FIX AND FLIP LOANS

Fix & Flip Loans – Hard Money Rehab Loans – Financing a House Flip

Our Fix & Flip RATES & TERMS:

Property Types

Loan Amounts

$75,000 – $2,000,000

Term

6 to 24 month interest-only loans available.

Loans Available

Loans are available to individuals with or without stated income, trusts, corporations, and limited partnerships.

Fix and flip loans (also known as hard money rehab loans, investment property rehab loans, or house flipping loans) are short-term financing tools. These tools enable a real estate investor to obtain the necessary capital to acquire, improve and resell a property for profit.

Fix and flip financing is available from hard money lenders but not from traditional lenders such as banks. Financing a house flip is a quick and straightforward process for an experienced lender like American Heritage Lending.

Real Estate Financing for Property Flippers

As a loan type, fix and flip is used exclusively for residential real estate opportunities that you are looking to rehab and sell within a short period of time, typically 6 to 9 months from the date of purchase. Investors will purchase a distressed property or fixer upper, with the intention of ‘fixing’ the damage and improving its look. The ultimate goal is for the investor to sell or rent the property under the following three conditions:

- Minimize the renovation expense as much as possible

- Maximize the market value of the property

- Retain the property for the shortest possible time

Good deals on single-family homes usually come up when you least expect it, and investors in the local real estate market are quick to respond. This is where American Heritage Lending comes in. When it comes to fixing and flipping, cash and speed are crucial. Real estate investors need the resources to execute their plan and make attractive offers that promise quick closes. For all but the most cash-rich investors, one of the few means of competing is our fix and flip loan.

?

Why choose a fix and flip hard money loan?

If you’re an investor or flipper interested in buying properties that require all-cash or hard money to fix and flip, consider our fix and flip program. Fix and flip loans provide up to 90% of the total project cost, which is the purchase price plus the rehab cost. These loans have no prepay, allowing you to sell the property quickly.

A fix and flip loan allows borrowers to come in with minimal skin in the game.

We realized that our clients who purchase investment properties perform some level of rehab on the property to get it ready for sale or rental. Occasionally, the rehab can cost more than the actual price of the purchase. To serve our clients better, we decided to make our fix and flip loans based on the total project cost. We can lend up to 90% of the total project cost in our fix and flip loan program – the rehab money is held back and released as the project is completed.

American Heritage’s fix and flip loans provide flexible terms for funding of up to 90 percent of the purchase and rehab costs of the project. We offer loans for fix and flip properties from $100,000 to $2 million, with no prepay penalty and no limit on the number of properties.

Use our fix and flip loans when traditional lending solutions are not available.

Often these undesirable properties do not meet traditional lending guidelines. This means federal agencies like Freddie Mac and Fannie Mae will not back these loans. These agencies provide money to traditional lending agencies that typically provide cash to home-buyers. Because federal agencies are not backing the loan, options for borrowers looking to purchase distressed properties are limited.

We can often provide you with same-day prequalification on our fix and flip loan, so you have the cash fast to take advantage of opportunities when they arise. Please complete our Fix and Flip Loan Interest Short Form to get started.

Please review a sampling of fix and flip deals funded to see our past performance.

Fix and flip loan scenarios we commonly assist with include but are not limited to:

- Short Sale Purchase and Rehab

- REO or Bank Owned Purchase and Rehab

- Refinancing a short term loan intended as a Flip

- Unable to qualify for Conventional Financing

- Portfolio Loans and Multi-Property Loans

There is no limit on the number of properties.

We offer interest-only fix and flip loans for up to 2 years, allowing you to choose a payment schedule that best fits your needs! If you’re looking to grow your real estate business, we can help!

We are as good as cash.

With no limits on the number of properties or fix and flip loans, you can leverage one building or your entire portfolio.

Our customized fix and flip loan programs allow you to get a loan that best suits your business needs.

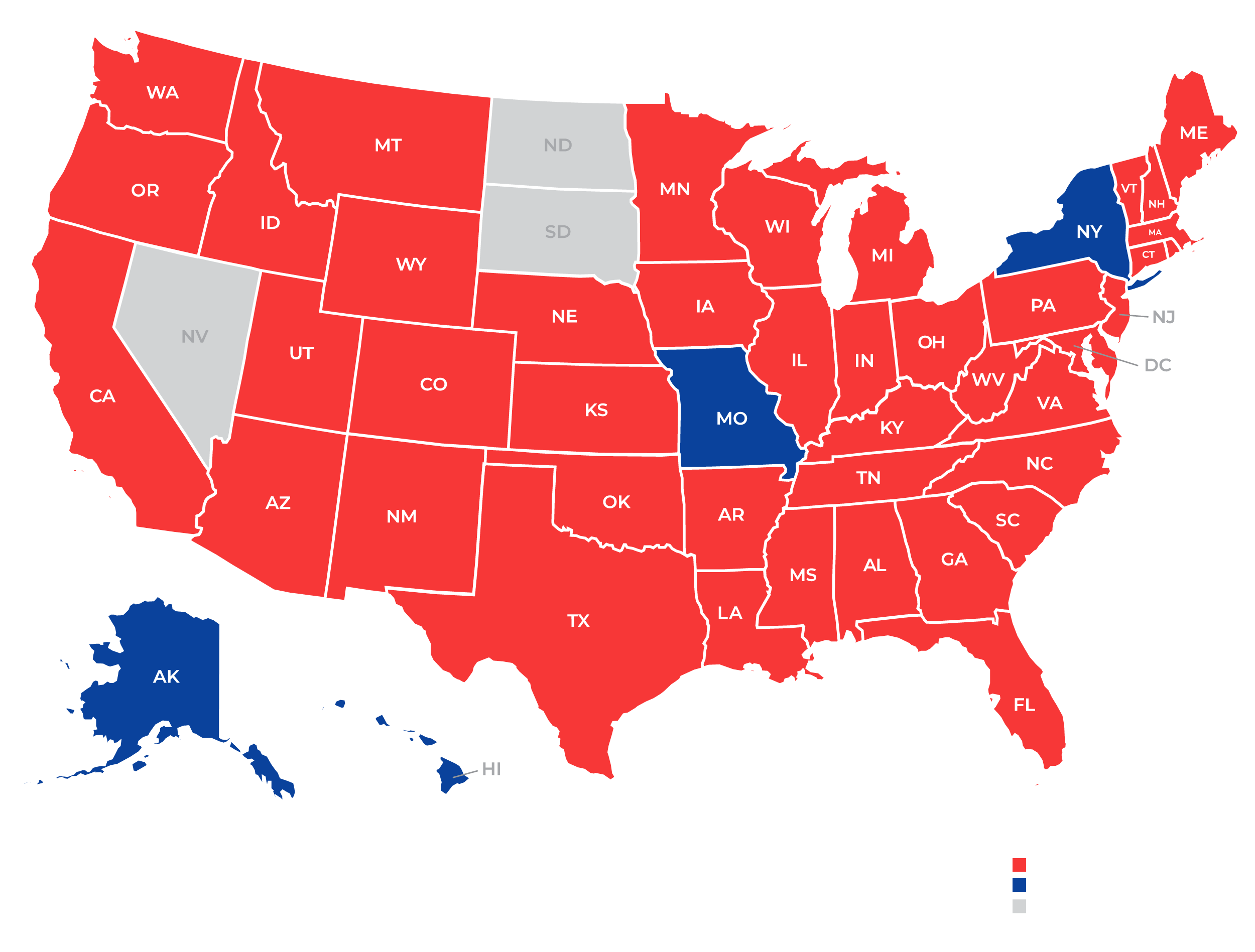

States We Lend In