Massachusetts real estate has long been a magnet for investors drawn to its unparalleled mix of historical charm, economic resilience, and relentless demand. In 2025, the landscape remains as promising as it is complex. For savvy investors leveraging Debt Service Coverage Ratio (DSCR) financing, understanding the nuances of this market—from Boston’s established neighborhoods to the overlooked gems of the South Coast—is critical. This article provides a comprehensive, data-driven analysis of where, why, and how to invest for maximum success.

Setting the Stage: Massachusetts Real Estate and Rental Market Overview

Massachusetts continues to be a powerhouse economy with a tight housing market and fierce rental demand. The state’s population growth, fueled by both domestic migration and international immigration, places relentless pressure on housing supply. Its strong labor market, anchored by industries such as education, healthcare, biotechnology, and finance, ensures that rental demand remains consistent across nearly all metro areas.

Key state-wide metrics include:

Key state-wide metrics include:

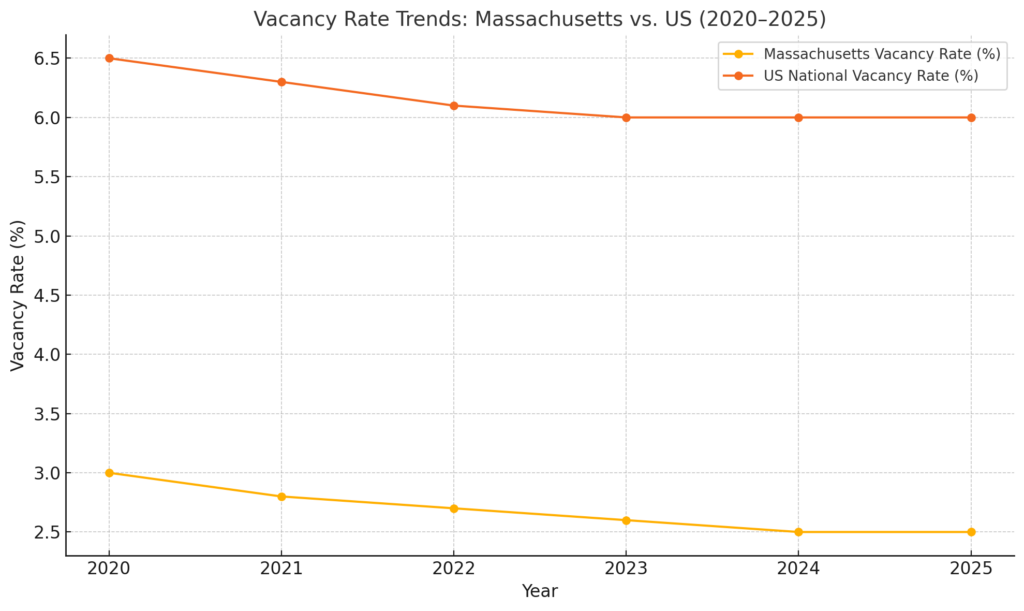

- Statewide vacancy rate: 2.5% (well below the national average of 6%)

- Median home price: ~$600,000

- Median rent: ~$3,100 in Greater Boston

- Year-over-year home price appreciation: 4.7% (2025)

- Rental growth rate: 5.2% annually

- Unemployment rate: 3.2% (compared to the national average of 3.8%)

Greater Boston commands the highest prices, but much of the state’s investment potential now lies in smaller cities and suburban markets that offer better entry points for yield-focused investors. Worcester, Springfield, and Lowell have all seen significant infrastructural investment and urban revitalization, helping to rebalance the opportunity away from Boston’s core.

Moreover, the lack of new multifamily construction due to restrictive zoning laws and high development costs has created a long-term supply shortage. As a result, rental markets across Massachusetts—even in traditionally overlooked areas—are tightening, and landlords have considerable pricing power.

In short, Massachusetts offers a dynamic playing field: mature markets with sky-high stability, secondary markets with cash flow opportunities, and emerging markets ready to blossom. For investors using DSCR financing, this environment provides a wealth of options tailored to different strategies, from aggressive portfolio expansion to cautious, steady wealth building.

Understanding DSCR Loans: Why They Are the Perfect Tool for 2025

DSCR loans allow investors to qualify based on a property’s cash flow, not personal income, making them a preferred strategy for scaling portfolios.

- Typical DSCR minimum: 1.10–1.25

- Max Loan-to-Value (LTV): 80% – 85%

- Interest rates: 6.5% to 9.0% depending on credit and DSCR

- Common borrower profiles: Self-employed investors, portfolio owners, house hackers scaling up

Given high property prices and increasingly strict conventional lending standards, DSCR loans open the door for investors to expand without traditional barriers.

Deep Dive: Top Massachusetts Markets for DSCR Investors

Massachusetts offers a wide array of investment opportunities, from world-renowned metro areas to under-the-radar gems that offer remarkable returns. Understanding the unique dynamics of each key market allows investors to fine-tune their DSCR strategies and select properties that align with their risk tolerance and investment goals.

| Market | Median Price ($) | Average Rent ($) | Cap Rate (%) | Vacancy Rate (%) |

|---|---|---|---|---|

| Boston | 800,000 | 3,100 | 4.0 | 2.8 |

| Worcester | 419,690 | 1,700 | 6.5 | 3.1 |

| Springfield | 287,783 | 1,742 | 7.5 | 5.5 |

| Lowell | 468,294 | 1,900 | 6.0 | 3.0 |

| Fall River | 425,292 | 1,590 | 6.4 | 4.5 |

| Pittsfield | 296,315 | 1,300 | 7.0 | 6.0 |

Boston: The Stability Giant

Boston remains the centerpiece of economic vitality in Massachusetts. Its prestigious universities, cutting-edge hospitals, booming biotech sector, and deep-rooted finance industry ensure strong, enduring rental demand. Despite high barriers to entry and compressed cap rates, Boston continues to deliver superior long-term appreciation.

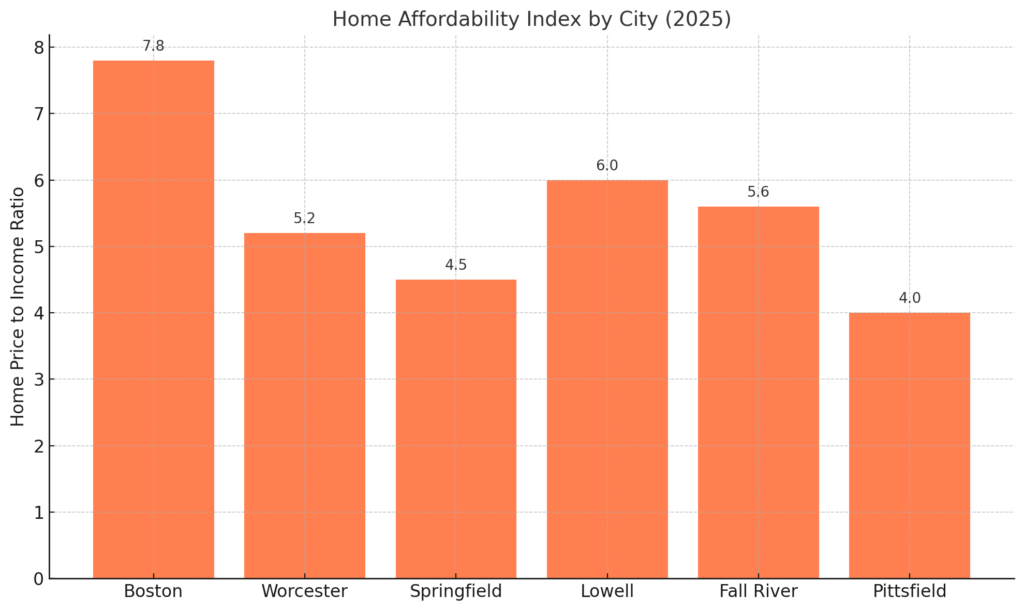

- Median home price: $800,000+

- Average rent: ~$3,100

- Cap rate: 3.5–4.5%

- Vacancy rate: 2.8%

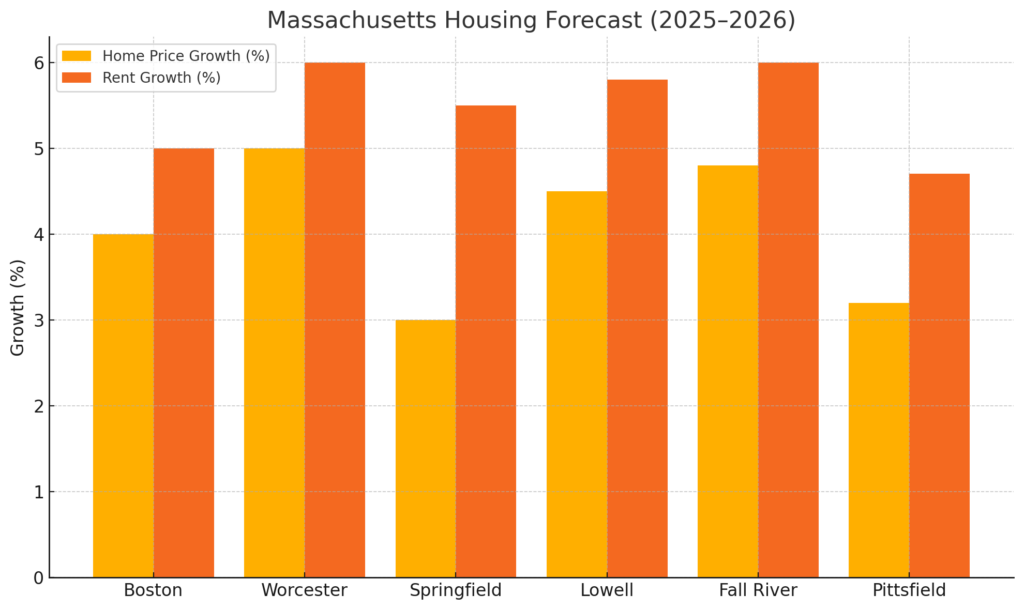

In 2025, Roxbury, East Boston, and Dorchester offer the best potential for DSCR investors seeking marginally better rent-to-price ratios. The city’s restrictive zoning and slow development pipeline ensure ongoing supply shortages, supporting steady rent growth even in a high-rate environment.

Worcester: The Resilient Cash Cow

Worcester, now affectionately known as “The Woo,” has rebranded itself as a dynamic hub for biotech, education, and healthcare industries. With millions poured into urban revitalization and infrastructure, Worcester represents a rare combination of yield and growth.

Worcester, now affectionately known as “The Woo,” has rebranded itself as a dynamic hub for biotech, education, and healthcare industries. With millions poured into urban revitalization and infrastructure, Worcester represents a rare combination of yield and growth.

- Median home price: $419,690

- Average rent: ~$1,700

- Cap rate: 6–7%

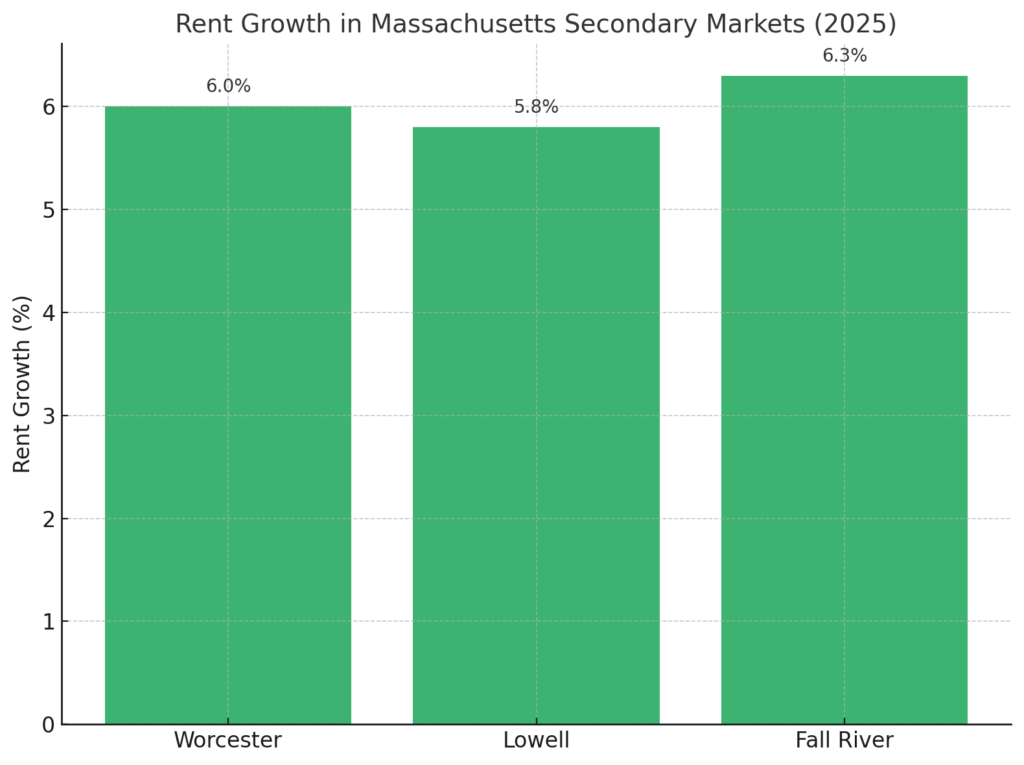

- Rental growth: 5.6% YOY

The city’s famed triple-deckers offer strong DSCR performance. Key neighborhoods like the Canal District and Green Island are popular among younger tenants drawn to new entertainment, dining, and work hubs.

Springfield: Pure Cash Flow Territory

Springfield delivers some of the best cash flow in the Commonwealth. Known for its affordability and high rental yields, it’s a working-class city with pockets of strong tenant demand, especially near medical centers and colleges.

- Median home price: $287,783

- Average rent: ~$1,742

- Cap rate: 7–8%

- Vacancy rate: 5.5%

Neighborhoods like Forest Park and East Forest Park are favored for stable tenancies, while areas around the new casino developments offer potential appreciation upside.

Lowell: The Emerging Urban Hub

Lowell is benefiting from a convergence of student, young professional, and workforce rental demand. Its proximity to Boston (30 miles north) and extensive commuter rail options make it increasingly attractive.

- Median home price: $468,294

- Average rent: ~$1,900

- Cap rate: 5.5–6.5%

- Vacancy rate: 3%

Investors targeting historic mill conversions and properties near UMass Lowell can find steady tenants and above-average rental growth. Downtown revitalization projects are accelerating the city’s upward trajectory.

Fall River: Waterfront Opportunity Rising

Fall River is experiencing a renaissance driven by major waterfront redevelopment and the long-anticipated South Coast Rail project, which will connect it directly to Boston.

- Median home price: $425,292

- Average rent: ~$1,590

- Cap rate: 6.4%

- Rental growth: 6.3% YOY

Neighborhoods near the waterfront and upcoming MBTA stations present the best opportunities for DSCR-friendly acquisitions. New mixed-use developments and retail hubs are further enhancing livability and rental appeal.

Pittsfield: The Berkshires’ Steady Cash Flow Engine

Located deep in the scenic Berkshires, Pittsfield offers the lowest barrier to entry among major cities analyzed. It appeals to retirees, remote workers, and those seeking affordability with a relaxed pace of life.

- Median home price: $296,315

- Average rent: ~$1,300

- Cap rate: 6.6–7.5%

Tourism seasons fuel short-term rental opportunities, while a strong healthcare employment base ensures consistent year-round rental demand. Investors who prioritize cash flow and low competition find Pittsfield particularly appealing.

Hidden Gems: Emerging Markets Primed for Growth

While Boston and Worcester dominate the headlines, Massachusetts’ true investment treasures often lie in its emerging secondary markets. These cities and towns offer exceptional rent-to-price ratios, promising revitalization projects, and increasing tenant demand—ideal conditions for DSCR-backed investments aiming for strong cash flow and growth potential. Here is a closer look at each of these promising areas:

| Market | Median Price ($) | Average Rent ($) | Rental Growth (%) |

|---|---|---|---|

| New Bedford | 417,643 | 1,386 | 5.9 |

| Lawrence | 475,536 | 1,910 | 6.5 |

| Fitchburg | 387,504 | 1,418 | 5.8 |

| Holyoke | 304,899 | 1,020 | 5.2 |

| Brockton | 450,000 | 2,100 | 5.7 |

New Bedford: The Coastal Climber

New Bedford, long known for its historic fishing industry, is rapidly transforming into a desirable residential and commercial hub. The expansion of its port facilities and ferry access to Martha’s Vineyard and Nantucket has created employment opportunities and a rising demand for quality rental housing. Investors can find attractive multi-unit properties at competitive prices, particularly near downtown and the waterfront district. As the city modernizes, rents are projected to continue growing steadily.

- Median home price: $417,643

- Average rent: ~$1,386

- Rental growth: 5.9% YOY

New Bedford’s waterfront economy and ferry access to Martha’s Vineyard and Nantucket create solid tenant demand.

Lawrence: Dense Housing, Dense Returns

Lawrence’s dense urban landscape offers investors an opportunity to capitalize on strong rental demand fueled by its strategic location between Boston and New Hampshire. Former mill buildings have been repurposed into residential units, and a young, working-class demographic ensures consistent tenant turnover with minimal vacancy. Community redevelopment grants and investment in transportation infrastructure are poised to lift both property values and rental rates over the next five years.

- Median home price: $475,536

- Average rent: ~$1,910

- Rental growth: 6.5% YOY

Spillover from the North Shore and Merrimack Valley is pushing rents upward.

Fitchburg: The Budget Buy

Located about an hour outside of Boston, Fitchburg remains one of the most affordable investment markets in the state. The commuter rail connection to Boston has made it an attractive alternative for renters priced out of metro areas. Investors seeking high DSCR coverage can still acquire duplexes and triplexes under $400,000—a rarity in Massachusetts. The presence of Fitchburg State University also ensures steady rental demand from students and faculty alike.

- Median home price: $387,504

- Average rent: ~$1,418

- Rental growth: 5.8% YOY

Low prices and commuter rail access to Boston make Fitchburg a top pick for early adopters.

Holyoke: Incentives and Revitalization

Holyoke’s historic downtown is undergoing a significant renaissance, aided by state and federal incentives for multifamily property rehabilitation. The city’s efforts to attract remote workers through fiber-optic internet expansion and new coworking spaces have opened fresh rental opportunities. Investors can benefit from both low acquisition costs and grants that reduce renovation expenses, creating a strong value-add proposition in a city that still has room to appreciate significantly.

- Median home price: $304,899

- Average rent: ~$1,020

Holyoke is offering grants for property renovation, further sweetening the pot for investors looking for value-add opportunities.

Brockton: The South Shore Titan

Brockton’s strategic location along the commuter rail to Boston, combined with its growing healthcare and retail sectors, makes it one of the top emerging markets for rental investment. Median rents are climbing faster than the state average, supported by an influx of young professionals and immigrant families. Investors targeting multifamily units near downtown and hospital districts can expect strong tenant retention and DSCR metrics that comfortably exceed minimum thresholds.

- Median home price: $450,000

- Average rent: ~$2,100

- Rental growth: 5.7% YOY

Proximity to Boston, strong transportation, and a growing healthcare sector are fueling Brockton’s rental market.

Trends and Forecasts: What’s Ahead for Massachusetts Investors

Looking beyond 2025, several macroeconomic and local dynamics will continue shaping the Massachusetts real estate landscape. Investors should prepare for both tailwinds and headwinds as demographic shifts, legislative changes, and economic factors play out. Forward-thinking strategies will be essential to capitalize on opportunities and mitigate risks in an increasingly competitive environment.

Looking beyond 2025, several macroeconomic and local dynamics will continue shaping the Massachusetts real estate landscape. Investors should prepare for both tailwinds and headwinds as demographic shifts, legislative changes, and economic factors play out. Forward-thinking strategies will be essential to capitalize on opportunities and mitigate risks in an increasingly competitive environment.

Key Market Trends

- Continued Home Price Appreciation: Massachusetts home values have reached an average of $635,252, marking a 4.5% rise over the past year. Boston itself boasts average home prices around $750,143. Limited supply and strong economic fundamentals are expected to sustain appreciation into 2026.

- Persistent Inventory Shortages: Despite state efforts to increase housing supply, restrictive zoning and high construction costs mean inventory will remain tight. This will support property values but increase competition for attractive assets.

- Mortgage Rate Stabilization: 30-year mortgage rates are stabilizing near 6.65%, improving investor sentiment compared to the peaks of 2023 and 2024.

- Robust Rental Demand: Boston’s average rent for a two-bedroom unit stands at approximately $2,935—well above the national average. Secondary markets like Worcester and Lowell are also experiencing rapid rent growth (5%–6% annually).

Potential Risks Ahead

Economic Vulnerability of Key Institutions: Heavy reliance on universities like Harvard and the biotech sector exposes Boston’s economy to potential shocks. Recent funding freezes affecting Harvard ($2.26 billion impacted) underscore the importance of economic diversification.

Economic Vulnerability of Key Institutions: Heavy reliance on universities like Harvard and the biotech sector exposes Boston’s economy to potential shocks. Recent funding freezes affecting Harvard ($2.26 billion impacted) underscore the importance of economic diversification.- Climate Change Impact: Coastal markets such as New Bedford and Fall River face rising flood risks. Properties close to the waterfront could experience devaluation over time due to erosion and insurance cost spikes.

- Affordable Housing Shortfalls: The gap between home price growth and income increases affordability pressures. While this supports rental demand, it could eventually limit tenant pool growth if wages stagnate.

- Regulatory Overreach: Efforts like Boston’s push for rent control and expanded tenant protections may ripple across other cities, impacting landlord profitability and property appreciation forecasts.

- Insurance and Financing Challenges: Higher insurance premiums and stricter DSCR underwriting criteria (due to climate and risk modeling) could add to investor operating costs in the coming years.

Forecast Summary

Massachusetts is expected to see:

- Home price growth of 3–5% annually through 2026

- Rental growth outpacing inflation in most markets

- Continued strength in secondary cities with commuter rail access

- Gradual, modest rate cuts supporting refinance and acquisition activity

However, vigilance around legislative changes, coastal risk zones, and affordability constraints will be crucial for portfolio resilience.

Conclusion: How to Win with DSCR in Massachusetts in 2025 and Beyond

Massachusetts isn’t an easy market, but it’s one of the most rewarding. Smart investors who combine DSCR financing with data-driven market selection can build portfolios that balance cash flow, appreciation, and long-term security.

Focus on emerging markets if you want stronger yields. Bet on stable hubs like Worcester and Lowell for reliable tenants and steady growth. And remember: good property management and thorough underwriting are just as important as picking the right ZIP code.

At American Heritage Lending (AHL), we specialize in helping investors like you navigate the Massachusetts market with customized DSCR solutions. Whether you’re house hacking your first triple-decker in Worcester or scaling into small multis in Fall River, we’re here to fund your vision.

Let’s build something extraordinary. Contact AHL today to start your DSCR investment journey in Massachusetts!

Frequently Asked Questions

Why is Massachusetts considered a strong market for DSCR investors in 2025?

Massachusetts combines high rental demand, low vacancy rates, and slow housing construction, making it one of the most stable rental markets in the country. With statewide vacancies around 2.5% and rents rising more than 5% annually, DSCR investors can qualify using property income alone and still achieve strong long-term performance.

What are the best cities in Massachusetts for DSCR-backed rental investing?

Boston offers unmatched stability and long-term appreciation, while Worcester, Springfield, Lowell, and Fall River provide better cash flow and stronger DSCR ratios. Emerging markets like New Bedford, Lawrence, Fitchburg, Holyoke, and Brockton combine affordability with fast-growing rental demand.

How do DSCR loans help investors overcome high Massachusetts property prices?

DSCR loans allow investors to qualify based on rental income rather than personal income or DTI, making it easier to buy in high-cost markets. Many MA properties especially triple-deckers, small multis, and value-add opportunities, generate strong enough rent to meet DSCR minimums despite higher acquisition costs.

What risks should DSCR investors consider when buying rental property in Massachusetts?

Key risks include insurance increases in coastal markets, potential rent-control legislation, slower new construction, and economic concentration around universities and biotech employers. Investors should also evaluate flood risk, local zoning restrictions, and affordability pressures that could limit long-term rent growth.

Sources

- Zillow.com — Median Home Prices and Rent Data (2025)

- BostonPads.com — Real-Time Availability Rate (RTAR) for Boston Rentals

- Apartments.com — Average Rent Data by City (Springfield, Fall River, etc.)

- MetroRealtyCorp.com — Massachusetts Housing Forecast (2025)

- NBCBoston.com — Massachusetts Home Sales and Mortgage Rate Trends

- Boston.com — 2025 Rental Market Overview

- Wall Street Journal — Harvard Funding Freeze and Economic Impacts

- Axios.com — Coastal Erosion and Climate Risk in Massachusetts

- Investopedia.com — U.S. Housing Shortage Analysis

- UMass Lowell Economic Development Reports

- Massachusetts Housing Partnership (MHP) — Zoning Reform Updates

- American Heritage Lending internal DSCR loan program guidelines (2025)