Georgia, affectionately dubbed the Peach State, is increasingly becoming the “sweet spot” for real estate investors diving into fix-and-flip projects. In 2025, investors ranging from seasoned professionals to enthusiastic newcomers are flocking to Georgia, drawn by the state’s unique blend of stable appreciation, attractive ROI, and diverse market dynamics. As national markets face volatility, Georgia’s more predictable, steady environment provides both security and substantial profit opportunities.

Market Overview: From Big Cities to Small-Town Treasures

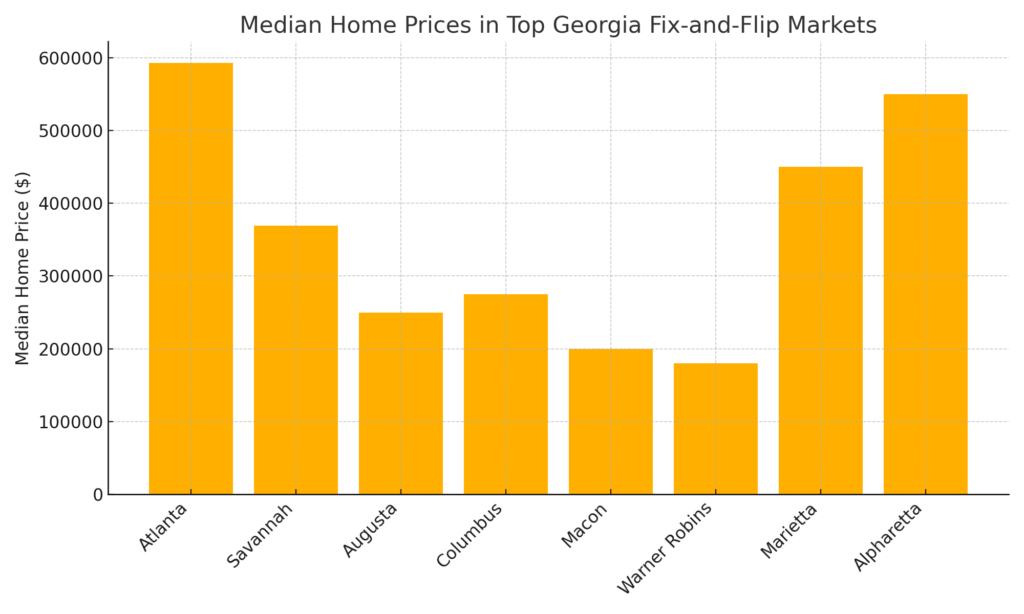

Atlanta remains the beating heart of Georgia’s fix-and-flip scene, where property values have climbed steadily by approximately 5%, bringing the average single-family home price close to $593,000. Atlanta’s diverse economy, driven by finance, tech, healthcare, and education sectors, supports continued housing demand. Neighborhoods such as Midtown, Buckhead, and the West End remain magnets for high returns, boasting strong buyer demand and premium resale values.

Savannah and Augusta also continue to enjoy robust growth trajectories, underpinned by targeted economic expansions. Savannah, with its historic charm and coastal allure, experienced around 6.8% annual appreciation, reaching average home values just above $322,000. This market benefits from an expanding port, growing tourism, and increased migration from higher-cost states. Augusta’s real estate market stability is bolstered by the healthcare and military sectors, providing consistent appreciation and attractive returns for flippers.

Small-town Georgia, however, is where savvy investors are uncovering surprisingly lucrative opportunities. Bremen, Aragon, and Bowdon are examples where modest investment can yield outsized returns. Bremen alone has demonstrated impressive average gross ROIs of around 177%, turning small investments into substantial profits due to limited competition and rising local demand. Such smaller markets, though previously overlooked, are now gaining recognition for their high-profit potential.

Small-town Georgia, however, is where savvy investors are uncovering surprisingly lucrative opportunities. Bremen, Aragon, and Bowdon are examples where modest investment can yield outsized returns. Bremen alone has demonstrated impressive average gross ROIs of around 177%, turning small investments into substantial profits due to limited competition and rising local demand. Such smaller markets, though previously overlooked, are now gaining recognition for their high-profit potential.

Statewide Trends: Stability Amidst Opportunity

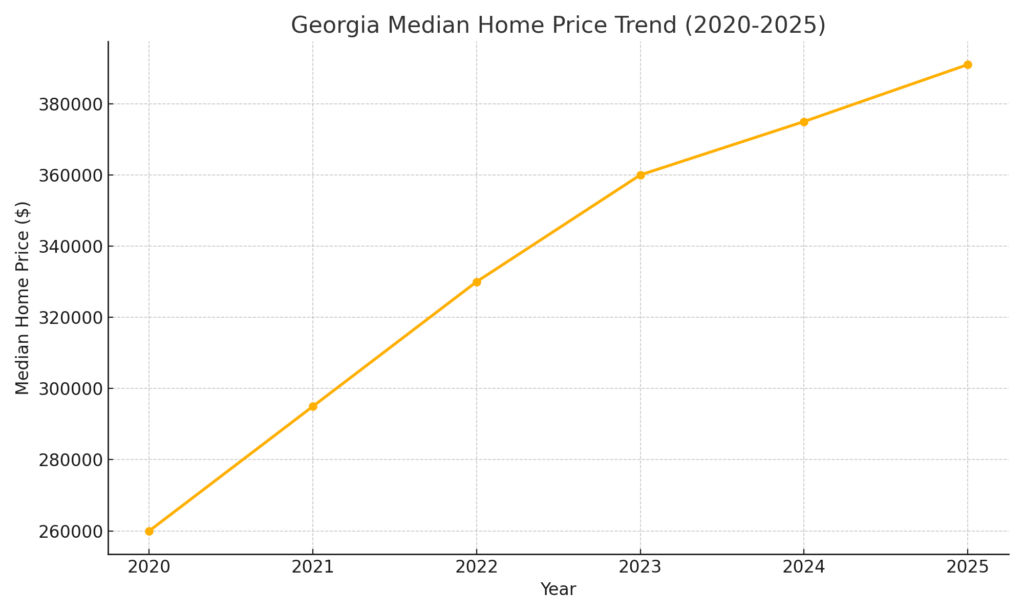

Georgia’s housing market has cooled from its pandemic-driven frenzy into what many analysts call a “Goldilocks zone”—not too hot, not too cold. Median statewide home prices hovered around $360,000 in 2024 and rose gently to about $391,000 by mid-2025, reflecting sustainable growth. Inventory levels have also improved notably, with active listings increasing around 25% year-over-year, enabling investors to find viable projects more easily than during recent housing booms.

Days on Market (DOM) have lengthened slightly to about 47 days by mid-2025. Although longer DOM could increase holding costs, it provides room for negotiation, reducing bidding wars and allowing investors to secure properties at favorable terms, ultimately enhancing profitability.

ROI and Profitability: A Delicate Balancing Act Across Georgia

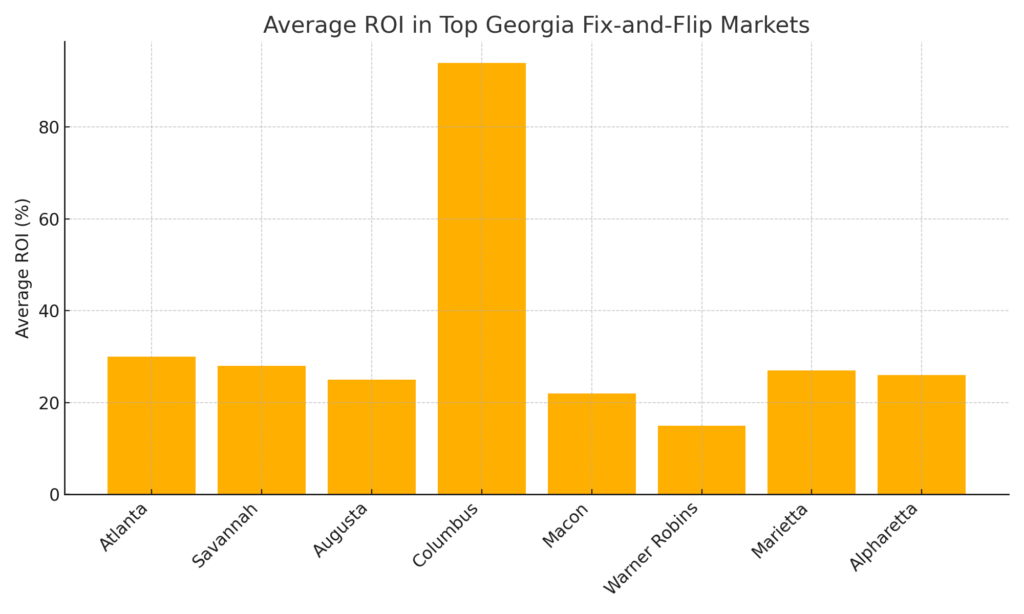

The profitability of fix-and-flip projects in Georgia varies greatly, heavily dependent on regional specifics. Nationwide, gross ROI averaged approximately 28.7%, and Georgia generally aligns with or exceeds this figure. Notably, Columbus, GA, stands out with nearly 94% gross ROI, driven by extremely affordable acquisition costs and robust buyer interest, exemplifying the kind of opportunities available in select Georgia markets.

The profitability of fix-and-flip projects in Georgia varies greatly, heavily dependent on regional specifics. Nationwide, gross ROI averaged approximately 28.7%, and Georgia generally aligns with or exceeds this figure. Notably, Columbus, GA, stands out with nearly 94% gross ROI, driven by extremely affordable acquisition costs and robust buyer interest, exemplifying the kind of opportunities available in select Georgia markets.

Conversely, Warner Robins illustrates the importance of careful market analysis. Despite being a highly active flipping market (around 23% of home sales), flippers in Warner Robins reported thin gross margins averaging just $3,500 per flip. Such data highlights the crucial need for thorough due diligence, emphasizing smart buying decisions and prudent project management to achieve sustainable profitability.

The widely respected “70% rule” remains the standard guideline for successful investors in Georgia. Investors typically target net ROI between 15-20%, buying at or below 70% of a property’s After Repair Value (ARV) minus anticipated renovation costs, thus safeguarding against unforeseen costs and ensuring consistent profitability.

Permits and Bureaucracy: Navigating Georgia’s Regulatory Waters

Permitting processes play a pivotal role in determining flip project timelines and profitability. Atlanta, notorious for slower permit processing times, often sees extended delays that must be carefully accounted for in investors’ project timelines. Conversely, smaller municipalities typically offer quicker and more efficient permit approvals, significantly reducing project timelines and accelerating profitability.

Historic districts, particularly in cities like Savannah, introduce additional complexity. Preservation approvals may extend project timelines by 30-60 days, impacting holding costs and overall profitability. Compliance with permit regulations in Georgia is non-negotiable; violations can result in substantial fines, project delays, or jeopardized insurance coverage. Savvy investors proactively incorporate these considerations into their planning processes to avoid costly pitfalls.

Top Markets for Fix and Flips in Georgia

1. Atlanta

1. Atlanta

Atlanta leads the state in fix-and-flip opportunities due to its strong economy, diverse housing stock, and consistent demand. The median home price is around $593,000 with 5% annual growth, while desirable neighborhoods such as Midtown, East Atlanta, Buckhead, and Old Fourth Ward offer high resale values. Days on market average about 34 days, and demand remains strong due to corporate relocations, job growth in tech, logistics, and entertainment, and a thriving cultural scene. ARVs in trendy neighborhoods often exceed $700,000, with luxury flips surpassing $1 million. Suburban markets like Decatur and Sandy Springs also see high turnover, and investor-friendly zoning in some areas boosts redevelopment potential.

2. Savannah

Savannah’s median home prices hover near $369,000, with 6.8% appreciation over the last year. Properties in Forsyth Park or Ardsley Park can reach ARVs well above $500,000 after renovation. Days on market average around 45 days, but demand is consistent due to its booming tourism, port activity, and military presence. Investors benefit from the city’s mix of historic homes and modern buyers seeking turnkey properties. The area’s steady population growth, with younger professionals relocating for lower cost of living, further supports the fix-and-flip cycle.

3. Augusta

Augusta’s median price is below $250,000, offering low entry costs and attractive ARVs. Popular neighborhoods like Summerville and Forest Hills see ARVs between $300,000 and $400,000 post-renovation. Augusta is home to a large medical community and Fort Gordon, which stabilize demand and minimize volatility. Investor interest is fueled by ongoing downtown revitalization and rental demand from healthcare professionals.

4. Columbus

Columbus stands out with a median home price around $275,000 and gross profits of $50,000-$60,000 per flip. The city’s strong local economy, bolstered by Fort Moore, tech businesses, and nearby manufacturing hubs, supports quick resale times. Days on market average under 40 days for renovated homes, and specific neighborhoods like Midtown and North Columbus are popular for first-time buyers, enhancing liquidity for flippers.

5. Macon

Macon’s median home price sits near $200,000, with appreciation over 22% annually. Revitalization projects in downtown Macon and historic neighborhoods like Vineville create opportunities for ARVs exceeding $300,000. The city is also attracting younger buyers due to its affordable cost of living, arts scene, and improving infrastructure. Investor demand is high in areas near Mercer University, where rental and resale markets overlap.

6. Warner Robins

Warner Robins boasts a median price under $180,000 with 23% of home sales being flips. ARVs typically range from $200,000 to $250,000, but profit margins are tight. The city benefits from military families and steady demand from Robins Air Force Base. Neighborhoods near the base and schools have strong rental demand, making them appealing for investors looking for hybrid flip-and-rent strategies.

7. Marietta (Cobb County)

Marietta’s median prices average around $450,000, with renovated homes selling quickly due to proximity to Atlanta. Top neighborhoods like East Cobb and Historic Marietta attract families, pushing ARVs up to $550,000-$600,000. The area’s school system and local amenities make it a consistent performer, and DOM is often under 30 days for well-staged homes.

8. Alpharetta

Known for high-end buyers, Alpharetta’s median price is around $550,000, with luxury flips often reaching $800,000-$900,000. Tech industry growth, corporate headquarters, and top-rated schools ensure strong demand and low DOM for quality properties. Homes in Avalon and Windward areas command particularly high ARVs due to lifestyle amenities.

Emerging Markets Worth Watching

Bremen

Bremen’s ROI of 177% stems from median acquisition prices of $107,000 and resale values above $240,000. The town’s growth is driven by affordable housing, improved infrastructure, and proximity to I-20. DOM remains low, around 35 days for renovated homes, indicating healthy buyer interest.

Aragon

Aragon offers entry points under $150,000 with rising buyer interest. ARVs of $220,000-$240,000 are achievable, and its proximity to Rome and Cartersville adds appeal. The small-town environment combined with improved commuting options is attracting first-time buyers and investors.

Bowdon

Bowdon’s quiet charm, affordable inventory, and steady migration from Atlanta suburbs make it a lucrative market. Investors report ARVs in the $200,000 range, with DOM under 50 days. Local schools and community projects are enhancing neighborhood desirability.

Jefferson

Jefferson’s 13% appreciation rate is fueled by its location within commuting distance of Atlanta and Athens. New developments, infrastructure upgrades, and school system improvements are drawing in buyers. Investors are seeing resale prices in the $280,000-$350,000 range for fully renovated properties.

Port Wentworth

Port Wentworth benefits from Savannah’s port expansion and industrial growth. Median home prices have risen over 15% year-over-year, with ARVs reaching $300,000-$350,000 post-renovation. The influx of logistics companies and manufacturing facilities is boosting long-term demand.

Markets to Watch Out For

East Macon

While Macon overall is booming, East Macon has seen slower growth, with DOM often exceeding 60 days. Inventory turnover is lower, requiring careful budgeting for carrying costs.

Rural South Georgia Towns

Certain rural areas in southern Georgia face declining populations and limited resale demand. Flips in these markets can suffer from low liquidity and reduced buyer interest.

Strategic Insights for Long-Term Success

Investors who closely monitor market dynamics, local economic developments, and demographic shifts will gain substantial advantages. Areas benefiting from job growth, such as regions around major new industrial investments like the Rivian EV plant or Hyundai’s Savannah facility, are particularly attractive. Leveraging localized market intelligence, understanding emerging buyer segments, and maintaining rigorous financial discipline will allow investors to consistently capitalize on Georgia’s evolving opportunities.

Conclusion: Georgia’s Investment Sweet Spot

Georgia’s fix-and-flip market in 2025 offers a compelling blend of predictability, opportunity, and profitability. Investors who meticulously analyze markets, manage project timelines effectively, and maintain compliance with regulatory requirements will find substantial and sustainable rewards. Georgia continues to be a fertile landscape for profitable ventures, from vibrant urban centers to burgeoning small-town communities. Whether choosing bustling Atlanta, historic Savannah, or promising smaller markets, Georgia offers ample opportunities as enticing and rewarding as its iconic peaches.

Frequently Asked Questions

Is Georgia still a good state for fix-and-flip investing in 2025?

Yes. Georgia’s 2025 market sits in what many call a “Goldilocks zone” not too hot, not too cold. Statewide median home prices rose from about $360,000 in 2024 to roughly $391,000 by mid-2025, inventory is up around 25% year-over-year, and Days on Market (~47 days) give investors more room to negotiate. The result is a market that offers predictable appreciation, deal flow, and solid profit potential without the extreme volatility seen in some other states.

Which Georgia markets offer the strongest fix-and-flip potential?

Georgia’s opportunities range from big metros to small-town plays:

-

Atlanta – Median price around $593,000 with ~5% annual growth; ARVs in hot neighborhoods like Midtown, Buckhead, East Atlanta, and Old Fourth Ward often exceed $700,000.

-

Savannah & Augusta – Strong appreciation driven by tourism, port activity, healthcare, and military employers; ARVs can push above $500,000 in top Savannah neighborhoods.

-

Columbus & Macon – Lower entry prices with strong buyer demand and revitalization; Columbus flips often net $50,000–$60,000 in gross profit, while Macon sees >22% annual appreciation in some areas.

-

Emerging towns like Bremen, Aragon, Bowdon, Jefferson, and Port Wentworth – These smaller markets offer lower buy-in and outsized ROIs, with Bremen posting average gross ROIs near 177%.

How do permits and historic rules impact flip timelines in Georgia?

Permits and local regulations can significantly affect your timeline and profitability:

-

Atlanta is known for slower permit processing, so investors need to budget extra time and carrying costs into their project timelines.

-

Smaller cities and towns typically offer faster, more efficient permitting, which can shorten project durations and improve returns.

-

Historic districts especially in places like Savannah often require preservation approvals, which can add 30–60 days to a project.

Skipping or mishandling permits in Georgia can lead to fines, delays, or insurance issues, so compliance needs to be part of your upfront planning, not an afterthought.

What kind of ROI should fix-and-flip investors target in Georgia?

Most successful Georgia flippers still follow the 70% rule:

Try to buy at or below 70% of ARV minus renovation costs, then aim for 15–20% net ROI after all expenses.

The state includes both standout ROI markets and cautionary zones:

-

High-ROI markets like Columbus and Bremen show how affordable acquisitions plus strong demand can drive very strong gross returns.

-

Tighter-margin markets like Warner Robins where flips can represent ~23% of all sales but average only $3,500 gross profit underscore the importance of careful underwriting and conservative budgeting.

Sources

- Georgia MLS Data (2020-2025) – Median home price trends and inventory statistics.

- Redfin Market Reports (2024-2025) – Housing market analysis for cities including Atlanta, Savannah, Macon, and Warner Robins.

- Zillow Housing Data (2020-2025) – Median sales prices and historical appreciation trends for Georgia.

- ATTOM Data Solutions (2024 House Flipping Report) – Statewide and city-level ROI, flipping volume, and profit margins.

- U.S. Census Bureau – Population growth and demographic data for Georgia metro and small-town areas.

- National Association of Realtors (NAR) Reports – Market insights, DOM trends, and investor-focused metrics.

- Local Government and Permitting Portals – Information on permitting timelines in Atlanta and Savannah historic districts.

- City of Savannah & Port of Savannah Growth Reports – Economic and infrastructure development impacting property values.

- Georgia Department of Economic Development – Updates on major job growth drivers (e.g., Rivian EV Plant, Hyundai facility).

- NeighborhoodScout & Realtor.com – City-level price and rental demand indicators.

- Local News Outlets (Atlanta Journal-Constitution, Savannah Morning News) – Updates on local housing revitalization and flipping activity.

- BiggerPockets Real Estate Forums – Market commentary and investor ROI case studies in Georgia.

- Rocket Homes & Houzeo Blogs – Supplemental data on Columbus and Macon real estate metrics.