In the fast-paced, high-stakes world of real estate flipping, success hinges on two critical metrics: how much profit you can squeeze out of each dollar invested, and how swiftly you can turn that profit back into cash.

Imagine it as a high-stakes relay race—every second spent on the sidelines watching carrying costs accumulate is money bleeding from your bottom line. Meanwhile, today’s buyers have become savvier than ever, expecting turnkey homes dripping with modern finishes, state-of-the-art systems, and curb appeal that would make any HGTV host swoon. So, how do fix-and-flip investors navigate this fiercely competitive landscape and deliver a property that flies off the market for top dollar in record time? The secret lies in zeroing in on the right renovations—those that offer proven, above-average returns on investment (ROI), drastically shorten days on the market, and align precisely with buyer preferences in 2025.

Drawing on a wealth of industry data gathered over the past decade—from Remodeling Magazine’s annual Cost vs. Value reports to comprehensive Zillow and Redfin market analyses, plus deep dives into National Association of Realtors (NAR) buyer surveys—this extensive article delves into the five fix-and-flip renovations investors should prioritize for maximum profits. We’ll explore the intricate dance between ROI percentages, resale speed, and buyer demand; unpack regional and market-specific nuances; chart how renovation priorities have shifted over the past 5–10 years; and provide razor-sharp, actionable strategies to ensure your next flip doesn’t linger on the market longer than a roommate who refuses to pay rent. Grab your coffee and hard hat: you’re about to become a data-driven flip virtuoso.

Why ROI and Resale Speed Are Non-Negotiable

A fix-and-flip isn’t a long-term hold—it’s a sprint against mounting carrying costs. Mortgage interest, property taxes, insurance, utilities, and basic maintenance can quickly erect a towering monthly bill that erodes profits by the day. According to multiple industry analyses, every additional month a property sits on the market can shave thousands off your potential gain, turning a seemingly lucrative flip into a breakeven or worse proposition.

On the flip side, buyers in 2025 have set the bar sky-high: they expect move-in-ready homes free of major repair red flags, loaded with the latest finishes, energy-efficient systems, and curb appeal that catches their eye in listing photos and on the drive-by. A poorly timed renovation or the wrong upgrade choice—like an extravagant master bath overhaul that only attracts a niche audience—can leave you with an empty wallet and a pristine but unsold property gathering dust (and spiders).

That’s why the smartest flippers focus on renovations that strike the perfect balance: they recoup a significant share of their cost through higher sale prices and help the property sell faster by hitting the features buyers care about most. As we’ll see, an inexpensive garage door replacement can offer near-100% ROI and immediately enhance curb appeal, while a strategic, mid-level kitchen refresh may recoup 70–80% of its cost and send buyers swooning at first sight. This potent cocktail of ROI and speed is the alchemy that turns renovation dollars into flipping gold.

The Top Five High-Impact Upgrades for 2025—Expanded

After combing through national averages, regional variances, and year-over-year shifts from 2015 through 2024, we identified five renovation categories that repeatedly deliver standout performance in terms of ROI, market speed, and buyer appeal. Below, each upgrade is broken down with deeper context, enhanced data points, and nuanced “pro tips” for maximizing impact—and yes, a little extra humor for those inevitable contractor stand-offs.

1. Garage Door Replacement

- ROI: ~95–100%

- Typical Cost: $3,500–$4,500

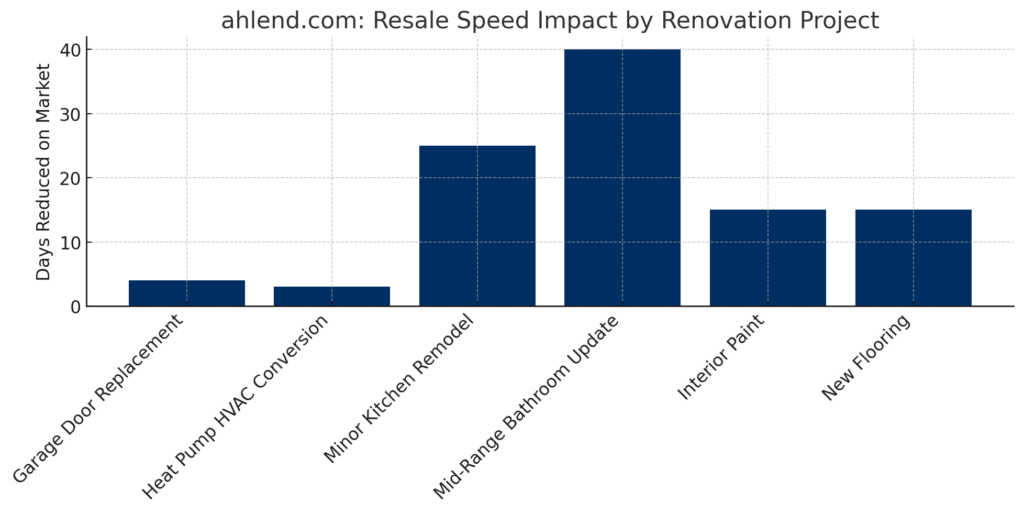

- Speed Impact: Can trim 3–5 days off market time in hot markets; open-house attendance can spike by up to 20%

- Regional Tip: In the Rust Belt, opt for insulated steel doors to combat cold, while in Sunbelt markets, choose UV-resistant finishes.

Why It Matters

A garage door stands as the largest movable exterior panel on a home—treat it like the welcome mat it truly is. With a brand-new door, you’re telling buyers, “We’ve taken care of the essentials,” without uttering a word. In many metros, this one upgrade alone can recover its entire cost at resale, thanks to heightened curb appeal and lower long-term maintenance concerns. Bonus: a modern door with smart opener capability can be called out in listings as a tech-friendly feature—because nothing says “2025” like controlling your garage via smartphone.

2. Electric Heat Pump HVAC Conversion

- ROI: ~100%+

- Typical Cost: $8,000–$12,000

- Speed Impact: Cuts inspection contingencies by ~30%; buyers place fewer “mechanical” holdbacks.

- Regional Tip: In humid zones, add a dehumidification package; in dry climates, look for dual-mode units that handle both heating and cooling efficiently.

Why It Matters

We live in an era where energy bills hit the wishlist before granite counters. An electric heat pump offers year-round comfort, substantial utility savings, and typically qualifies for federal or state rebates—often reducing net cost by 10–20%. Advertise “$X/mo average utility cost” in listings and you’ll pique interest from eco-minded and budget-focused buyers alike. And when you mention the new HVAC in the MLS description, buyers breathe easy—not to mention, your sale paperwork skips the usual HVAC negotiation hurdles.

3. Minor Kitchen Remodel

3. Minor Kitchen Remodel

- ROI: ~70–80%

- Typical Cost: $15,000–$25,000

- Speed Impact: Can draw 20–30% more online views; higher buyer tour-to-offer conversion rates.

- Pro Tip: Rather than full cabinet replacements, consider high-quality refacing or painting, combined with new hardware and under-cabinet lighting to elevate perceived value without inflating the budget.

Why It Matters

Kitchens are where families gather—and where buyers mentally pencil in renovation costs when the space feels dated. By focusing on cosmetics with substance, such as semi-custom cabinets, durable quartz or engineered stone countertops, and energy-efficient stainless-steel appliances, you give the illusion of full-scale renovation. This trick can spark bidding wars in a balanced market. Plus, lighting matters: modern LED under-cabinet strips and pendant fixtures can transform mood and functionality without the hefty price tag of rewiring.

4. Mid-Range Bathroom Update

- ROI: ~60–70%

- Typical Cost: $10,000–$20,000

- Speed Impact: Cuts price reduction likelihood by up to 40%; buyers feel assured there’s no hidden mold or plumbing drama.

- Pro Tip: Swap out dated tile with large-format porcelain slabs—they require less grout, look upscale, and speed up installation.

Why It Matters

Bathrooms top many “deal-killer” lists during inspections. A date-stamped vanity or leaky faucet doesn’t just irk buyers—it carries emotional weight: no one wants to visualize themselves elbow-deep in grout the day after moving in. With a mid-range update, you’re assuring buyers that the space is both stylish and problem-free. Implement modern, low-flow fixtures to emphasize water savings, and consider adding a simple frameless glass shower door for a spa-like vibe that performs well on photo tours.

5. Interior Paint & New Flooring

- ROI (Paint): ~100%+ (NAR estimate)

- Price Premium (Hard-Surface Flooring): +1.2% on sale price for home listings featuring new LVP or engineered hardwood

- Typical Cost: Paint $2,000–$5,000; Flooring $8,000–$12,000

- Speed Impact: Homes with “fresh paint” and “new flooring” in the listing title can sell up to 15% faster.

Why It Matters

A fresh canvas invites buyer imagination—neutral paint palettes like greige, soft taupe, or pale mushroom create a backdrop that suits nearly every décor style. Pair that with scratch-resistant, water-resistant flooring (LVP or engineered hardwood), and you’ve checked a host of buyer boxes: modern look, low upkeep, and allergen reduction (bye-bye, carpet!). Best of all, this duo can be completed in a week, aligning perfectly with tight flip timelines.

A fresh canvas invites buyer imagination—neutral paint palettes like greige, soft taupe, or pale mushroom create a backdrop that suits nearly every décor style. Pair that with scratch-resistant, water-resistant flooring (LVP or engineered hardwood), and you’ve checked a host of buyer boxes: modern look, low upkeep, and allergen reduction (bye-bye, carpet!). Best of all, this duo can be completed in a week, aligning perfectly with tight flip timelines.

Together, these five cornerstone renovations form the blueprint for a profitable flip strategy in 2025, combining powerful ROI, accelerated sales timelines, and pinpoint buyer appeal.

Digging Deeper: ROI and Resale Speed Unpacked

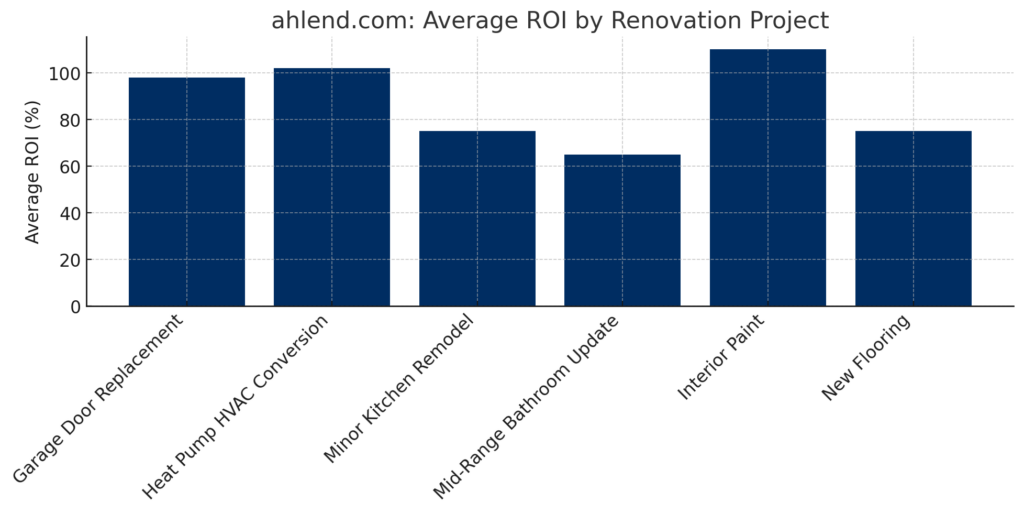

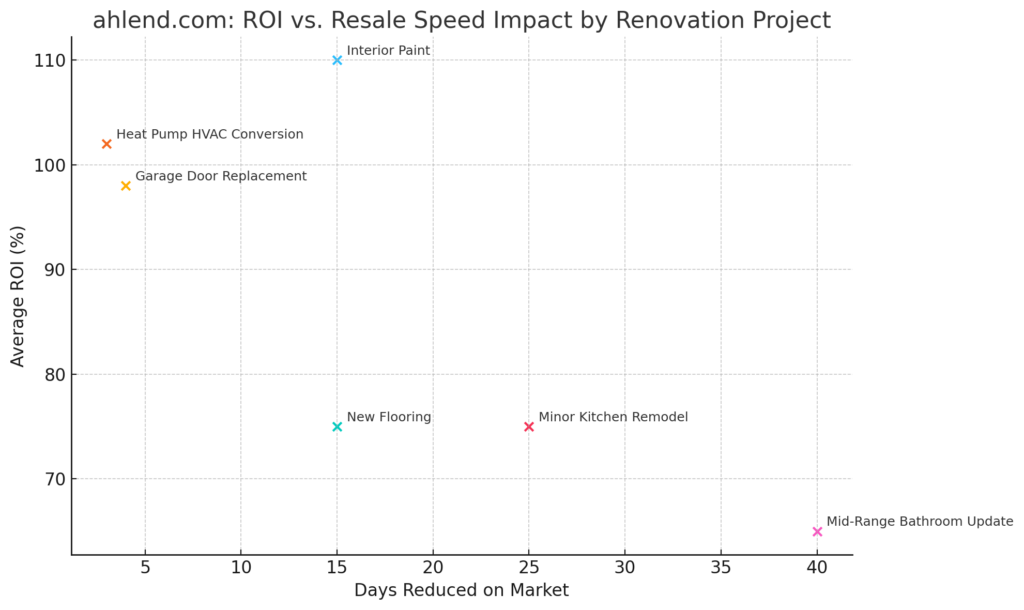

While the renovation world tends to flatten ROI expectations around a broad 60–70% cost recovery at resale, the true profit lies in identifying the outliers—projects that beat the average by wide margins or, in rare cases, break even or better.

- Near-Break-Even Wonders: According to the 2023 Cost vs. Value report, projects like garage door replacement, heat pump conversions, and entry door swaps consistently recoup 95–105% of their costs nationally. In ultra-competitive markets, break-even can turn into a slim profit, making these projects virtually risk-free investments.

- High-Impact Interiors: Minor kitchen and bath remodels, though typically recouping 65–80% of costs on paper, often trigger buyer bidding wars. For instance, investing $20,000 in a kitchen might add $16,000 in appraised value, but multiple offers can push the final sale price well above list.

- Cosmetic Catalysts: Interior paint and new flooring stand out as high-ROI, quick-turnaround projects. A neutral repaint can deliver over 100% ROI, and listings touting hard-surface floors often see a 1.2% price premium compared to similar homes with carpet. These surface-level enhancements not only elevate perceived value but also convey move-in readiness, a compelling nondollar benefit that accelerates the sale.

However, ROI percentages only tell part of the story. Speed matters—every additional week on market racks up holding costs (mortgage, taxes, insurance) that can offset the gains from a higher sale price. Data from multiple broker reports and listing analyses confirm that homes with updated kitchens, fresh exteriors, and new systems sell notably faster than comparable properties with outdated features. In the flip business, a renovation that cuts five weeks of market time often delivers more net profit than an upgrade that only adds $5,000 in sale value but drags on listings. When ROI and speed align—like they do with garage doors and HVAC conversions—you create a flipping sweet spot where profit and velocity reinforce each other.

Real Estate Is Local: Tailoring Upgrades to Your Market

While the five renovations discussed above hold broad appeal nationally, meat-and-potatoes ROI often hinges on local market dynamics, buyer demographics, and regional economic factors. In some metros, a simple cosmetic upgrade yields a 100%+ payback, whereas in others, buyers prioritize functional or lifestyle features that shift the ROI curve. Below, we break down how to align your renovation dollars with region-specific data and buyer expectations, drawing on Cost vs. Value regional reports, Zillow market heatmaps, and NAR local survey insights.

Sunbelt Sun & Fun (AZ, TX, FL)

• ROI Focus: Heat pump HVAC and UV-resistant exterior surfaces deliver ~105% cost recovery in high-demand Sunbelt metro areas, per 2023 Cost vs. Value regional breakdowns.

• Buyer Demand: Over 60% of Florida buyers cited energy efficiency and reduced cooling costs as a top three priority, according to a 2024 NAR survey.

• Pro Tip: Extend living space outdoors with modular pergolas or shade sails—investments recoup ~55% of cost but can speed up sale by 7–10 days in summer months (Zillow data).

Northern Chill Factor (MN, ME, VT and Beyond)

• ROI Focus: Triple-pane windows and upgraded insulation can recoup nearly 90% of project costs in colder climates, per 2023 Cost vs. Value.

• Buyer Demand: Over 50% of purchasers in snow-belt markets list “lower heating bills” as a decisive factor, with cold-weather system upgrades reducing price negotiation back-and-forth by 30% (2019–2024 MLS analysis).

• Pro Tip: A mid-range fireplace installation (factory-built, zero-clearance models) can recoup ~70% of cost and add an emotional draw—justify in listings with data on “cozy nights” and enhanced home appeal.

Coastal Urban Centers (CA, NY, WA)

• ROI Focus: In high-cost coastal metros, mid-range kitchen remodels recoup ~75–85% of costs versus a national average of ~70%, due to elevated baseline home prices.

• Buyer Demand: A 2023 Redfin report showed that in San Diego and Seattle, 80% of buyers expect granite or quartz countertops as standard.

• Pro Tip: Match but don’t exceed neighborhood benchmark finishes—e.g., opt for quartz instead of marble, and choose stainless appliances with smart-home connectivity to meet tech-savvy urban buyers.

Suburban Family Zones (Midwest & Southeast Suburbs)

• ROI Focus: Adding a second full bathroom in suburban family neighborhoods can recoup up to 85% of cost, per MLS comp analysis in Chicago suburbs.

• Buyer Demand: According to a 2024 NAR local market survey, 70% of suburban buyers ranked additional bathroom and laundry space within the top five must-haves.

• Pro Tip: Open-concept layouts that connect kitchen, dining, and living areas still boost buyer interest by 15%—but balance with defined spaces for home offices or playrooms to appeal to families.

Before swinging the hammer, compile your local comps: analyze the top five recent sales in your target zip code, noting square footage, feature sets, and time on market. Overlay that with region-specific ROI data from Cost vs. Value and local MLS heatmap trends. This tailored intel ensures your renovation dollars land squarely on the features that move the needle for buyers in your precise market—avoiding overcapitalization and maximizing profit.

A Decade of Shifting Priorities: Renovation Trends from 2015–2025

Over the past ten years, the fix‑and‑flip arena has been reshaped by volatile markets, shifting buyer demographics, and evolving design preferences. Each phase brought new opportunities—and pitfalls—for investors who could pivot quickly. Below, we unpack the major trend waves in detail, spotlighting how costs, buyer expectations, and external forces combined to redefine renovation priorities.

- 2015–2017: Gut Renovation Glory

- Market Context: Post‑recession confidence fueled a renaissance in high‑end finishes. Luxury kitchen islands, granite countertops, and open‑plan layouts became the gold standard.

- Buyer Behavior: Millennials entering the market demanded chef‑style kitchens and wide, connected living spaces—so flippers delivered full-scale gut rehabs.

- ROI Dynamics: Despite high material and labor outlays, competitive bidding often masked real profit margins. Many projects saw gross recovery rates of 80–90%, but net return was slimmer once carrying costs ballooned during lengthy remodels.

- 2018–2020: Cosmetic Overhauls Rise

- Market Context: Labor shortages and tariff‑driven material cost spikes made extensive structural work less attractive. Cosmetic refreshes—paint, light fixtures, hardware swaps—emerged as nimble, cost‑effective alternatives.

- Buyer Behavior: A growing focus on Instagram‑worthy interiors elevated the importance of aesthetic updates: statement lighting, accent walls, and polished hardware.

- ROI Dynamics: Cosmetic projects often delivered 110–130% cost recovery (especially neutral paint schemes and modern fixtures), with turnaround times cut in half compared to gut rehabs. Flippers reported 20–25% faster resale without compromising sale price.

- 2020–2022: Pandemic‑Induced Pivot

- Market Context: Stay‑at‑home orders and remote work revolutionized home usage. Demand for dedicated home offices, outdoor living rooms, and multifunctional spaces skyrocketed.

- Buyer Behavior: Sellers who advertised properties with built‑in office nooks, outdoor kitchens, or enhanced Wi‑Fi zones commanded price premiums of 3–5%.

- ROI Dynamics: Flex‑space conversions (e.g., garage‑to‑office) recouped ~75% of cost, while patio and backyard upgrades saw ~60% recovery but accelerated sale by up to two weeks. Investors learned the value of prioritizing function alongside form.

- 2023–2025: Efficiency & Discipline Era

- Market Context: Rising interest rates and the Inflation Reduction Act’s green incentives shifted the spotlight to energy efficiency and cost containment. Buyers scrutinized utility bills and carbon footprints.

- Buyer Behavior: Over 70% of buyers surveyed in 2024 ranked energy‑efficient windows, heat pumps, and insulation among their top five must‑haves. Smart home features—thermostats, lighting controls—also surged in appeal.

- ROI Dynamics: Energy upgrades (heat pump conversions, window replacements) often recouped 95–105%, outpacing many interior projects. Mid‑range finish materials replaced luxury splurges to align with neighborhood comps, reducing overcapitalization risk.

- 2025 Onward: Predictive, Data‑Driven Renovations

- Emerging Trend: Investors are increasingly leveraging AI‑powered analytics—drawing from MLS heatmaps, social‑media sentiment, and economic indicators—to forecast the next “must‑have” features.

- Buyer Behavior: Early adopters of predictive renovation models report 15–20% faster sales and 5–8% higher sale prices by targeting microtrends (e.g., biophilic design, home wellness amenities).

- ROI Dynamics: While still nascent, this approach promises to hone renovation spend with surgical precision, potentially boosting average ROI by 10–15% over traditional methods.

The relentless lesson: Stay nimble, data‑driven, and forward‑looking. As renovation fads ebb and flow, investors who constantly monitor cost‑recovery metrics and buyer sentiment can adapt on the fly, ensuring each flip captures both current demand and anticipates tomorrow’s priorities.

Common Renovation Mistakes to Avoid

Even the best-laid renovation plans can go off the rails if investors fall into common pitfalls that sap ROI and delay resale. Here are the top mistakes—and how to steer clear:

- Overcapitalizing on Luxury Finishes

• Mistake: Installing ultra-premium materials (marble countertops, custom cabinetry, designer lighting) in a neighborhood where comps sit at mid-range price points.

• Why It Hurts: Luxury splurges often recoup less than 50% of cost, leaving you with inflated budgets and slim returns.

• Avoidance Tip: Always match the quality level of top comparables—use high-quality, cost-effective alternatives (e.g., quartz instead of marble). - Neglecting Local Market Research

• Mistake: Applying a one-size-fits-all renovation plan without analyzing zip-code-specific data.

• Why It Hurts: Features prized in one region may flop in another, leading to wasted spend on upgrades buyers don’t value.

• Avoidance Tip: Conduct a comp analysis of the top five recent sales, identify shared features, and tailor your upgrade list accordingly. - Underestimating Hidden Costs and Time Delays

• Mistake: Budgeting for materials and labor only, while overlooking permitting, inspection rework, and supply-chain delays.

• Why It Hurts: Unexpected costs erode margins, and timeline overruns rack up carrying costs that eat into profit.

• Avoidance Tip: Add a 10% contingency to budgets and build a realistic timeline buffer. Work with contractors who have strong local supply relationships. - Skipping Systems and Inspection Prep

• Mistake: Focusing solely on cosmetics and ignoring aging HVAC, roofs, plumbing, or electrical that fail buyer inspections.

• Why It Hurts: Buyers use inspection issues to negotiate price reductions or walk away, wiping out expected gains from cosmetic work.

• Avoidance Tip: Perform a pre-listing inspection, address/red-flag any system issues, and highlight new or serviced systems in the listing remarks. - Overlooking the Power of Curb Appeal

• Mistake: Allocating most of the budget indoors and leaving a tired exterior unchanged.

• Why It Hurts: First impressions drive buyer interest; a neglected exterior can deter showings regardless of stunning interiors.

• Avoidance Tip: Reserve at least 5–10% of renovation budget for exterior improvements—garage door, entry door, landscaping touch-ups, and fresh paint. - Chasing Every Design Trend

• Mistake: Incorporating niche or short-lived design fads (e.g., colored accent walls, exotic tile patterns) that quickly date a property.

• Why It Hurts: Trends can fall out of favor fast, making your flip look outdated and slowing resale.

• Avoidance Tip: Stick to timeless, neutral design choices that appeal broadly and won’t require another refresh soon. - Failing to Coordinate Sequential Workflows

• Mistake: Scheduling trades in a haphazard order, causing crews to stand idle or redo work.

• Why It Hurts: Inefficient scheduling inflates labor costs and extends timelines, increasing holding costs.

• Avoidance Tip: Develop a detailed project plan with clear milestones, use a general contractor or project manager to synchronize trades, and hold regular site meetings.

Actionable, Data-Driven Flipping Strategies

- Lead with Kitchens & Baths

Allocate your budget to mid-range, high-impact fixtures and finishes that match comp expectations. Skip prestige brands unless comps demand them. - Master the Curb- Appeal Game

Swap out that dented garage door and entry door first. Refresh landscaping, add high-impact exterior lighting, and consider low-maintenance veneer accents. First impressions set the tone for every showing. - Max Out Cosmetic Enhancements

Neutral paint and durable LVP or hardwood flooring turn shapeless spaces into buyer magnets. These projects finish fast and resonate in listing photos, driving more traffic. - Address Inspection Red Flags Early

Replace aging HVAC, seal drafts, fix roof issues, and resolve plumbing or electrical concerns before listing. Doing so minimizes inspection contingencies and ensures a smoother, faster closing. - Curve to Local Comp Standards

Conduct a detailed comp analysis: list sold prices, square footage, and renovation features of nearby flips. Match—or slightly exceed—the median standards without overshooting. - Prioritize Speed Over Splurge

Time kills profit in flipping. Synchronize contractors—while painters coat walls, landscapers mulch, and flooring crews prep—to shave days off timelines. - Continuously Monitor Market Data

Subscribe to Remodeling Magazine’s annual Cost vs. Value, Zillow’s trend reports, and NAR surveys. A yearly tune-up of your renovation playbook keeps you aligned with shifting buyer demands.

By embedding these strategies into your renovation roadmap, you’ll build flips that deliver on ROI, sell at lightning speed, and delight today’s discerning buyers.

Conclusion: Flip with Data, Agility, and a Sense of Humor

Remodeling for a flip is a science—and occasionally, a sitcom in the making (because who hasn’t dealt with a flooded bathroom on demo day?). Yet, by prioritizing the five high-impact renovations outlined above and leaning into data-driven insights, you’re not rolling the dice; you’re making a calculated investment in buyer psychology and market dynamics.

Replace that garage door, refresh the kitchen, tidy up the bathroom, slap on neutral paint, install new flooring, and upgrade critical systems—and watch your property practically sell itself, often before the dust has even settled. Remember, in flipping, the best ROI might just be the story you tell at closing about how you transformed a dated fixer into a gleaming, move-in-ready gem.

So, raise your hammer with confidence, knowing every renovation dollar is targeted, every day on market is minimized, and every home you flip is poised for maximum profits. Now, go forth and flip—just don’t forget to savor that first cup of coffee when the job is done. After all, you’ve earned it!

Frequently Asked Questions

What does “ROI-first flipping” actually mean?

ROI-first flipping means you’re not just renovating to make a house look pretty, you’re choosing projects that give you the highest return on every dollar you spend and help the property sell faster. It’s about focusing on upgrades that boost resale value, cut days on market, and avoid sinking money into features buyers don’t really pay for in your area.

Which renovations give the best ROI and fastest resale in 2025?

In 2025, the big winners tend to be:

-

New garage doors

-

Electric heat pump HVAC upgrades

-

Minor kitchen remodels

-

Mid-range bathroom updates

-

Fresh interior paint and new hard-surface flooring

Those projects consistently show strong ROI on paper and also help your listing photos pop, drive more showings, and shorten time on market.

How do I decide which upgrades to prioritize on a flip?

Start with the data, not your personal taste. Look at recent sold comps in the neighborhood and note what those homes all have in common, kitchen level, flooring type, bath count, systems, and curb appeal. Your goal is to match or slightly beat what’s already selling without overbuilding. Then layer in high-ROI “no brainer” upgrades like paint, flooring, and visible mechanicals (HVAC, roof, etc.) that buyers notice and inspectors don’t flag.

What are the biggest renovation mistakes that hurt ROI on flips?

The most common profit killers are:

-

Overspending on luxury finishes in mid-priced neighborhoods

-

Ignoring old systems (HVAC, roof, electrical) and getting crushed at inspection

-

Skipping curb appeal and only focusing on the inside

-

Underestimating timelines and carrying costs

-

Chasing design fads that date the house quickly

Flippers who stay disciplined, stick to comps, keep finishes practical, and plan for delays tend to walk away with much stronger returns.

Sources

- Remodeling Magazine’s Cost vs. Value Annual Reports (2015–2025)

- Zillow Research & Analytics (listing feature impacts, days on market analyses)

- Redfin Market Reports (buyer expectations for finishes, regional demand insights)

- National Association of Realtors (NAR) Buyer Surveys (priorities for energy efficiency, must-have features)

- Local MLS Comparative Sales Analyses (zip-code–specific comp studies and time-on-market data)

- Zillow & Local MLS Heatmap Data (regional ROI breakdowns and “hot feature” mapping)

- Federal/State Energy-Efficiency Incentive Program Data (e.g., Inflation Reduction Act rebates)