If you’ve ever dreamed of making big profits in real estate without moving to a high-tax, high-cost coastal market, then pack your virtual tool belt and follow us to Tennessee. The Volunteer State has quietly become one of the most promising places in the U.S. for fix and flip investors, combining steady growth, investor-friendly laws, and – yes – a whole lot of houses just waiting to be flipped.

At American Heritage Lending, we’ve studied every creaky floorboard and overgrown yard from Memphis to Johnson City, so you don’t have to. Below is your comprehensive guide to Tennessee’s fix and flip landscape – past, present, and future – with the stats to back it up, sharp market insights, and just enough of a sense of humor to keep things interesting. Whether you’re an out-of-state investor looking for your next opportunity or a local pro hunting for new data, this guide will help you flip smarter, faster, and more profitably.

Why Tennessee? The Fix and Flip Fundamentals

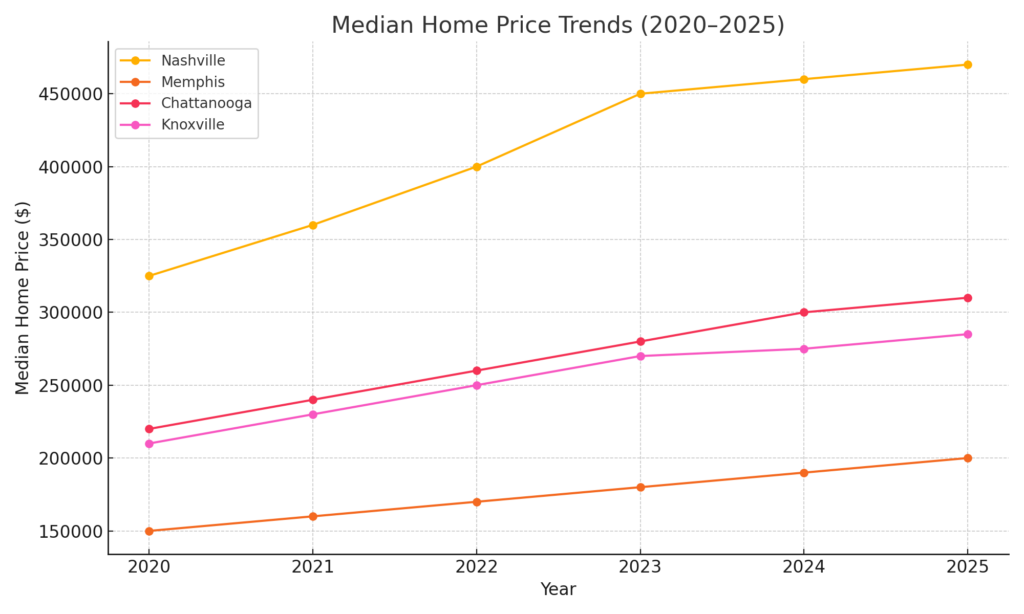

Tennessee has been on a real estate hot streak since 2020. It’s a perfect storm of favorable economics: a steady population influx, robust job growth across sectors like healthcare, logistics, and tech, and a famously tax-friendly environment.

Tennessee has been on a real estate hot streak since 2020. It’s a perfect storm of favorable economics: a steady population influx, robust job growth across sectors like healthcare, logistics, and tech, and a famously tax-friendly environment.

- Population growth since 2020: +1.8%

- State median home value (2024): ~$317,000

- Average flip gross profit (2023): ~$95,000

- Gross ROI (statewide): 3%–8% (depending on market and methodology)

The Volunteer State’s blend of urban and suburban, affordable and upscale, makes it a sandbox for creative investors. Whether you’re restoring a 100-year-old craftsman in East Nashville, converting a duplex in Memphis, or cleaning up a ranch in rural Chattanooga, you’re in good company. And the opportunities are still expanding.

Add in Tennessee’s lack of state income tax and relatively low property tax burden, and you’ve got a recipe for sustainable, long-term flipping success. While other markets see heavy volatility or over-saturation, Tennessee’s fix and flip economy offers real room to grow — especially if you know where to look.

Top Tennessee Markets for Fix-and-Flip Investors

1. Nashville – The Hitmaker

Nashville is the fix and flip capital of Tennessee. Home to healthcare giants, tech startups, a vibrant music and hospitality industry, and a steady influx of new residents, Music City has quickly become one of the Southeast’s most lucrative markets for housing turnover.

- Median sales price (2024): ~$460,000

- Typical flip gross profit: $80K–$100K

- Average time on market: ~25 days

East Nashville, with its eclectic vibe and older housing stock, remains a hotbed for flips, offering everything from early 1900s bungalows to mid-century ranches. North Nashville is in the midst of rapid redevelopment, with investors targeting single-family homes and small multifamily conversions. Donelson and Madison offer suburban appeal with solid upside due to proximity to downtown and ongoing infrastructure improvements. Flippers should also watch zoning changes and STR regulations closely—Nashville’s growth has brought tighter scrutiny to development and short-term rentals. The flips that succeed here often blend historic charm with modern amenities and sell fast if priced right.

2. Memphis – ROI Royalty

Memphis may not have the skyline of Nashville, but it boasts something just as valuable: margin. Known for its affordability, Memphis consistently ranks among the best cities in the country for fix and flip returns.

Memphis may not have the skyline of Nashville, but it boasts something just as valuable: margin. Known for its affordability, Memphis consistently ranks among the best cities in the country for fix and flip returns.

- Median sales price: ~$190K

- Typical flip ROI: Up to 66.7%

Memphis offers deep discounts on distressed properties, especially in neighborhoods like South Memphis, Frayser, and Binghampton, where homes can be acquired well below $100K. Midtown and Cooper-Young are more competitive but attract young professionals and have strong resale demand. The city’s historically high renter ratio means many flips get sold to landlord-investors, or held for BRRRR plays. Memphis is also a logistics hub, drawing a stable workforce from FedEx, St. Jude, and the Port of Memphis. Add in rising home values, expanding downtown development, and a low cost of living, and it’s clear why flippers from around the country target this market. Just be ready to do your due diligence—appraisal gaps and permit issues can trip up the unprepared.

3. Chattanooga – Scenic and Steady

Once known mainly for its riverfront and railroad history, Chattanooga is now an emerging real estate powerhouse with a vibrant startup ecosystem and strong tourism economy.

- Median list price (2024): ~$300K

- Annual appreciation (some neighborhoods): 12–15%

Flippers are thriving in neighborhoods like St. Elmo, Highland Park, and East Brainerd, where rising buyer demand and relatively low home inventory drive solid resale potential. Southside has experienced massive revitalization and is attracting high-end condo conversions and boutique flips. With a walkable downtown, access to outdoor recreation, and local incentives for redevelopment, Chattanooga is ideal for investors who want growth potential with a lower price point than Nashville. And yes, it’s still one of the most scenic places to own a property in Tennessee.

4. Knoxville – The Underdog Emerges

Knoxville doesn’t always get the same attention as Tennessee’s larger cities, but that’s changing quickly. The University of Tennessee, Oak Ridge National Lab, and a booming healthcare sector have created a strong jobs market—and demand for housing is rising in turn.

Knoxville doesn’t always get the same attention as Tennessee’s larger cities, but that’s changing quickly. The University of Tennessee, Oak Ridge National Lab, and a booming healthcare sector have created a strong jobs market—and demand for housing is rising in turn.

- Median home price: ~$275K

- Typical gross profit: $50K–$70K

South Knoxville is one of the fastest-growing pockets, with new breweries, restaurants, and greenways revitalizing older neighborhoods. Flippers targeting areas like Fountain City, Norwood, and Bearden are finding solid returns with mid-range entry points and relatively short time-to-market. The presence of a major university also supports hybrid strategies where a flip could become a rental if the market shifts. Knoxville’s strong sense of community and lower competition than larger cities make it a great entry market for new flippers looking to build a track record.

5. Bonus Round: Murfreesboro, Johnson City, and Clarksville

Not all high-potential flips are in the big cities. Tennessee’s smaller cities and growing suburbs are offering some of the best price-to-profit ratios in the region.

- Murfreesboro YoY home price growth: ~5%

- Johnson City entry prices: Under $200K in many cases

Murfreesboro is booming thanks to its proximity to Nashville, with new subdivisions popping up and strong demand from MTSU staff and students. Inventory remains tight, but older ranch-style homes and dated colonials offer good flip opportunities with $40K–$60K upside. Johnson City, located in the Tri-Cities area, is one of the most affordable college towns in the state, with a surprisingly strong economy driven by healthcare, education, and light manufacturing. Clarksville, just north of Nashville and home to a major military base, is seeing a population surge as people look for more space and affordable homes outside the metro core. Flippers are increasingly eyeing these markets for their balance of cost, stability, and growth potential—especially as urban markets become more saturated.

Combined, these non-metro markets represent a hidden layer of Tennessee’s real estate opportunity—ideal for flippers who want lower acquisition costs, rising ARVs, and less competition.

Fliponomics: The Math That Matters

Let’s break it down with a closer look at the hard numbers. Flipping is all about precision, timing, and profit. Here’s what a “standard” flip might look like in each market:

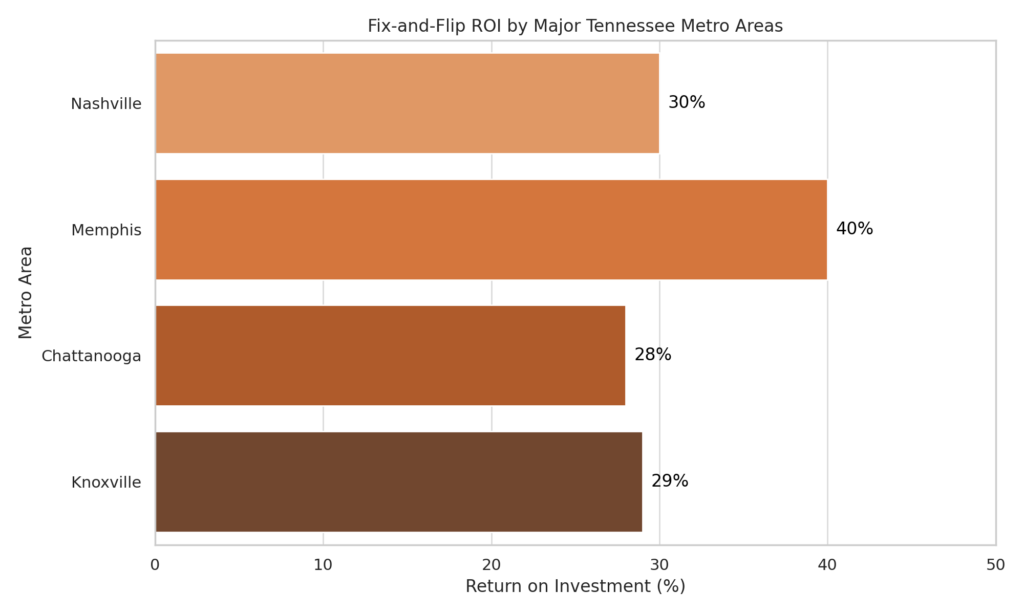

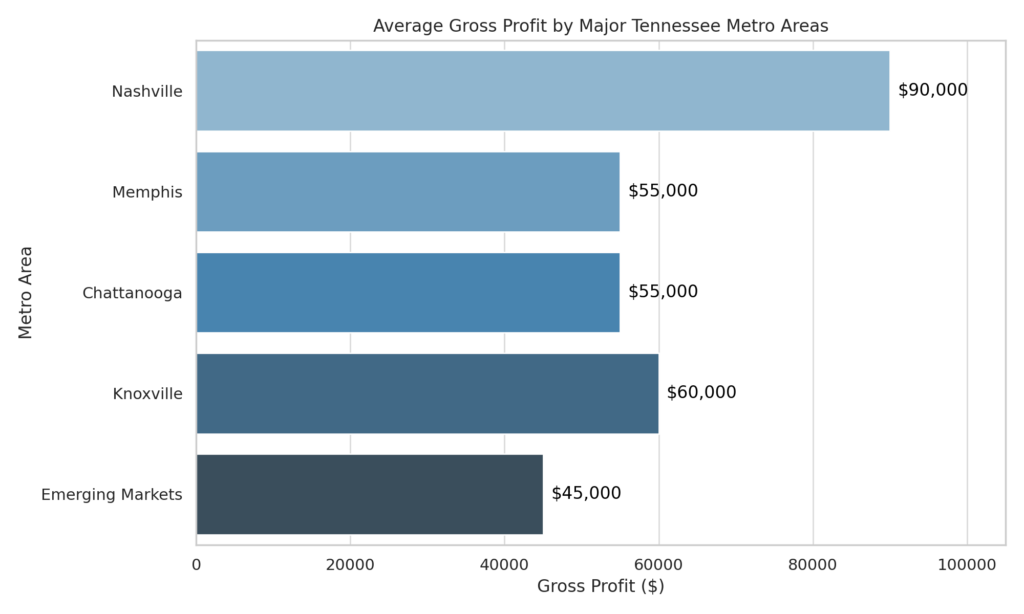

| City | Purchase Price | Rehab Budget | Resale (ARV) | Gross Profit | ROI (Est.) |

|---|---|---|---|---|---|

| Nashville | $300–350K | $50K | $450–500K | $80–100K | ~25–35% |

| Memphis | $120–150K | $40K | $200–220K | $40–60K | ~30–40%+ |

| Chattanooga | $180–220K | $40K | $280–320K | $50–60K | ~25–30% |

| Knoxville | $200–250K | $35K | $300–350K | $50–70K | ~25–30% |

| Small Markets | $150–250K | $30K | $250–350K | $30–60K | ~20–30% |

These are averages, of course. Skilled investors beat the spread by sourcing off-market deals, negotiating supply costs, and sticking to tight construction timelines. The fastest way to lose money in a flip? A rehab that drags into next year. Tennessee markets tend to move fast, so your project management game needs to be even faster.

How Are They Funding These Flips?

A majority of Tennessee flips are funded with cash or short-term financing, and increasingly, institutional private lenders like American Heritage Lending are setting the new standard for what modern flippers need: speed, flexibility, and reliability.

In today’s competitive market, waiting weeks for traditional bank approval or juggling flaky private investors isn’t just stressful—it can cost you the deal. That’s why professional investors across Tennessee are turning to specialized lenders like AHL. With same-day approvals, custom loan terms, and a draw process tailored to your rehab timeline, AHL offers a level of predictability that’s critical when you’re buying distressed properties and racing the clock.

Compare that to:

- Private money – often based on relationships, less formal, sometimes unreliable.

- HELOCs – useful, but tied to your personal equity and subject to rate fluctuations.

- Bank rehab loans – lower rates, but long underwriting timelines and rigid requirements.

- Crowdfunding platforms – decent in theory, but usually less responsive and limited by deal type.

By contrast, institutional private lenders like AHL blend the best of both worlds: the personalized support of a boutique firm with the capital stability of a national lender backed by a publicly traded financial services firm. Whether you’re a first-time flipper or operating at scale, that means you can act quickly, make stronger offers, and protect your profits from delays and red tape.

In 2024, the vast majority of flippers who scaled to 5+ deals per year reported using some form of private institutional lending. In Tennessee, where competition is heating up in every tier of the market, aligning with a financing partner like AHL can be the difference between winning the contract—or watching it go to someone who moved faster.

So, yes—Tennessee offers entry points at nearly every price level. But in a market where time kills deals, having the right lender in your corner matters more than ever.

Legal Stuff (a.k.a. Read This Before You Swing That Hammer)

Flipping in Tennessee isn’t difficult, but it’s not the Wild West either. Know the rules before you sign your first deal.

- Licensing: You don’t need a real estate license to flip, but it can help you save on listing fees.

- Permits: Always pull the necessary permits. Your inspector doesn’t care how great the backsplash looks if you ran new electrical without approval.

- Taxes: Tennessee doesn’t tax capital gains, but the IRS sure does. Treat your flips as a business and plan for ordinary income tax.

- FHA Flip Rule: Don’t sell to an FHA buyer within 90 days of your purchase date. If you do, you may run into loan rejection headaches.

Bonus tip: keep good records. If you flip more than a few houses, the IRS may classify you as a dealer, which means less favorable tax treatment. Consult a CPA familiar with real estate before year-end rolls around.

Trends to Watch in 2025 and Beyond

- Market Stabilization and Smart Buying: The frenzied appreciation of 2020–2022 has settled, creating a more predictable pricing landscape. In 2025, successful flippers are adjusting their strategies, focusing more on value-added improvements and buying below-market instead of riding appreciation. Look for tighter ARV projections and an emphasis on cosmetic rehabs that avoid permit delays.

- Remote Investing Gets Real: Out-of-state investors, especially from high-cost markets like California and New York, are pouring into Tennessee with virtual tours, local GCs, and site visits only at closing. Thanks to strong in-state partners and lenders like AHL offering boots-on-the-ground knowledge and rehab-ready capital, remote flipping is not only viable—it’s efficient.

- BRRRR-Flip Hybrids: With longer days on market in some cities and stricter buyer financing, investors are increasingly hybridizing strategies: fixing, renting temporarily, refinancing, then listing when market conditions are optimal. Institutional lenders with flexible terms—like AHL—are enabling these pivot strategies without penalty.

- Institutional Competition is Here to Stay: Large private equity funds and iBuyers continue exploring fix and flip at scale, especially in secondary cities like Chattanooga and Clarksville. Yet most big players struggle with nuance and local execution. This leaves room for nimble investors with quick funding from private lenders who can out-hustle and out-rehab the competition.

- Focus on Local Networks and Off-Market Deals: As MLS competition heats up, the best deals in 2025 are increasingly found through wholesalers, investor meetups, and local sourcing.

- Sustainability and Smart Home Trends: Buyers are showing preference for energy-efficient upgrades and smart tech amenities. Flippers who integrate modern convenience—think smart thermostats, efficient HVAC systems, and EV chargers—will not only sell faster but often command a price premium.

In short, the future belongs to prepared investors who combine discipline in the buy, efficiency in the rehab, and flexibility in the exit. And behind many of these high-performing operators? Institutional lenders like AHL who move with the speed of a cash offer and the reliability of a true business partner.

Final Word: Flip Smart, Flip Tennessee

From Music Row to the Smoky Mountains, Tennessee offers real estate investors a stage where opportunity plays every day. With the right financing, sharp market insights, and a well-managed crew, you can turn rundown houses into renovated gold.

Whether you’re tackling your first flip in Clarksville or scaling a portfolio in East Nashville, Tennessee is the kind of market where intelligent effort still gets rewarded. No gimmicks, no bubbles – just smart investing.

And if you need funding to make your next flip a reality, American Heritage Lending is here to help. We fund first-timers and veterans alike with fix and flip loans designed for speed, flexibility, and results.

Ready to flip? Tennessee’s waiting—and so are we.

Frequently Asked Questions

Why is Tennessee such a strong state for fix and flip investors right now?

Tennessee has a really solid mix of factors flippers love: steady population growth (+1.8% since 2020), a 2024 median home value around $317,000, and an average flip gross profit of about $95,000. Add in no state income tax, relatively low property taxes, and a diverse mix of urban, suburban, affordable, and upscale housing, and you get a market where well-run flips can still pencil out even as other states feel oversaturated.

Which Tennessee cities offer the best opportunities for fix and flip deals?

Nashville leads the pack with higher price points and typical flip profits in the $80K–$100K range, especially in areas like East Nashville, North Nashville, Donelson, and Madison. Memphis is the ROI king, with median prices around $190K and potential flip returns up to 66.7%, while Chattanooga and Knoxville offer strong growth and solid spreads in neighborhoods like St. Elmo, Southside, South Knoxville, and Bearden. Smaller markets such as Murfreesboro, Johnson City, and Clarksville add another layer of opportunity with lower entry prices, rising ARVs, and less competition.

How are most fix and flip investors in Tennessee funding their projects?

Most Tennessee flippers are using cash or short-term financing, and more of them are moving toward institutional private lenders like American Heritage Lending. Compared with private money, HELOCs, bank rehab loans, or crowdfunding, lenders like AHL offer faster approvals, rehab-friendly draw schedules, and more flexible terms tailored to investors who need to move quickly on distressed properties. For investors doing 5+ deals a year, this kind of reliable, “almost like cash” financing is often the difference between winning and losing a deal.

What key risks and trends should Tennessee flippers watch in 2025 and beyond?

The wild appreciation of 2020–2022 has cooled, so winning deals now is more about buying below market, focusing on value-add rehabs, and keeping timelines tight. Investors should stay on top of permitting rules, tax treatment (including potential “dealer” status with the IRS), and the FHA 90-day flip rule, while also watching trends like remote out-of-state investors, BRRRR-flip hybrid strategies, and growing institutional competition in secondary cities. At the same time, buyers are rewarding energy-efficient upgrades and smart-home features, so flippers who pair disciplined acquisitions with modern, market-ready finishes are best positioned to thrive.

Sources

-

ATTOM Data Solutions – Real estate market trends, gross profit statistics, and ROI data.

-

Zillow – Median home values, price appreciation trends by city.

-

Redfin – Sales activity, time on market, and buyer demand indicators.

-

Local MLS Reports (Tennessee-specific) – Metro-specific home price and inventory insights.

-

U.S. Census Bureau – Population growth and demographic shifts in Tennessee.

-

Investopedia – Definitions and investment strategy context (e.g., BRRRR, ROI).

-

American Heritage Lending proprietary data – Loan usage patterns, flip performance, and borrower trends in Tennessee markets.