If Georgia were a stock, smart real estate investors would have “Buy and Hold” flashing across their screens in neon lights. With explosive migration, affordable property prices (at least for now), and rental demand that won’t quit, the Peach State has earning its spot as one of the country’s hottest real estate investment destinations. But – and it’s a big but, like a Zillow “fixer-upper” hiding a cracked foundation – navigating Georgia’s property markets today takes more than enthusiasm. It takes data, strategy, and an understanding of where the real opportunities lie.

Let’s dive deep into Georgia’s DSCR financing landscape, top and emerging rental markets, and why savvy investors are putting peaches and profits together like never before.

The Big Picture: Why Georgia?

First things first – why are so many investors flocking to Georgia?

- Population Growth: Georgia surpassed 11.18 million residents in 2024, growing at roughly 1.4% annually, beating national averages.

- Migration Boom: Massive net in-migration from high-cost states like New York, California, and Illinois.

- Affordability Advantage: Median home value of ~$329,000 vs. ~$420,000 nationally.

- Landlord-Friendly Laws: No statewide rent control, fast eviction processes.

- Strong Economy: Diversified sectors – logistics, tech, manufacturing, film production – and an unemployment rate hovering near historic lows (3.1%-3.5%).

Georgia’s low property taxes, expanding infrastructure, and cultural vitality further strengthen its appeal to investors seeking long-term growth markets.

Georgia Rental Market Analysis

Atlanta Metro: Georgia’s Rental Giant

- Metro Population: 6.3 million (2024)

- Median Rent: Down 2.5% year-over-year

- New Apartment Deliveries: 14,500+ units in 2023; 38,000 in the pipeline

- Vacancy Rates: 10%-12% in Midtown/Buckhead

- Job Growth: 2%-3% annually

Atlanta continues to be Georgia’s rental giant but with clear sector-specific risks. Investors should avoid luxury overbuild zones like Buckhead and Midtown where concessions are rising and vacancy pressure persists. Instead, suburban markets like Gwinnett County, South Fulton, and Alpharetta are outperforming. Smart money is targeting workforce housing, garden-style apartments, and SFR portfolios.

DSCR lenders remain active, especially for suburban projects showing stable cash flow and healthy lease-up trends. Conservative underwriting — assuming flat rents in core urban areas — is a must.

Savannah: Coastal Strength Meets Global Logistics

- Average Rent: ~$2,000

- Rent Trend: 7% decrease from peak, stabilizing

- Hyundai Plant Impact: $7+ billion investment, 8,500+ new jobs

- Cap Rates: 6%+

Savannah is entering a multi-year expansion phase. The Port of Savannah’s aggressive expansion and Hyundai’s forthcoming Metaplant are expected to generate tens of thousands of jobs directly and indirectly. Areas west of Savannah like Pooler, Bloomingdale, and Bryan County offer excellent positioning.

Rental demand is expected to tighten again post-2025 as industrial growth attracts workers. Early investors capturing assets now — especially build-to-rent communities — stand to benefit from both rental upside and significant home price appreciation.

Augusta: Stability and Strong Yields

- Recent Rent Growth: 20% year-over-year

- Average Rent: ~$1,500

- Cap Rates: 7%-8%

Augusta’s diversified economy (military, cybersecurity, healthcare) provides a stabilizing buffer against downturns. Investors should prioritize well-located small multifamily or single-family properties built after 1990, which are easier to finance and attract more stable tenants.

Augusta’s relatively low pricing and strong cap rates allow DSCR investors to achieve immediate cash flow while enjoying moderate long-term appreciation potential.

Emerging Markets: Hidden Gems for Rental Property Investors

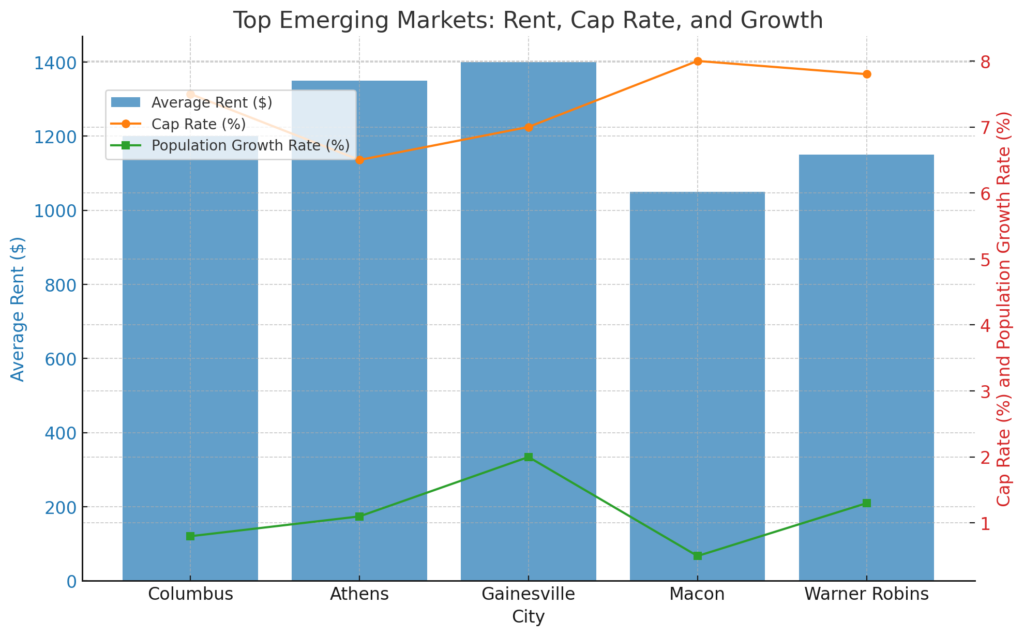

Columbus

Columbus

- Average Rent: ~$1,200 (2-bedroom)

- Cap Rates: 7%-8%

- Key Economic Drivers: Fort Moore (military), Aflac headquarters, TSYS (financial tech)

- Population: ~206,000 (growing ~0.8% annually)

Columbus combines affordability with economic resilience. The presence of Fort Moore guarantees strong demand for rental housing, especially for single-family homes and small multifamily units. Recent revitalization projects downtown and along the Chattahoochee Riverwalk have also boosted demand among young professionals.

Investor Strategy: Focus on SFRs near Fort Moore for stable tenant turnover, and value-add duplexes close to downtown for higher rent potential. DSCR loans are widely available, with lenders preferring properties near military bases.

Athens

- Average Rent: ~$1,350 (2-bedroom)

- Rent Growth: 2%-4% annually

- Key Demand Drivers: University of Georgia, Piedmont Athens Regional Medical Center

- Population: ~130,000 (growing ~1.1% annually)

Athens thrives on educational and healthcare job bases, creating consistent rental demand. The student market is massive but competitive, and institutional buyers are increasingly active here.

Investor Strategy: Single-family homes within 1-2 miles of campus rent fastest. Multifamily properties (4-12 units) designed for student housing can produce excellent returns if properly managed. Expect higher turnover but premium rents.

Gainesville

- Average Rent: ~$1,400 (2-bedroom)

- Growth Drivers: Healthcare, poultry processing industry, logistics hubs

- Population: ~45,000 (fast-growing ~2% annually)

Gainesville is the economic engine of North Georgia, with a booming healthcare sector and substantial industrial employment along I-985. Rental inventory remains limited, supporting long-term rental rate growth.

Investor Strategy: Build-to-rent suburban developments or acquisition of existing SFR portfolios will be highly competitive. Vacancy rates below 4% make this a strong “buy and hold” market.

Macon and Warner Robins

- Average Rent: ~$1,050 (Macon), ~$1,150 (Warner Robins)

- Anchor Employers: Robins Air Force Base, GEICO, Navicent Health

- Population: Macon ~156,000; Warner Robins ~82,000 (steady growth in Warner Robins)

While Macon struggles with some urban blight issues, Warner Robins is a rising star thanks to the stability of Robins Air Force Base, which employs nearly 24,000 people. Housing affordability is exceptional, and yields remain high compared to other Georgia markets.

Investor Strategy: Focus on workforce housing and Class B/C single-family rentals. Value-add opportunities exist but require careful due diligence on location.

Georgia Rental Market Forecast: 2025-2027

Georgia’s rental market is poised for a steady yet dynamic evolution shaped by moderating construction, persistent population growth, and evolving macroeconomic conditions.

Key projections include:

- Statewide Rent Growth: 3%-5% annually, strongest in suburban Atlanta, Savannah, and emerging secondary cities.

- Vacancy Rates: Normalizing in Atlanta by late 2026; sub-5% in secondary markets.

- Home Prices: 2%-4% appreciation annually, driven by migration pressure and limited inventory.

- Investor Competition: Surge expected post-2025 as rates moderate and institutional players reenter the market.

- Migration Patterns: Continued inbound flow from high-cost states.

- DSCR Financing Trends: Expansion of portfolio DSCR products, increased use of interest-only periods to boost initial cash flows.

Strategic Investor Tips:

- Lock in fixed-rate DSCR loans before spreads tighten.

- Focus on assets near employment hubs and infrastructure projects.

- Budget 5%-8% annual expense increases for taxes and insurance.

- Underwrite rent growth conservatively at 2%-3%.

- Diversify holdings across at least two distinct Georgia MSAs.

Georgia’s 2025-2027 environment will reward data-driven investors who structure deals conservatively and scale portfolios intelligently.

Final Thoughts: Georgia’s Golden Era for Investors

Georgia isn’t just “one to watch”— it’s “one to act on.” With strong migration trends, a resilient economy, and expanding infrastructure, the state offers compelling opportunities for real estate investors looking for long-term wealth creation.

Winning in Georgia will require:

- Deep Market Knowledge: Drill down to submarket dynamics and local employment trends.

- Financing Mastery: Use DSCR strategies smartly, securing flexible loan terms to future-proof cash flow.

- Asset Quality Focus: Target properties and locations with proven tenant demand.

- Operational Precision: Partner with local property managers skilled in lease-up, retention, and expense control.

From metro Atlanta’s thriving suburbs to Savannah’s industrial corridors and Augusta’s military-anchored stability, Georgia provides fertile ground for investors serious about scaling strategically.

Pack your underwriting spreadsheets, double-check your DSCR calculations, and maybe keep a cold glass of sweet tea close by — because Georgia’s next real estate cycle is heating up, and the best seats are being claimed right now.

Frequently Asked Questions

Why are so many real estate investors choosing Georgia right now?

Georgia has the perfect mix of migration, affordability, business growth, and landlord-friendly laws. Population is climbing, cost of living is still reasonable compared to other fast-growing states, and rental demand keeps rising, especially in metro Atlanta and high-growth suburbs. Investors love it because it’s one of the few markets where you can still find strong cash flow and long-term appreciation.

What are the best Georgia markets for DSCR-friendly rental investing?

You’ve got the big names like Atlanta, Savannah, and Augusta, but the real standouts are often the smaller or emerging markets. Columbus, Athens, Gainesville, and Warner Robins are pulling in steady population and job growth without the sky-high price tags. These cities offer stronger DSCR ratios, better yields, and renters who stick around.

How do DSCR loans benefit investors in a market like Georgia?

Georgia’s affordable prices and strong rent-to-price ratios make DSCR loans extremely workable. Because DSCR financing focuses on the property’s income—not your personal income, it’s easier to qualify even in markets with fluctuating rents like Atlanta. For investors trying to scale quickly, DSCR loans let you buy in LLCs, avoid DTI roadblocks, and close faster than traditional mortgages.

What risks should investors keep in mind when buying rentals in Georgia?

Georgia’s growth is real, but not every submarket is a home run. Luxury pockets in Atlanta are oversupplied, certain neighborhoods in Macon still struggle with distress, and tax/insurance costs are creeping up statewide. Investors should underwrite conservatively, watch local vacancy trends, and stick close to employment hubs, schools, and new infrastructure projects.

Sources

-

U.S. Census Bureau — Net migration trends and Georgia population growth data.

-

Zillow Research — Median home value comparisons (Georgia vs. U.S. national averages).

-

Georgia Department of Economic Development — Major employer expansions and Savannah port growth data.

-

National Association of Realtors (NAR) — Metro Atlanta housing market and vacancy trends.

-

Yardi Matrix & Apartment List — Atlanta rental market supply/demand and new construction statistics.

-

Bureau of Labor Statistics (BLS) — Georgia unemployment rate and economic sector diversification.

-

Hyundai Motor Group Newsroom — Hyundai Metaplant Savannah project employment projections.

-

City of Savannah Development Authority — Port of Savannah expansion impacts.

-

University System of Georgia — University of Georgia enrollment and Athens rental housing dynamics.

-

BeautifyData (via U.S. Census Bureau API) — Net migration by Georgia county (2023).

-

HUD and Freddie Mac Multifamily Outlook — DSCR loan market trends and financing projections for 2025-2027.