Everything’s Bigger in Texas, Including the Real Estate Opportunity: A 2025 Investor’s Guide to DSCR Financing & the Texas Rental Market

Welcome to Texas, where the brisket is smoky, the boots are shiny, and the real estate? It’s booming. In 2025, the Lone Star State is serving up a sizzling plate of rental property potential, and savvy investors are digging in with gusto. But here’s the twist: traditional financing? That’s yesterday’s news. Today, it’s all about DSCR loans—the turbocharged financing strategy that lets the property do the talking (and qualifying).

This isn’t just another market summary; this is your data-fueled, sarcasm-sprinkled guide to unlocking Texas-sized returns with a side of sweet loan structuring. So grab your favorite hat, pour yourself a tall glass of iced tea, and let’s dive into the spicy goodness of Texas investing, boots first.

Why Texas is Still a Landlord’s Paradise

Let’s set the stage with why Texas continues to be the land of opportunity for rental property investors before we zoom into specific cities.

In case you haven’t heard, everyone and their cousin is moving to Texas. Nearly 473,000 people joined the party last year, and they didn’t all bring tents. That means housing demand—and especially rental demand—is on fire.

Key Stats:

-

Median home price statewide: ~$335,000 (a slight dip = investor entry point!)

-

Investor purchase rate: ~22% of all homes sold

-

2025 job growth: 270,000+ new positions added (read: renters incoming)

Combine that with no state income tax, a pro-business climate, and housing prices that still make Californians do a double take, and you’ve got yourself a potent investment cocktail. Add in the fact that many major employers—like Tesla, Oracle, and Toyota—have relocated or expanded to Texas, and the long-term population growth becomes not just likely, but inevitable.

And we can’t forget about legislation. Texas has long been known as one of the most landlord-friendly states in the U.S. There are fewer regulatory hurdles, no rent control, and expedited eviction processes. In a world where some investors feel like they need a law degree to collect rent, Texas keeps it simple—and profitable.

Let’s not overlook the diversity of opportunity, either. From bustling metros to college towns, border cities to oil country, the Texas rental market offers a wide range of tenant profiles and investment strategies. Whether you’re after appreciation, cash flow, or a little of both, there’s a Texas market that fits the bill.

So whether you’re eyeing a hipster bungalow in Austin, a family-friendly rental in Dallas, or a student special in Lubbock, there’s no shortage of opportunity—or barbecue.

Top Texas Markets for Rental Property Investment

Before we ride into the specific cities, it helps to take a step back and look at the broader map of Texas. From the piney woods of East Texas to the high plains of the Panhandle, and from the bustling border towns down south to the sparkling skyscrapers in the north, Texas is more than just one economy—it’s a patchwork of micro-markets. Each region brings different investment dynamics: tech-driven appreciation, oil-influenced cash flow, university-fueled rental demand, or cross-border commerce.

With over 1,200 incorporated cities and a land mass larger than many countries, choosing where to invest in Texas isn’t about finding “the” best market—it’s about finding the right one for your strategy. Below, we’ve broken down the state’s most promising metros and rising stars to help guide your next move.

The beauty of Texas is that it’s not just one market—it’s many. Each region has its own flavor, strengths, and quirks. Here’s a breakdown of where to look, what to expect, and why investors are placing their bets across the state.

1. Austin – The Tech Darling

-

Median home price: $450K–$500K

-

Rents: Down ~16% YOY (but don’t panic—techies still need places to live)

-

Yields: 4–5%

-

Vibe: Flip-flops meet Fortune 500

Austin’s reputation as the “Silicon Hills” of the South is well-earned. Major tech players have transformed the local economy, bringing high-paying jobs and a constant influx of young professionals. Though rents have dipped due to a flood of new apartment supply, the long-term fundamentals remain strong. Investors betting on Austin today are banking on continued tech growth, cultural cachet, and rising wages to fuel appreciation and steady rent increases.

2. Dallas-Fort Worth – The Balanced Beast

-

Median home: ~$400K

-

Rental yield: ~4.7%

-

Over 55% renter households

-

Landlord law rating: 10/10, would evict again (legally, of course)

The Dallas-Fort Worth metroplex is Texas’s largest economic engine, with industries ranging from finance and logistics to healthcare and defense. This region is ideal for investors seeking balance—solid rental demand, reasonable home prices, and a diverse tenant pool. With population growth spread across both Dallas and its rapidly developing suburbs (think Frisco, Plano, and Arlington), investors can find options ranging from luxury apartments to cash-flowing single-family homes in up-and-coming neighborhoods.

3. Houston – The Affordable Giant

-

Median home: ~$330K

-

Average rent: ~$1,240

-

Cap rates: 5.5%+ (hello, cash flow)

-

Bonus: High oil, low risk (if you pick the right neighborhood)

Houston is the wild card of Texas real estate: large, diverse, and full of opportunity. The city’s vast geographic sprawl means investors can find deals across a wide range of zip codes—from urban townhomes near the medical district to suburban single-family rentals on oversized lots. The oil and energy industry still looms large here, but Houston’s economy is increasingly diversified. Strong rental yields, low purchase prices, and rising in-migration make it a great place to seek positive monthly cash flow.

4. San Antonio – Steady as She Grows

-

Median home: ~$309K

-

Rents: ~$1,600 (apt) / ~$1,800 (SFR)

-

Rent declines in 2024 = buying opportunity

-

Military + Tech = diversified tenant base

San Antonio flies under the radar, but investors who do their homework find a gem. The city boasts a growing population, a strong military presence (thanks to multiple bases), and an expanding healthcare and cybersecurity industry. Home prices are still accessible, and competition is less fierce than in Austin or Dallas. Investors who value consistent, long-term tenants—especially military families and young professionals—will feel right at home.

Emerging Markets Worth Watching

Texas isn’t just a tale of big metros. Some of the highest returns are found in places with smaller populations and bigger upside. These cities often fly under the radar, but for the savvy investor, they offer a combination of affordability, strong tenant demand, and lower competition. Whether you’re looking to diversify your portfolio or get in early before a market takes off, these areas are worthy of a closer look.

Waco – From Fixer Upper to Investor Favorite

Waco – From Fixer Upper to Investor Favorite

-

Median Home Price: ~$270K

-

Average Rent: $1,450–$1,600

-

Gross Yields: 6%–8%

-

Claim to Fame: Chip & Joanna made it cute. Baylor made it stable.

Once known primarily for silo-shopping tourists and college football, Waco has quietly become one of the most promising mid-size rental markets in Texas. The city sits halfway between Dallas and Austin, giving it strategic logistical value while retaining small-town affordability. Investors are latching onto value-add properties, student rentals, and short-term units serving the endless stream of HGTV pilgrims.

Rental demand is driven by Baylor University (over 20,000 students), healthcare employment, and a growing young professional base. Oh—and it’s still one of the few markets where you can find a solid duplex under $300K and cash flow from day one.

Lubbock – The West Texas Workhorse

-

Median Home Price: ~$240K

-

Average Rent: $1,200–$1,350

-

Yields: Often 7%+, especially on student housing

-

Anchors: Texas Tech + a booming healthcare sector

Lubbock is a textbook college town—literally. Home to Texas Tech (enrollment ~40,000), it offers consistent rental demand from students, faculty, and medical professionals. Investors love Lubbock for its high cash flow potential and lower-than-average competition. Cap rates here are significantly higher than in bigger metros, and vacancy risk is minimal with 9-month lease cycles common in student housing.

There’s also an increasing push toward mid-term furnished rentals, with traveling nurses and contract workers becoming a larger share of renters. Lubbock may not be flashy, but it’s one of the most consistent markets for those who love spreadsheets more than skylines.

McAllen – Borderline Brilliant

-

Median Home Price: ~$220K

-

Average Rent: $950–$1,300 (depending on unit type)

-

Yield Potential: 6%–9% for entry-level SFRs

-

Why It Works: Trade, medical tourism, and low housing costs

Located in the Rio Grande Valley, McAllen is booming in its own quiet way. A hub for international trade, healthcare, and manufacturing, the city’s economy is deeply tied to the U.S.–Mexico relationship. It also has one of the youngest populations in Texas, which translates to long-term rental demand.

While the rents aren’t sky-high, neither are the prices—and that makes for excellent yield math. Investors have been particularly successful with small multifamily properties and buy-renovate-rent strategies. Bonus: property taxes and insurance are often lower than in hurricane-prone Gulf Coast areas.

El Paso – The Sun City Sleeper

-

Median Home Price: ~$230K

-

Average Rent: $1,100–$1,400

-

Occupancy: ~95% for well-located SFRs

-

Key Drivers: Fort Bliss, logistics, and cross-border commerce

Way out west, El Paso offers an intriguing mix of military stability and economic growth. Fort Bliss is one of the largest military complexes in the country, generating a steady stream of tenants. The city is also a key logistics hub, with growth in warehousing and cross-border distribution.

Real estate in El Paso is among the most affordable of any major U.S. metro. Investors here often target single-family homes near base or workforce housing near job centers. With consistent rental demand and minimal new housing supply, El Paso has quietly become a favorite for investors looking to diversify geographically.

Killeen/Temple – Military Muscle Meets Growth Potential

-

Median Home Price: ~$230K

-

Rents: $1,200–$1,500

-

Vacancy Rates: Low (especially near Fort Cavazos)

-

Growth Factors: Military turnover, healthcare expansion, affordable entry

Killeen and nearby Temple offer the kind of fundamentals that make DSCR lenders smile: low prices, consistent rent, and demand that doesn’t vanish during market dips. Anchored by Fort Cavazos (formerly Fort Hood), Killeen sees constant turnover—meaning investors rarely deal with long vacancies.

Meanwhile, Temple is quietly building its own name thanks to Baylor Scott & White Medical Center and a growing manufacturing base. The I-35 corridor between Austin and Waco is tightening, and these cities are catching overflow demand. With the right property management, even new investors can turn a healthy profit here.

Honorable Mentions

-

-

Tyler: A medical and retirement hub with growing STR potential.

-

Abilene: Another solid military town, anchored by Dyess Air Force Base.

-

Brownsville: Big infrastructure and port investments are on the rise.

-

Each of these markets offers something unique. The trick is aligning your investment goals—be it cash flow, appreciation, or tenant stability—with the personality of the city. For those willing to explore beyond the usual suspects, Texas’s emerging markets might just be your next gold rush.. The trick is aligning your investment goals—be it cash flow, appreciation, or tenant stability—with the personality of the city.

DSCR Loans: Your Real Estate MVP

Say goodbye to tax returns, W-2s, and awkward conversations with your CPA. DSCR (Debt Service Coverage Ratio) loans look at the property’s income—not yours.

How it Works:

-

If your property’s rent covers the mortgage (typically 1.0x or more), you’re in business.

-

DSCR loans don’t care if you just started your LLC, quit your job, or claim your dog as a dependent.

Current DSCR Loan Highlights (Texas Edition):

-

Rates: ~6.5% – 8% (comparable to investor conventional loans)

-

LTV: Up to 85% (with AHL—yes, that’s us)

-

Minimum DSCR: Typically 1.0, but we see you 0.75 mavericks

-

Terms: 30-year fixed, 40-year IO, and more

-

Who qualifies: Humans with decent credit, and even foreign nationals

Why Investors Love DSCR Loans:

-

No income verification

-

Qualify in your LLC (hello, asset protection)

-

Unlimited property count (buy till you drop… responsibly)

-

Short-term rental income counts (Airbnb, we’re looking at you)

-

Fast closings (some as fast as 14–20 days)

These loans are designed for scalability. Whether you’re building a 10-property empire or financing a cash cow in College Station, DSCR loans keep the momentum going.

DSCR vs. Conventional Loans: The Showdown

Let’s put these financing methods in the ring and see who comes out swinging.

| Feature | DSCR Loan | Conventional Loan |

|---|---|---|

| Income Qualification | Property income (DSCR) | Borrower’s income + DTI |

| Max Properties | Unlimited | 10 max (Fannie/Freddie rules) |

| Loan to Entity (LLC) | Yes | No (personal name only) |

| Docs Required | Light (lease, appraisal, credit) | Heavy (W-2s, tax returns, DTI worksheet, etc.) |

| Short-Term Rental Friendly? | Yes | Not unless you’ve got 2+ years of Airbnb tax returns |

| Closing Speed | Fast (3 weeks) | Slower (6–8 weeks) |

| Prepay Penalty | Optional (0-5 years) | Rare |

| Flexibility | High | Low to moderate |

Unless you’re a W-2 unicorn with low DTI and a love for paperwork, DSCR is the smarter play for scaling your portfolio. Especially when your game plan involves holding properties under an LLC, tapping short-term rental income, or closing in under a month. For more information, see our post: DSCR Loans vs Traditional Financing: Which is Right for Your Strategy?

Texas Rental Market Trends: What’s Hot in 2025?

With everything from new construction waves to shifting renter preferences, the Texas rental market in 2025 is nothing short of dynamic. If 2023 was the cooldown and 2024 was the stabilization, 2025 is shaping up to be the year of strategic opportunity. For investors with the right financing (ahem—DSCR loans), the path to profits is clearer than ever.

Let’s break down what’s happening behind the leases.

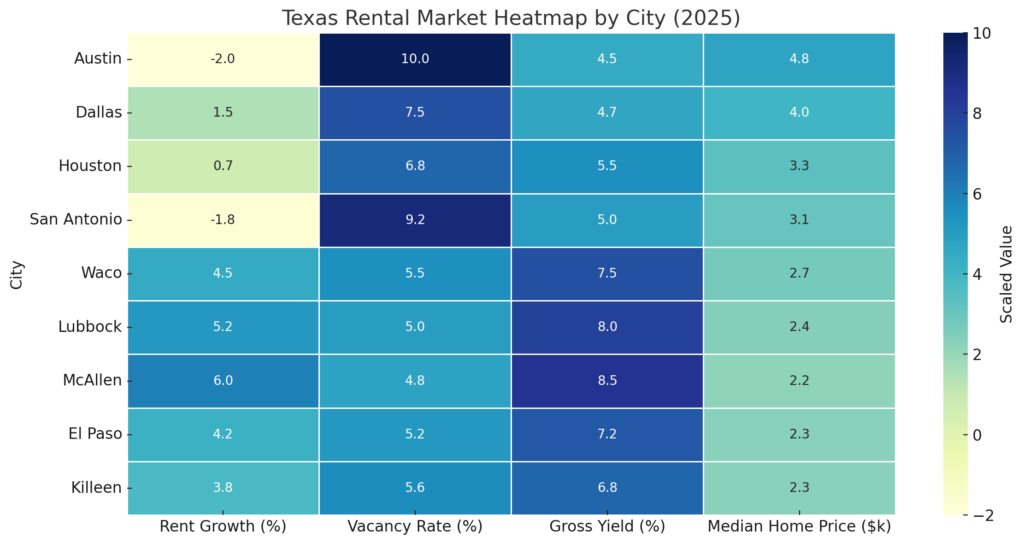

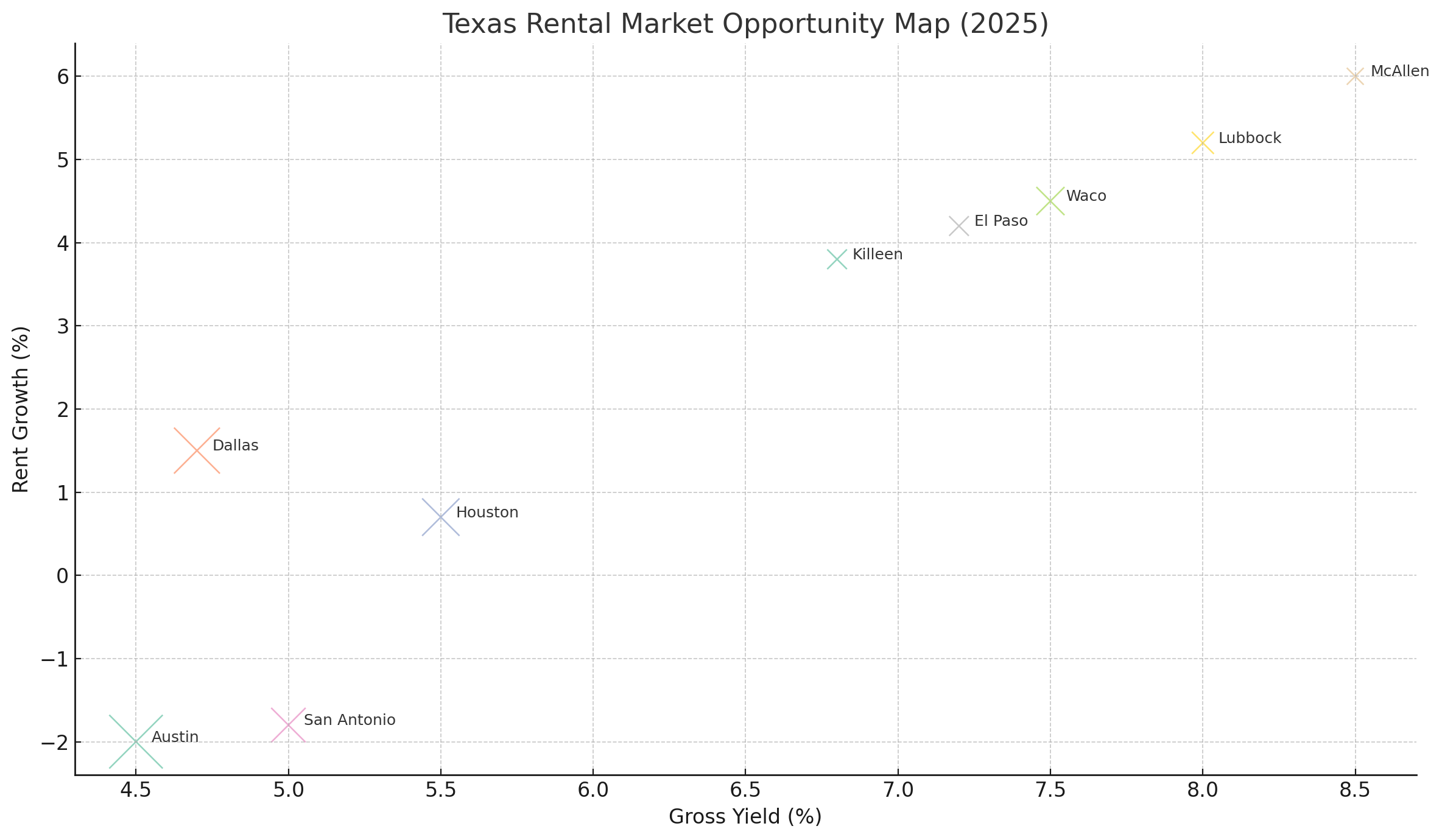

Vacancy Rates: Some Air in the Balloon, But No Pop

After years of tight inventory and bidding wars for rentals, Texas finally got the memo and built… a lot. New apartment deliveries across metros like Austin, San Antonio, and Dallas have nudged statewide vacancy rates to around 9%—up from the historic lows of ~7% we saw in the pandemic aftermath.

But here’s the kicker: that vacancy rate is skewed by large multifamily projects, many of which came online in 2023–2024. In the single-family rental (SFR) segment, especially in suburban and secondary markets, vacancy remains low—hovering around 4%–6% depending on the metro. Families, remote workers, and long-term renters are favoring the stability and space of single-family homes more than ever.

Investor takeaway: If you’re buying apartments downtown, budget for a lease-up period and maybe a free month or two of rent. If you’re buying a three-bed/two-bath in Katy, Frisco, or New Braunfels? It might rent in a week.

Rent Growth: Cooling Off But Still Toasty

Texas renters caught a break in 2024 as rent growth finally took a breather after years of double-digit increases. But don’t mistake normalization for stagnation.

-

Statewide YoY rent growth (2024–2025): ~2.8%

-

SFRs: Seeing stronger growth at 3.5%–4.2%

-

Multifamily: Holding steady or slightly declining in high-supply areas like Austin and San Antonio

-

Smaller markets (Waco, El Paso, Lubbock): Experiencing 4–6% growth due to limited new supply and population inflows

Austin, which led the nation in rent spikes during 2021–2022, saw a ~16% rent correction from its peak, making it a cautionary tale (and a potential buying opportunity). Meanwhile, Houston remains one of the most affordable major cities for renters, with median asking rent just above $1,240, and DFW continues to churn out slow but steady increases, especially in the northern suburbs where new jobs are landing.

Investor takeaway: Build your pro formas with conservative rent growth (2%–3%), but know the upside is real—especially in the single-family and mid-market segments.

Tenant Trends: Know Thy Renter

Today’s Texas renter isn’t just a stopgap homeowner—they’re a demographic with defined needs and preferences. Understanding these preferences gives investors a leg up on marketing, unit selection, and lease structuring.

What’s trending in 2025:

-

Remote professionals seeking larger units with office space, even if it means moving farther from city centers

-

Millennial families renting longer while waiting for affordability to return to the for-sale market

-

Boomer downsizers opting for hassle-free, well-located rentals with amenities

-

Young transplants arriving from California, Illinois, and New York, usually earning more than the local average and willing to pay for nicer finishes or walkable locations

-

Short-term gig and healthcare workers, especially in smaller markets near hospitals or military bases, preferring furnished mid-term rentals (30–120 days)

The days of one-size-fits-all rental offerings are over. Successful investors in 2025 are segmenting their target renters just like marketers do—because when your product fits the customer, vacancy drops and rent rises.

Short-Term vs. Long-Term Rentals: Choose Your Fighter

Short-term rentals (STRs) have matured past the wild-west days. Regulatory battles have cooled in some cities (and heated up in others), and seasoned investors are pivoting to mixed-use strategies:

-

Austin: Still a hot STR market during event seasons (SXSW, ACL), but licensing is capped and tightly enforced. STR investors here are turning to boutique mid-term stays instead—think 30-day minimums targeting traveling creatives or digital nomads.

-

Galveston & South Padre: Vacation rental goldmines—still thriving in 2025 thanks to coastal tourism and low inventory.

-

Fredericksburg & Hill Country: Weekend getaway STRs remain lucrative, especially for investors targeting wine-loving Texans and out-of-state romantics.

-

Dallas & Houston suburbs: The rise of mid-term rentals (30–90 days) is real, especially near major hospitals, energy hubs, and data centers. These often outperform long-term leases in both rate and turnover control.

Long-term rentals, meanwhile, are proving to be the tortoise in this race: slower, steadier, and less regulatory risk. Investors aiming for 5+ years of hold time are still leaning heavily into long-term leases to anchor cash flow.

Investor takeaway: STRs and mid-terms are great—if you know your local laws and have a management plan. Otherwise, long-term still wins the “set-it-and-forget-it” trophy.

Cap Rates & Cash Flow: The Math Is Back in Your Favor

Remember those sub-4% cap rates from 2021? Yeah… no one misses those.

As of 2025:

-

Multifamily cap rates in Texas have rebounded to the 5.5%–6.2% range

-

SFRs in tertiary markets (Waco, Lubbock, Temple): 6.5%–8% gross yields

-

Urban infill properties (Houston, San Antonio): 4.8%–5.4%, but often with appreciation upside

Higher interest rates might make borrowing more expensive, but they’ve also cooled down the “overpay to win” frenzy from the pandemic years. Smart investors with DSCR financing can now lock in reasonable terms and still generate monthly cash flow. In some cases, cash-on-cash returns are higher now than they were in 2021—even with a 2-point higher interest rate.

Final Word on 2025 Rental Trends

This isn’t a “boom or bust” year—it’s a “strategize and win” year. The Texas rental market is shifting from reactive to intelligent. If you’re plugged into tenant demand, realistic about rents, and sharp with your financing (hint: talk to us about DSCR), you can build a resilient portfolio in one of the best landlord markets in the country.

Just remember: vacancy eats profits, flexibility protects returns, and spreadsheets never lie. (Except maybe about that one duplex in Pflugerville. We’ve all been there.)

Texas is Still Open for Business

Whether you’re planning to scale a portfolio in Dallas, run STRs in Hill Country, or cash flow your way through Waco, Texas offers serious upside. And with DSCR loans? You don’t just play the game. You change it.

This is a state where growth is the norm, not the exception. And with new people, jobs, and businesses arriving every day, the rental market isn’t just surviving—it’s thriving.

At American Heritage Lending, we specialize in helping investors finance smart, fast, and flexibly. Our DSCR rental loans are tailor-made for markets like Texas, where opportunity is as wide as the horizon.

Ready to lasso your next deal? Let the property’s income do the heavy lifting, and let us do the lending. Because in Texas, you go big—or you go bigger.

Frequently Asked Questions

Why is Texas considered one of the best states for DSCR rental investing in 2025?

Texas combines strong population growth, job creation, no state income tax, and landlord-friendly laws. With nearly half a million new residents a year, diverse local economies, and relatively affordable housing compared to coastal states, investors can still find solid cash flow and long-term appreciation across multiple Texas markets.

Which Texas markets are most attractive for DSCR-financed rentals?

Major metros like Dallas–Fort Worth, Houston, Austin, and San Antonio remain core targets thanks to strong job bases and steady rental demand. Beyond that, emerging markets such as Waco, Lubbock, McAllen, El Paso, and Killeen/Temple offer lower prices, higher yields, and consistent tenant demand from universities, military bases, healthcare employers, and logistics hubs.

How do DSCR loans help investors scale rental portfolios in Texas?

DSCR loans qualify primarily based on the property’s income, not the borrower’s personal income or tax returns. That means investors can buy in LLCs, avoid traditional DTI limits, use short-term or mid-term rental income, and hold unlimited financed properties. In a fast-moving market like Texas, DSCR financing lets investors close quickly and keep acquiring without hitting the usual conventional loan ceilings.

What rental trends should DSCR investors watch in the Texas market for 2025?

In 2025, new multifamily supply has nudged overall vacancy higher, but single-family rentals in suburbs and secondary markets still see low vacancy and solid demand. Rent growth has cooled to the 2–4% range, but cash-flow math is improving thanks to better cap rates and more realistic pricing. Mid-term rentals near hospitals and job hubs are growing, and investors are focusing on conservative underwriting, tenant preferences, and product–market fit rather than speculative appreciation.

Sources

-

Texas Real Estate Research Center (Texas A&M University) – For statewide home price trends, job growth, and investor activity

-

Zillow Research & Zillow Observed Rent Index (ZORI) – For city-level rent growth, affordability rankings, and market forecasts

-

Redfin Data Center & Market Reports – For median home price fluctuations and sales activity across major Texas metros

-

U.S. Census Bureau (Housing Vacancies & Homeownership Survey) – For vacancy rates and rental household statistics

-

Freddie Mac & Fannie Mae Investor Market Reports – For mortgage rate comparisons and underwriting trends

-

OfferMarket, Kiavi, CoreVest, and New Silver DSCR Loan Program Guidelines – For current DSCR loan rates, terms, and qualification standards

-

American Heritage Lending Internal Data & Product Sheets – For details on LTV, DSCR minimums, and lending flexibilities in Texas

-

U-Haul Growth Index & U.S. Census Migration Data – For insights on inbound population trends and city-level migration hotspots

-

AirDNA & STR Insights (Austin, Galveston, Hill Country) – For short-term rental performance, average daily rates, and occupancy trends

-

Yardi Matrix, RentCafe & Apartment List – For multifamily construction pipelines, rent trends, and occupancy figures

-

Local MLS Reports (HAR, ABOR, NTREIS) – For hyper-local real estate performance data (e.g., Houston, Austin, North Texas)