California Bridge Lending Solutions

Elevating CA Real Estate Investor Aqusitions

Our Bridge Loan Rates & Terms:

Property Types

Single family, condos, townhomes, multi-family 2-4 units

1st Trust Deeds up to 80% Loan to Value

Loan Amounts

$100,000 – $2,000,000+

Term

Terms from 6-24 months Interest Only, Purchase or Refi

Loans Available

Loans are available to individuals, trusts, corporations, and limited partnerships.

California real estate investors focusing on bridge lending can gain substantial benefits in the state’s fast-evolving market. Bridge loans provide the necessary agility and adaptability for acquiring appealing properties, executing prompt renovations, or navigating through financing transitions. These financing solutions are geared towards investors seeking short-term opportunities with the promise of significant returns. Utilizing bridge loans enables investors to quickly seize market opportunities, boosting the profitability of their portfolios in California’s vibrant real estate scene.

- Applicable for various property types

- Up to 80% financing based on property value

- Loan amounts ranging from $100,000 to $2 million

- Interest-only payment options for flexible terms

American Heritage Lending is attuned to the specific needs of California’s real estate market, specializing in bridge lending to provide investors with customized, effective financing strategies. This focused approach facilitates a smooth loan process, ensuring the swift allocation of funds with fewer procedural obstacles. The commitment to tailored solutions and quick processing allows investors to efficiently capitalize on the competitive opportunities within California’s real estate market, securing their investments with both confidence and accuracy.

INTRODUCTION TO BRIDGE LOANS FOR THE CALIFORNIA MARKET

A KEY FINANCIAL STRATEGY FOR REAL ESTATE ACHIEVEMENT

In the vibrant and competitive California real estate landscape, bridge loans stand out as a vital financial tool. They act as an essential link for investors needing immediate capital to bridge the gap to long-term financing. Especially for investors and real estate professionals operating within the nuances of the California market, bridge loans present a practical solution for acquiring properties, stabilizing investments, or facilitating swift closings when conventional financial avenues fall short.

?

Why Consider a Bridge Loan?

Versatility Across Real Estate Ventures

Designed to support a wide array of real estate activities

Bridge loans are designed to support a wide array of real estate activities.

- Developers gain access to the necessary capital to advance their projects pending equity financing.

- Investors secure funds for renovations or operational expenses until the ideal tenants are found.

- Homebuyers achieve quick financing to seize prime real estate opportunities.

California Bridge Loan Solutions Tailored to Your Needs

Innovative Financing for a Range of Real Estate Ventures For Owner/Users

Our bridge loans are meticulously crafted for the purchase and improvement of residential properties, offering a rapid and efficient financing route. This proves invaluable for:

- Fast-paced projects requiring immediate financial settlement.

- Individuals who may not qualify for standard bank loans due to stringent criteria.

- Property enhancements designed to boost the equity and market value.

For Investment Properties:

Specially tailored to bridge the financial gap for California properties without a stable tenant history, our loans facilitate necessary renovations and tenant placement. This is crucial for generating a steady income in situations where traditional financing falls short, providing a lifeline to investors aiming to enhance the property’s appeal and profitability.

For Refinancing:

Our bridge loans become an indispensable tool in scenarios where conventional refinancing avenues are blocked, whether due to credit issues or properties that do not meet standard lending criteria. They offer a swift influx of capital to address immediate financial demands, ensuring liquidity and stability during critical periods.

In the intricate and ever-evolving California real estate market, our bridge loan solutions stand as a beacon for those navigating the complexities of property investment and development. Whether you’re looking to quickly close on a promising residential property, seeking to revitalize an investment property for future income, or in urgent need of refinancing options, our customized bridge loans offer a flexible, reliable, and timely financial resource.

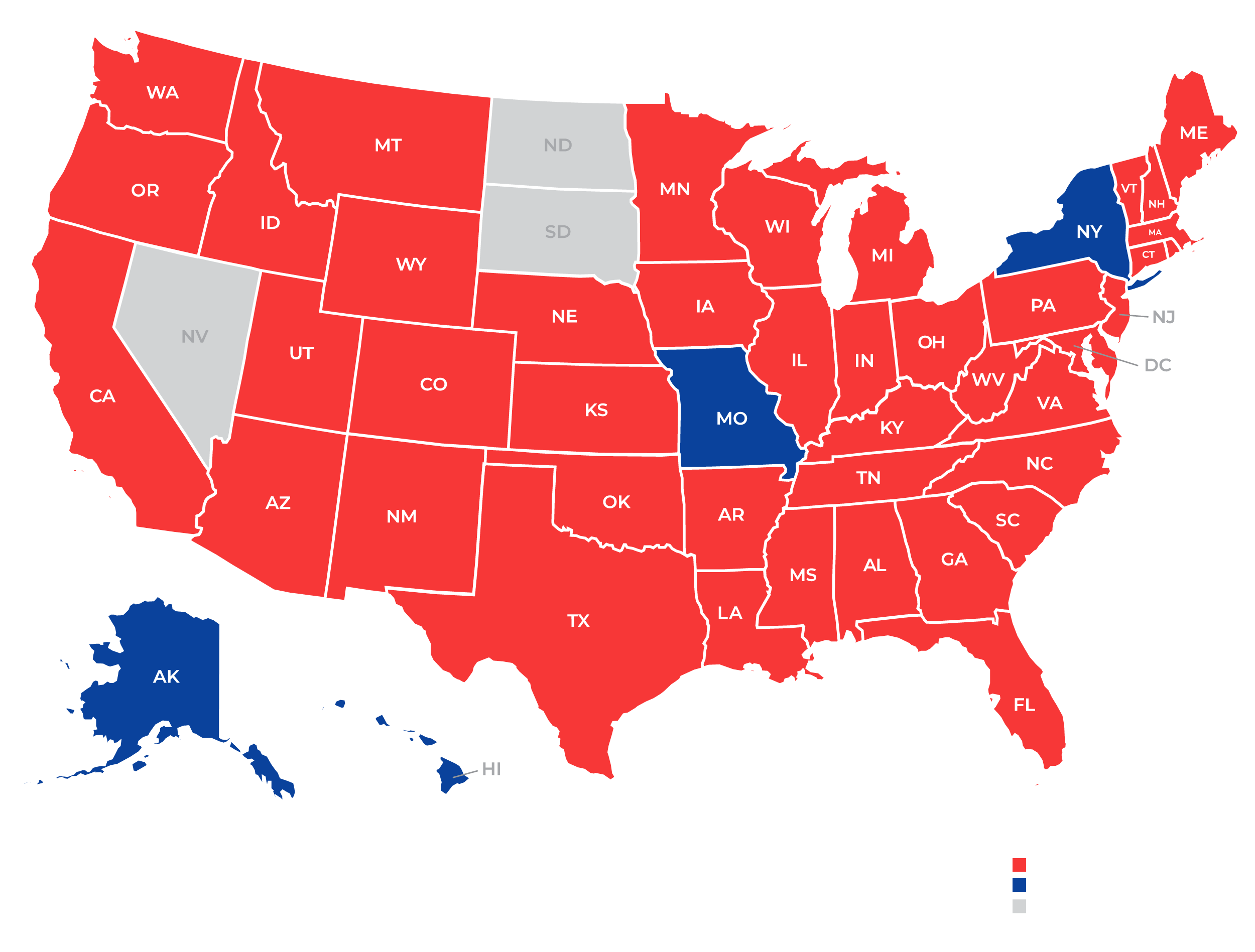

States We Lend In