Welcome to South Carolina: where the sweet tea flows, the beaches beckon, and rental property investors smile all the way to the bank.

Whether you’re eyeing a beach bungalow in Myrtle Beach, a downtown condo in Charleston, or a multi-family gem in Greenville, the Palmetto State has become one of the Southeast’s most attractive real estate playgrounds.

But behind the charm and magnolia trees is a serious story: South Carolina’s rental property market is quietly (and sometimes not-so-quietly) outperforming much of the nation. For Debt Service Coverage Ratio (DSCR) investors, this state offers a rare cocktail of strong rental demand, favorable yields, and a landlord-friendly legal environment—all shaken (not stirred) by solid demographic and economic trends.

Let’s break down what’s happening in the Palmetto State—and why it’s catching the attention of savvy DSCR investors from coast to coast.

The South Carolina Rental Boom – A Decade of Growth

Over the last decade, South Carolina has transformed from a “maybe later” market to a must-watch destination for rental property investors across the country. Fueled by one of the fastest-growing populations in the U.S., the Palmetto State has seen consistent migration from retirees, remote workers, young families, and job-seekers drawn by its lower cost of living, favorable climate, and pro-growth economy.

According to Census data, the state added more than 700,000 residents between 2010 and 2023—an increase of over 15%. Metro areas like Charleston, Greenville, and Myrtle Beach have been the big winners, but even smaller cities such as Rock Hill and Aiken have gained momentum. Horry County (Myrtle Beach) alone grew by more than 20% in just a few years, and Charleston isn’t far behind. New residents mean new housing demand—and in many cases, that demand is skewing toward rentals.

That shift is partly because South Carolina’s home price appreciation has outpaced wage growth. From 2020 to 2024, Columbia saw home prices soar more than 63%, while wages climbed just 24% in the same period. Similar affordability gaps have opened up across other metro areas. The result? A growing segment of the population that either can’t afford to buy—or chooses not to, opting instead for the flexibility and lifestyle benefits of renting.

The rental response has been strong. Rents have increased dramatically, particularly in urban and suburban markets with solid job growth. Occupancy rates have climbed as more people turn to rentals, while vacancy rates have plunged in cities like Columbia, Charleston, and Greenville. And even with new construction on the rise, demand continues to outpace supply in many key markets.

Perhaps most importantly, this isn’t a flash-in-the-pan boom driven by one-off events. The demographic, employment, and infrastructure fundamentals supporting South Carolina’s growth trajectory are long-term and structural. The state continues to attract major employers, such as Boeing, BMW, and Volvo, along with growing industries in logistics, health care, tech, and manufacturing.

From a DSCR investor’s perspective, this creates a powerful setup: strong tenant demand, rising rents, improving yields, and an overall environment that supports rental stability and growth. Investors who got in five years ago have already seen serious returns. But for those looking to enter or expand in 2025 and beyond, the window of opportunity is still open—and the runway looks long.

Rents, Returns, and Ratios: DSCR Heaven?

For DSCR investors, the golden question is always the same: Does the rent cover the debt?

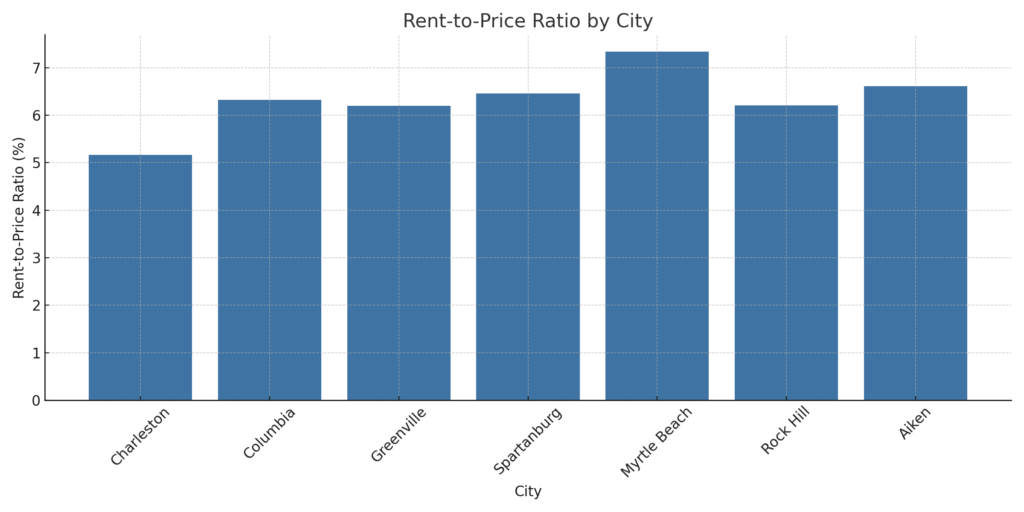

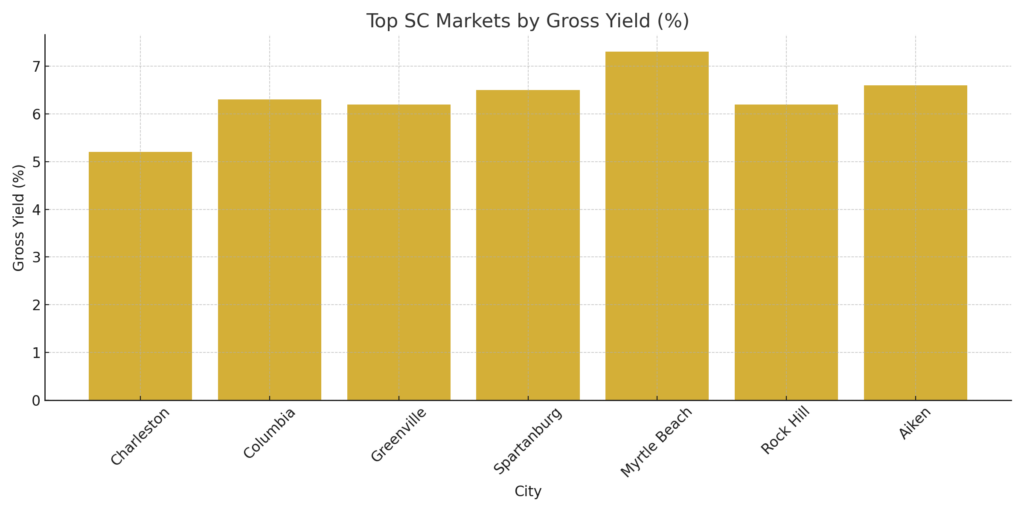

In South Carolina, the answer is increasingly a resounding yes. Across many metros, median gross rental yields are comfortably hovering between 7% and 8%, with select counties—like Aiken, Florence, and Sumter—cracking the double-digit mark. These are numbers that make underwriters smile, especially in a lending environment where income-generating assets reign supreme. In short-term rental hotspots like Myrtle Beach, it’s not unusual to see gross yields exceeding 15%, driven by high occupancy and seasonal surges. For those investing in beachside condos or Airbnb-friendly districts, the revenue potential often outpaces even the state’s strong long-term rental markets.

But it’s not just about income—it’s also about the balance between rent and acquisition cost. South Carolina continues to offer lower home prices than neighboring North Carolina and Georgia, and far below the national average. This creates a rare opportunity where both cash flow and appreciation are in play. Investors can pick up a 3-bedroom property for under $250,000 in many markets, rent it out for $1,700–$2,000/month, and still maintain healthy operating margins.

But it’s not just about income—it’s also about the balance between rent and acquisition cost. South Carolina continues to offer lower home prices than neighboring North Carolina and Georgia, and far below the national average. This creates a rare opportunity where both cash flow and appreciation are in play. Investors can pick up a 3-bedroom property for under $250,000 in many markets, rent it out for $1,700–$2,000/month, and still maintain healthy operating margins.

Cap rates have also rebounded after a long period of downward pressure during the ultra-low-interest-rate years. Thanks to higher interest rates and some price normalization, multifamily and single-family rental properties now commonly trade at 5.5% to 6.5% cap rates—ideal territory for DSCR math. These higher yields make it easier to hit or exceed that magic 1.25 DSCR number that lenders love. And because rents are still climbing—albeit more moderately—South Carolina’s investment math continues to get more attractive over time.

Cash-on-cash returns have similarly improved. In markets like Spartanburg, Columbia, and Rock Hill, many investors are reporting CoC returns north of 10%, even after financing and operating costs. These are strong results in any cycle, but especially impressive in a post-pandemic, higher-rate environment. The ability to acquire below replacement cost in some tertiary markets adds an extra layer of upside.

Let’s not forget the scalability factor. DSCR loans are built for expansion—no tax returns, no income statements, just property performance. And in a state like South Carolina, where rental yields are strong and investor competition is relatively light outside of the major metros, that’s a recipe for rapid, responsible growth. Whether you’re a seasoned operator building a portfolio of 50 doors or a first-time investor looking for your second deal, South Carolina gives you the room and the numbers to do it smartly.

In short: for the numbers people—and DSCR investing is all about numbers—South Carolina delivers. It’s not just fertile ground. It’s turnkey, cash-flowing, rent-raising, cap-rate-balancing, DSCR-qualified gold.

Regional Deep Dive – Where to Plant Your Flag

Charleston: The jewel of the coast and arguably South Carolina’s most iconic city. Charleston boasts a thriving tech sector, a powerful tourism engine, and a historic charm that’s catnip for renters and vacationers alike. Average rents for new lease apartments top $1,800, and short-term rental properties can gross six figures annually in tourist-heavy zones. Just remember: Charleston has local regulations for STRs, so be sure to read the fine print before buying that pastel beach house.

Charleston: The jewel of the coast and arguably South Carolina’s most iconic city. Charleston boasts a thriving tech sector, a powerful tourism engine, and a historic charm that’s catnip for renters and vacationers alike. Average rents for new lease apartments top $1,800, and short-term rental properties can gross six figures annually in tourist-heavy zones. Just remember: Charleston has local regulations for STRs, so be sure to read the fine print before buying that pastel beach house.

Beyond downtown Charleston, surrounding areas like Mount Pleasant, West Ashley, and North Charleston offer a range of investment options. Mount Pleasant caters to upper-income families with stable long-term rental demand and appreciation upside, while North Charleston’s more affordable housing stock delivers higher yield potential. Investors who prioritize school zones, proximity to job centers like Boeing and MUSC, and easy access to the Port of Charleston will find enduring demand.

Myrtle Beach: It’s not just for spring breakers and golf retirees anymore. With median home prices hovering around $270K and vacation rentals bringing in $40K to $60K per year, Myrtle Beach is a short-term rental juggernaut. Its seasonality is offset by off-season events and consistent tourism traffic, making it one of the most profitable STR markets in the country.

Savvy investors also look to surrounding towns like North Myrtle Beach and Surfside Beach, which offer more family-friendly atmospheres, strong occupancy rates, and slightly less competition. Whether you’re investing in oceanfront condos, townhomes near golf resorts, or small single-family homes, this area continues to rank high for gross rental income performance and occupancy year-round.

Greenville & Spartanburg: Welcome to the Upstate, where manufacturing meets modern revitalization. Greenville has become a magnet for young professionals, thanks to its booming job market, walkable downtown, and quality of life. Spartanburg, meanwhile, offers lower price points and higher yields—perfect for BRRRR investors looking to extract equity and reinvest. With average home prices well under $300K and rent growth continuing, these markets offer scalable opportunities.

Greenville’s West End and North Main neighborhoods are seeing a surge in infill development, while surrounding suburbs like Simpsonville, Mauldin, and Greer provide strong school systems and renter-friendly communities. Spartanburg’s appeal lies in its blue-collar backbone and expanding healthcare and logistics sector—an ideal mix for steady rental demand. Investors in both cities are also finding success with mid-term rentals serving traveling nurses and manufacturing contractors.

Columbia: This government-and-education-heavy market has seen extraordinary rent growth since 2020, with average rents jumping over 40%. Between the University of South Carolina, Fort Jackson, and a growing number of remote workers and retirees, demand here remains resilient. Columbia also ranks among the best metros for rental occupancy improvement—proof that the demand curve is still pointing up.

Downtown Columbia and The Vista neighborhood are popular for student and young professional renters. The suburbs—Lexington, Irmo, and Blythewood—offer great options for families and provide consistent long-term rental demand. Investors focusing on USC-adjacent properties can optimize student housing strategies (think per-bed leasing), while others find success with furnished short-term rentals for visiting medical personnel and government contractors.

Emerging Markets: Don’t sleep on Aiken, Rock Hill, Florence, Sumter, or Anderson. These second-tier cities offer sub-$250K inventory, minimal investor competition, and stable renter demand thanks to local healthcare systems, manufacturing hubs, and military installations. In many cases, gross rental yields range from 8% to 11%, making them excellent choices for yield-focused investors.

Aiken benefits from proximity to Augusta and the Savannah River Site, bringing in federal workers and contractors. Rock Hill and Fort Mill act as Charlotte spillover markets, with investors taking advantage of South Carolina’s lower taxes and fewer rental regulations. Florence, a regional healthcare hub, sees steady demand from medical professionals, while Sumter has a strong military presence due to Shaw Air Force Base. Anderson’s small-town charm, anchored by manufacturing and nearby Clemson University, makes it a sleeper hit for long-term investors targeting affordability and upside.

Together, these regions form a rich, varied investment landscape. Whether you’re seeking short-term rental riches on the coast, value-add BRRRR plays in the Upstate, or dependable cash flow in overlooked towns, South Carolina’s metro and micro-markets offer a flavor for every investor appetite.

Supply, Demand, and Why You Shouldn’t Panic

It’s true—around 45,000 new rental units are expected to hit the Carolinas in 2025, and on the surface, that sounds like a flood. But take a breath, DSCR investors: the fundamentals tell a different story. Demand in South Carolina is not just strong; it’s surging. In Columbia alone, rental occupancy jumped by 6.5% in just one year, despite an influx of new housing. Charleston is holding firm at above 93% occupancy, a testament to how resilient demand remains, even in the face of aggressive development.

What’s driving this demand? Several factors. First, homeownership remains out of reach for many due to high prices and elevated interest rates. Second, population growth continues unabated—people are still moving to South Carolina in droves for jobs, lifestyle, and affordability. Third, there’s a cultural shift favoring renting over owning, particularly among millennials and Gen Z professionals who value mobility and amenity-rich living.

Now, let’s talk about supply. Developers have been busy, especially in prime metros. But the bulk of what’s being built falls into the Class A, luxury apartment category. Think rooftop lounges, dog spas, and yoga studios. These projects are concentrated in urban cores and cater to high-income renters. While they add units to the market, they don’t directly compete with the bread-and-butter of most DSCR portfolios: single-family rentals, small multifamily properties, and workforce housing.

What’s more, the construction pipeline is tightening. High interest rates and increasing material costs have slowed new project starts. In fact, many developers are delaying or canceling proposed projects altogether. The boom of 2023 and early 2024 is expected to taper by late 2025, creating a short-term surge in completions followed by a more modest delivery schedule into 2026 and beyond.

From an investor’s lens, this is a prime opportunity. Inventory is temporarily high, giving buyers some negotiating power, especially on tired listings or overleveraged assets. Meanwhile, rents have remained stable—or are even growing—in many submarkets. That balance of softer pricing and solid income makes it easier to achieve favorable DSCR terms. Investors who get in now can lock in solid assets while the competition is still digesting the new inventory.

Additionally, many of the markets with the most construction—Charleston, Greenville, and Columbia—are precisely the areas with the strongest job and population growth. That means even with new units, there’s a growing tenant base ready to absorb them. And since DSCR investors often target properties just outside the luxury segment, the effect of this new supply is muted where it matters most.

The takeaway? Don’t be scared off by the cranes in the sky. Supply may be rising, but smart investors who understand submarket dynamics—and who stick to properties with strong rent-to-price ratios—won’t feel the squeeze. In fact, they might just find this moment to be the best buying window of the cycle.

Landlord Laws, Taxes, and Other Fun Stuff

When it comes to landlord-friendliness, South Carolina is about as investor-friendly as it gets. There’s no rent control. No onerous tenant protection schemes. And no statewide eviction moratoriums that can tie your hands for months. In fact, evictions can legally begin just five days after a missed payment, and the court process tends to move quickly. That gives landlords a level of predictability that’s becoming increasingly rare in many U.S. markets. It’s one of the big reasons South Carolina stands out when compared to more heavily regulated states like California, New York, or even parts of North Carolina.

Municipal codes are generally straightforward, and many counties and towns are accustomed to investor activity, meaning permitting and inspection processes are often more streamlined. That doesn’t mean you can skip your due diligence—but it does mean you’re far less likely to be blindsided by sudden regulatory shifts or byzantine enforcement.

Tax-wise, South Carolina maintains an investor-friendly stance. While owner-occupied homes are assessed at 4%, investment properties are assessed at 6%. However, the state’s overall property tax burden remains light. Even at the 6% rate, effective property tax rates for most investors average just around 1%—competitive with North Carolina and significantly lower than Georgia, where county-level millage rates can really eat into cash flow. Additionally, there’s no state-level transfer tax on deeds, keeping transaction costs lower.

Insurance remains relatively affordable in most inland markets, though coastal investors should be prepared to carry wind and flood coverage—and premiums can be substantial, especially post-hurricane season. Still, South Carolina compares favorably to other Southeastern coastal states like Florida, where skyrocketing premiums are squeezing investor margins.

For short-term rental (STR) operators, the landscape is largely favorable but varies by locality. Charleston, for instance, has zoning rules and licensing requirements that limit STRs to designated zones or property types. You’ll want to get familiar with your municipality’s rules before diving into Airbnb territory. That said, outside of a few metro hubs, most of the state takes a hands-off approach to vacation rentals. Many smaller towns and suburban enclaves offer wide-open opportunities for STR income without the licensing gauntlets you might find in places like Asheville or Savannah.

South Carolina also doesn’t impose burdensome rental registration or inspection requirements on landlords. While some cities are experimenting with proactive rental inspections, most of the state allows you to operate your rental business without intrusive oversight. That frees up investor bandwidth—and margins.

In sum, the legal and financial climate for rental property owners in South Carolina is stable, transparent, and refreshingly rational. You can underwrite with confidence, manage with autonomy, and scale without navigating a legal minefield.

SC vs. GA and NC: The Battle of the Southeast Titans

Let’s break it down. Georgia brings big-city energy with Atlanta, and North Carolina counters with booming Raleigh-Durham and Charlotte. These markets are magnets for institutional money, tech growth, and corporate relocations. But bigger doesn’t always mean better—especially for DSCR investors who are chasing yield, stability, and long-term upside.

South Carolina’s competitive edge lies in its combination of affordability and investor-friendliness. While Atlanta’s median home price is pushing $400K and Raleigh isn’t far behind, many South Carolina metros still offer sub-$300K inventory—and we’re talking quality inventory. This price advantage means better rent-to-price ratios, stronger cash-on-cash returns, and higher DSCRs without over-leveraging. It’s no wonder gross yields in many SC markets are a full percentage point or more higher than their GA or NC counterparts.

Then there’s the legal and operational terrain. South Carolina is widely considered one of the most landlord-friendly states in the Southeast. Compared to North Carolina, where landlords face longer notice periods for evictions and more robust tenant protections, South Carolina’s streamlined legal system is a breath of fresh air. Georgia is similarly landlord-friendly, but counties like Fulton and DeKalb have become increasingly bureaucratic, and permitting processes can vary widely.

From a competitive standpoint, South Carolina still flies under the radar of many institutional buyers. That’s not to say hedge funds and REITs aren’t sniffing around Charleston or Greenville—they are—but they haven’t flooded the state like they have in Atlanta or Charlotte. This gives small and midsize investors more room to operate, better acquisition margins, and less pressure to overbid on deals.

In terms of appreciation, North Carolina and Georgia may have an edge in certain high-growth corridors. However, South Carolina’s upward trajectory is accelerating. Charleston continues to see year-over-year price and rent appreciation, and Greenville has positioned itself as one of the Southeast’s best-kept secrets with a blend of affordability and economic growth. Coastal markets like Myrtle Beach and Hilton Head are benefiting from both tourism-driven demand and the “Zoomtown” phenomenon, where remote workers are choosing lifestyle-first locations with strong rental fundamentals.

One more comparison worth noting: state and local taxes. South Carolina generally has lower property tax rates than Georgia and offers a more predictable tax structure than some of North Carolina’s county-by-county systems. The result? More stability in your operating costs and fewer surprises at the closing table.

The final verdict? If you’re looking for scale, institutional validation, and large-market buzz, Georgia and North Carolina might be your game. But if you want yield, efficiency, control, and untapped opportunity, South Carolina punches far above its weight—and might just be the best-value play in the entire Southeast.

Final Thoughts: Should You Invest in South Carolina in 2025?

After breaking down the data, the market dynamics, and the legal landscape, the verdict is clear: South Carolina is one of the most compelling rental property markets in the country for DSCR-focused investors. It’s not just that the state has solid fundamentals—it’s that those fundamentals are aligning at just the right time.

If you’re looking for:

- Strong DSCR coverage ratios that keep lenders happy

- Multiple viable investment strategies (STR, LTR, BRRRR, turnkey)

- Landlord-friendly laws and stable tax policies

- High-growth metros and overlooked secondary markets

- The kind of diversity that lets you build a balanced portfolio in one state

Then South Carolina deserves a serious look.

But here’s what sets it apart even more: it’s a market that offers both safety and upside. You’re not taking wild swings or speculative bets—you’re leveraging rent-to-price ratios, predictable legal frameworks, and population trends that favor landlords. Whether you’re deploying capital for yield, for appreciation, or for long-term wealth-building through scale, South Carolina gives you room to maneuver and options to pivot.

You can go conservative with Class B multifamily in the Midlands. You can go aggressive with high-octane short-term rentals along the coast. You can build generational equity in the Upstate or chase double-digit yields in overlooked counties where competition is low and margins are high. Whatever your strategy, South Carolina meets you where you are—and then adds tailwinds.

And let’s not forget the lifestyle bonus. From beaches to mountains, golf courses to breweries, historic towns to innovation corridors, investing here means you’re building a portfolio in a place people actually want to live. That’s not just good for tenants. It’s good for long-term demand, pricing power, and brand equity—especially if you’re operating under your own property management umbrella.

So, pack your underwriting spreadsheet, grab some boiled peanuts, and get ready to write your next (or first) chapter in a market that’s built for cash flow, growth, and real investor returns.

South Carolina isn’t just on the rise—it’s in its prime.

Interested in acquiring DSCR rental properties or scaling your portfolio in South Carolina? Our team at American Heritage Lending can help you structure the financing, identify market opportunities, and close faster than you can say “Summerville Duplex.”

Let’s grow together in the Palmetto State.

Frequently Asked Questions

Why is South Carolina such a strong market for DSCR rental investors in 2025?

South Carolina combines population growth, rising rents, and relatively affordable home prices, which is a sweet spot for DSCR investing. Many markets see gross rental yields in the 7–8% range, with some counties hitting double digits and short-term rental hotspots like Myrtle Beach reaching 15%+ gross yields. Add in strong job growth from employers like Boeing, BMW, Volvo, and healthcare/logistics hubs, and you get solid rent-to-price ratios that make it easier to hit DSCR targets while still leaving room for cash flow and long-term upside.

Which South Carolina markets are most attractive for DSCR rentals?

The state offers a mix of coastal, metro, and secondary markets that all work for different strategies. Charleston and Myrtle Beach shine for vacation and short-term rentals, while Greenville and Spartanburg in the Upstate are great for value-add and BRRRR plays with strong job bases and reasonable prices. Columbia benefits from government, military, and university demand, driving big rent growth since 2020. Emerging markets like Aiken, Rock Hill, Florence, Sumter, and Anderson offer sub-$250K inventory, 8–11% gross yields, and less competition, ideal for yield-focused DSCR investors.

Should investors worry about all the new rental construction in South Carolina?

Not really, if you’re buying the right product in the right locations. While tens of thousands of new units are hitting the Carolinas, most of that new supply is luxury Class A apartment product in urban cores. DSCR investors are usually targeting single-family rentals, small multifamily, and workforce housing, which don’t compete directly with rooftop-pool apartments. At the same time, demand is surging: occupancy in places like Columbia and Charleston remains above 93%, and population growth is still strong. With many future projects being delayed due to higher rates and construction costs, today’s brief window of softer pricing can actually be an advantage for buyers.

How landlord-friendly is South Carolina compared to nearby states like Georgia and North Carolina?

South Carolina is one of the most landlord-friendly states in the Southeast. There’s no rent control, eviction can legally begin just five days after a missed payment, and the court process is relatively fast and predictable. Property taxes on rentals are assessed at 6%, but effective rates still hover around ~1%, which is competitive with North Carolina and generally lower than Georgia once local millage rates are factored in. Short-term rental rules are mostly local, with tighter regulation in places like Charleston but a largely hands-off approach in many other cities. Overall, the legal and tax environment gives investors a high level of control and stability compared with more heavily regulated states.

Sources

-

U.S. Census Bureau

-

Population growth estimates for South Carolina counties (2010–2023)

-

Migration trends and housing data

-

-

U.S. Department of Housing and Urban Development (HUD)

-

Rental affordability and Fair Market Rent (FMR) data

-

-

Redfin & Zillow Market Reports

-

Median home price trends across SC metros (2020–2024)

-

Sales volume and appreciation rates

-

-

RentCafe & Apartment List

-

Monthly and annual rent growth data

-

Occupancy rates for Charleston, Columbia, Greenville, etc.

-

-

CoStar & Yardi Matrix

-

New construction pipeline and multifamily development data

-

Cap rate and occupancy trends

-

-

South Carolina Housing Finance and Development Authority (SC Housing)

-

Local housing demand projections

-

Affordable housing stats

-

-

AirDNA & Mashvisor

-

Short-term rental revenue estimates for Myrtle Beach, Charleston, etc.

-

STR occupancy rates and seasonal performance

-

-

Local MLS Reports (e.g., Charleston Trident Association of Realtors)

-

Neighborhood-level pricing and rental comp data

-

-

County Tax Assessor’s Offices (Charleston, Richland, Greenville)

-

Property tax assessment rates and effective tax burdens

-

-

Bureau of Labor Statistics (BLS)

-

Job growth, wage data, and employment trends across SC

-

-

Local News Sources (The Post and Courier, The State, Greenville News)

-

Real estate development updates

-

Municipal STR regulations and landlord ordinances

-