep many Millennials and Gen Z renters out of the homebuying market. Vacancy rates are expected to remain near historic lows, and rental rates are forecast to rise between 2–4% annually in most markets through 2026. In high-demand rental markets such as Atlanta, Detroit, and parts of Texas, rent growth may exceed these averages, providing attractive cash-flow opportunities for investors.

Ground-Up Construction Outlook

Ground-up construction is expected to remain limited throughout 2025 due to high construction costs, labor shortages, and elevated financing rates. However, this pullback in new construction could further exacerbate the housing supply shortage, especially in affordable segments. By 2026, if interest rates ease and consumer confidence improves, we may see a resurgence in construction activity, particularly from larger builders and well-capitalized investors. Those who start projects during the latter part of 2025 could be well-positioned to deliver new inventory when market conditions strengthen.

Investor Sentiment and Strategy

Investor sentiment for the remainder of 2025 is cautiously optimistic. Many investors are already shifting toward long-term buy-and-hold strategies to weather the current high-rate environment. With predictions of lower rates and stabilizing prices on the horizon, investors who acquire quality assets now—particularly in yield-friendly markets—stand to benefit from both cash flow and potential appreciation over the next few years. Flippers are advised to focus on value-add projects that cater to first-time homebuyers, while rental investors may find success in markets with strong population growth and job creation.

Regional Expectations

Regions like the Southeast (Atlanta, Charlotte, Nashville) and Midwest (Cleveland, Indianapolis, Detroit) are projected to remain top-performing markets for both rentals and flips due to their affordability and strong local economies. In contrast, markets like San Francisco, Seattle, and Austin may continue to face challenges due to lower ROI and higher barriers to entry.

Economic Considerations

The broader economy will play a significant role in shaping the outlook for late 2025 and early 2026. If inflation continues to trend downward and the Federal Reserve eases monetary policy, we could see an uptick in housing transactions and a healthier market for investors. Conversely, if economic headwinds strengthen or if job growth slows, demand could weaken temporarily, emphasizing the need for conservative underwriting and diversified strategies.

Key Takeaways for Investors

- Focus on Value and Efficiency: Flippers must prioritize properties with strong value-add potential rather than relying solely on market appreciation. Investing in efficient renovations, such as cosmetic upgrades and energy-saving improvements, can help maintain profit margins in tighter markets.

- Cash and Creative Financing Dominate: Investors with cash or creative financing options, including loans from private and institutional lenders like AHL, hold a competitive advantage. Access to flexible capital allows for quicker acquisitions and the ability to outbid competitors who are constrained by traditional lending requirements.

- Leverage Data and Market Research: Successful investors in 2025 are leaning heavily on data analytics to guide their decisions—identifying undervalued markets, assessing rental yield potential, and forecasting demand trends with precision.

- Regional Insights Are Critical: Midwest and Southeast markets remain top performers for both flips and rentals due to their balance of affordability and demand. Recognizing local trends—such as population shifts, infrastructure developments, and economic drivers—can yield above-average returns.

- Long-Term Thinking Over Quick Wins: The days of quick, high-margin flips are waning. Many investors are now adopting hybrid models, holding properties longer for rental income while waiting for optimal selling conditions.

- Prepare for a Rate-Driven Rebound: With rate cuts expected in 2026, investors who strategically position their portfolios now—by securing lower entry prices and focusing on high-demand property types—will be best poised to capitalize on increased activity when financing becomes cheaper.

- Diversification and Risk Management: Building a mix of property types and geographies helps protect against local market downturns. Investors are increasingly spreading their portfolios across both cash-flow-heavy regions (like the Midwest) and long-term appreciation hubs (like the Southeast).

- Relationship Building with Lenders: Establishing strong partnerships with flexible financing partners, including private lenders like AHL, is becoming essential. These relationships offer investors the speed and creativity needed to close competitive deals, especially in fast-moving or distressed markets.

Conclusion

The 2025 real estate investor market underscores the importance of adaptability. The days of easy flips and rapid appreciation are behind us, but opportunities remain for those who are strategic and data-driven. Whether it’s flipping starter homes in Georgia, building rental portfolios in the Midwest, or cautiously entering ground-up construction, success depends on meticulous planning and market awareness.

At American Heritage Lending, we provide tailored financing solutions to help investors seize these opportunities.

Ready to expand your portfolio in 2025? Contact our team today to explore flexible funding strategies designed for your success.

Frequently Asked Questions

Why did fix-and-flip activity slow down in early 2025?

Fix-and-flip activity slowed because investors faced margin compression from high renovation costs, 10% tariffs on building materials, limited access to undervalued properties, and double-digit financing rates. These factors made it harder to hit pre-pandemic profit levels and forced investors to focus more on entry-level homes.

Which regions are offering the strongest rental returns in 2025?

Midwest markets including Detroit, Cleveland, Indianapolis, and Kansas City are producing rental yields between 9–11%, making them some of the strongest cash-flow regions in the country. The Southeast also remains strong due to affordability and job growth.

How are investors adapting their strategies in today’s high-rate environment?

Investors are shifting toward long-term buy-and-hold strategies, using private and institutional lenders for flexible DSCR and bridge financing, targeting mid-term rentals, focusing on value-add improvements, and diversifying into multiple markets to reduce risk.

What is the outlook for the housing market for the rest of 2025 and into 2026?

Interest rates are expected to gradually decline into late 2025 and 2026, improving cash flow and stimulating investor demand. Home price appreciation will remain moderate at 2–3% annually, while rental demand stays strong due to affordability challenges and low vacancy rates.

Sources

-

ATTOM Data Solutions – Real estate investor activity, flipping rates, and ROI data.

-

CoreLogic – Housing price trends, appreciation rates, and market forecasts.

-

Census Bureau – Building permits and construction activity data.

-

Freddie Mac and Fannie Mae Reports – Mortgage rate trends and lending outlook.

-

National Association of Realtors (NAR) – Existing home sales and investor purchase statistics.

-

U.S. Bureau of Labor Statistics (BLS) – Construction labor trends and cost indexes.

-

Zillow Research – Rental yield data, regional market analysis, and price forecasts.

-

Redfin Data Center – Investor activity share, home price index, and regional trends.

-

Moody’s Analytics – Housing market risk assessment and economic forecasting.

-

American Heritage Lending (AHL) Insights – Private lending trends and DSCR loan data