A Data-Driven Guide to Why Professional Investors are Flocking to Ohio and Leveraging DSCR Financing to Build Scalable, Cash-Flowing Portfolios

Let’s be honest: Ohio doesn’t always top the list when real estate investors start dreaming of portfolio expansion. It doesn’t have Florida’s palm trees, Texas’ swagger, or California’s… well, California-ness. But if your investment strategy is driven by data, yield, and long-term stability—rather than beachfront aesthetics—Ohio might just be the most underrated goldmine in the country. And if you’re not using DSCR (Debt-Service Coverage Ratio) loans to tap into its potential, you’re leaving serious money (and growth) on the table.

This article takes you deep into the heart of Ohio’s rental property market, examines why DSCR financing is tailor-made for savvy investors, and reveals why more professionals are swapping out palm trees for Buckeye trees. Whether you’re an experienced landlord or a first-time investor looking for solid returns, this is your roadmap to smart investing in the Buckeye State.

What is a DSCR Loan (and Why Do Investors Love It)?

DSCR loans are like the espresso shot of investment financing—strong, fast, and designed to get things done. Instead of looking at your W-2s, tax returns, or how many hours you clocked at the office, DSCR lenders care about one thing: can the property pay for itself?

Here’s the formula: DSCR = Property Income / Debt Service. If your rental brings in more than it costs to own, you’re in business. Most lenders want to see a DSCR of 1.20 or higher, meaning your rent covers 120% of your mortgage payment.

Why it matters: Unlike traditional mortgages, DSCR loans don’t require personal income verification. That means no tax returns, no DTI calculations, no awkward questions about why you wrote off your entire income last year. For full-time investors, self-employed entrepreneurs, or anyone who’s reached the conventional 10-property limit, DSCR loans are a game-changer.

These loans offer flexibility and scalability. Investors can build portfolios in LLCs, qualify based on cash flow instead of employment status, and often close in half the time of conventional financing. And because DSCR loans are primarily evaluated based on a property’s income-generating potential, they work especially well in markets like Ohio, where affordable prices and solid rents combine to produce strong monthly margins.

Ohio by the Numbers: Rents Are Rising, Vacancies Are Falling, and Investors Are Smiling

Let’s talk data. As of 2024:

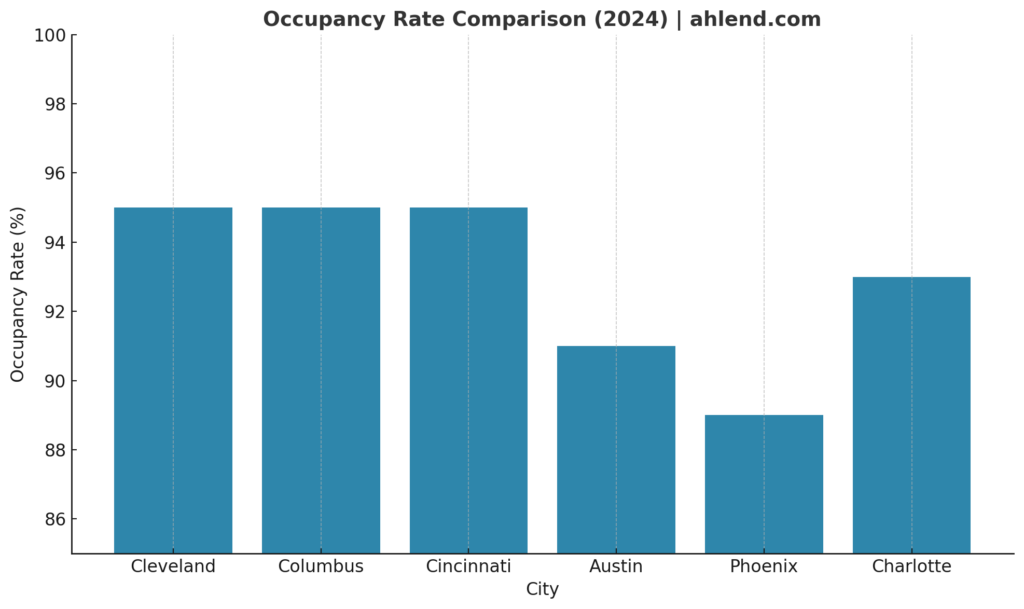

- Occupancy: Major Ohio metros (Columbus, Cincinnati, Cleveland) are boasting 95-96% occupancy rates. That’s tighter than your uncle’s Thanksgiving pants.

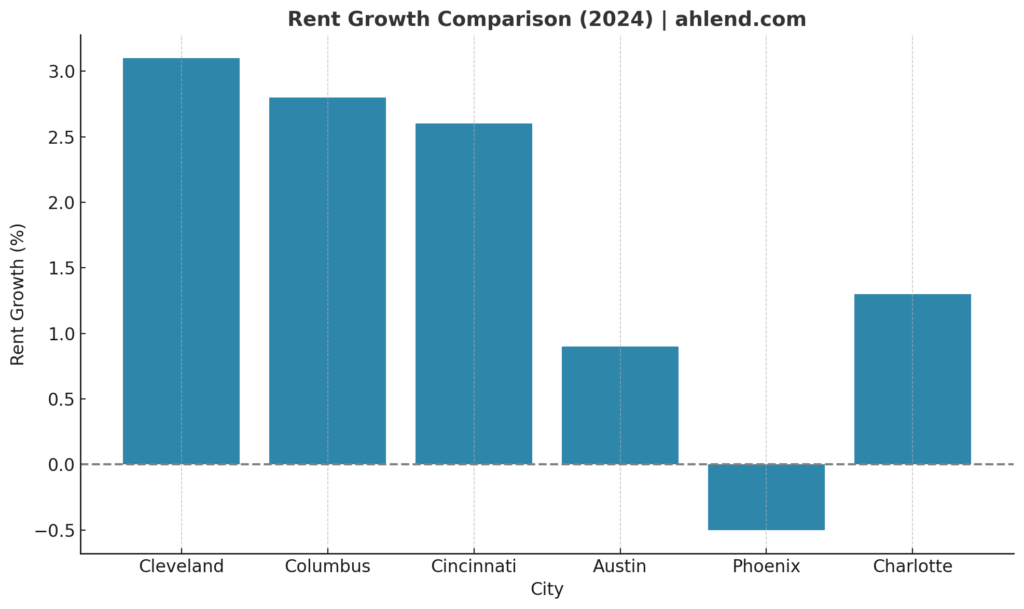

- Rent Growth: While national rent growth flatlined (around 0.4%), Ohio cities outperformed:

- Cleveland: +3.1%

- Columbus: +2.8%

- Cincinnati: +2.6%

- Home Price Growth: Statewide prices increased 7.3% in 2024, compared to ~3% nationally.

- Affordability: Average home value in Ohio is $235,000, nearly 35% below the national average. Translation? You can still buy cash-flowing properties without auctioning off your crypto wallet.

But the story gets even more compelling when you dig deeper:

But the story gets even more compelling when you dig deeper:

- Rental Affordability Ratios are among the best in the nation. Ohioans typically spend less than 25% of their income on rent, well below the 30% national average—meaning stronger tenant retention and less turnover risk for landlords.

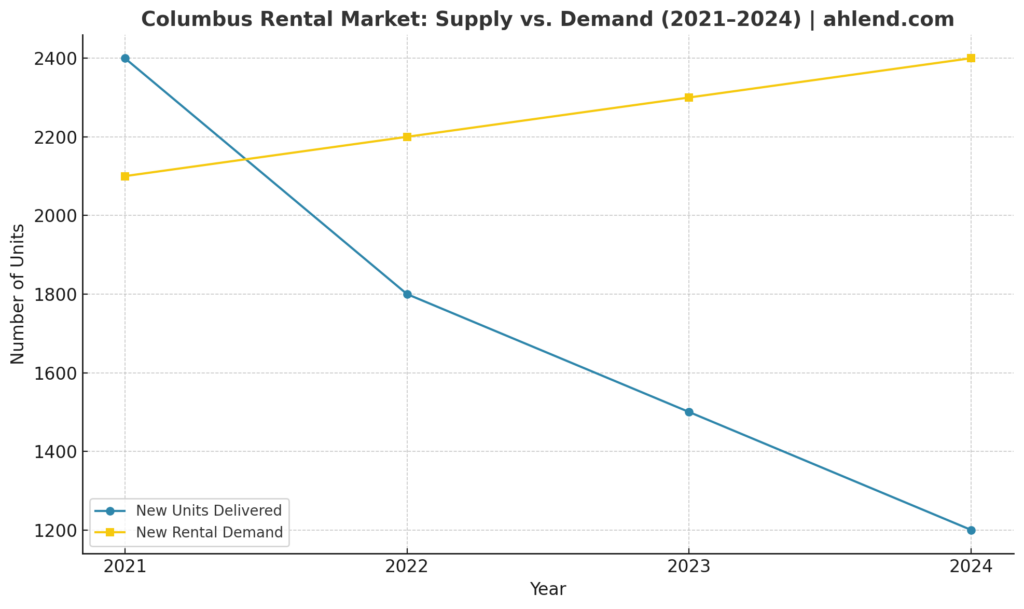

- Supply-Demand Imbalance: While some Sun Belt markets are dealing with a glut of new units, Ohio cities have seen construction slow as borrowing costs rise—tightening supply and helping landlords push rents higher.

- Investor Demand: According to recent lending reports, Ohio markets saw a 14% increase in DSCR loan applications year-over-year, outpacing the national average by over 2x.

- Strong Employment Centers: Columbus and Cincinnati rank among the top 20 U.S. cities for job growth in 2024, with major employers in tech, healthcare, logistics, and advanced manufacturing drawing in a steady population of renters.

Columbus offers job growth and infrastructure investment. Cleveland is experiencing a resurgence in key neighborhoods. Cincinnati’s steady economy and low cost of living continue to draw renters. And then there’s Toledo and Dayton, with low entry points and emerging appeal.

Columbus offers job growth and infrastructure investment. Cleveland is experiencing a resurgence in key neighborhoods. Cincinnati’s steady economy and low cost of living continue to draw renters. And then there’s Toledo and Dayton, with low entry points and emerging appeal.

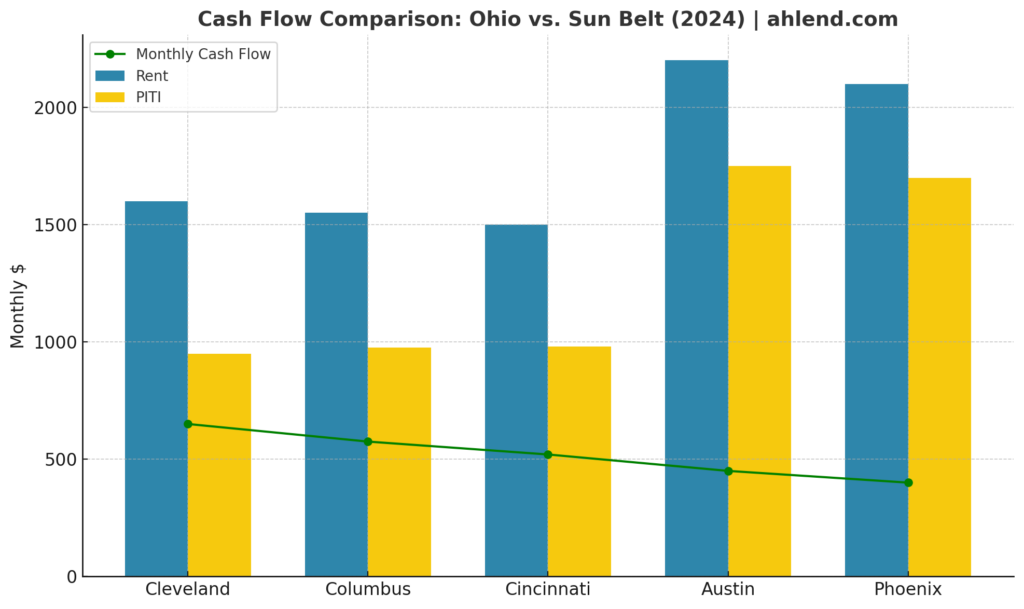

This combination—strong rent growth, high occupancy, and low prices—creates ideal conditions for DSCR loans. You don’t need Manhattan-level rents when the mortgage on a duplex in Cleveland is $800 and it brings in $1,600/month. The DSCR is healthy, the cash flow is real, and the barriers to entry are lower than your average down payment in Miami.

Put simply: Ohio isn’t just an affordable option. It’s a high-performance one.

Top Ohio Markets for DSCR-Backed Investments

Let’s take a deeper dive into some of the state’s most investor-friendly cities. Ohio’s diversity in job sectors, rental demand, property prices, and neighborhood types makes it a fertile ground for multiple investment strategies—from short-term flips and BRRRRs to long-term cash-flow rentals.

Columbus: The state’s capital is booming with job growth, thanks to tech giants like Intel setting up shop, Amazon expansion, and a surging healthcare and education sector. According to Colliers, Columbus experienced 2.8% rent growth in 2024 and continues to see upward pressure on occupancy, which has hovered around 95%. The average monthly rent is $1,309 as of late 2024, with multifamily vacancy tightening to just 5.2%. Developers have slightly pulled back from new construction, which should help buoy rents. Neighborhoods like Franklinton and the Near East Side are seeing significant gentrification and rental demand from young professionals and students.

Columbus: The state’s capital is booming with job growth, thanks to tech giants like Intel setting up shop, Amazon expansion, and a surging healthcare and education sector. According to Colliers, Columbus experienced 2.8% rent growth in 2024 and continues to see upward pressure on occupancy, which has hovered around 95%. The average monthly rent is $1,309 as of late 2024, with multifamily vacancy tightening to just 5.2%. Developers have slightly pulled back from new construction, which should help buoy rents. Neighborhoods like Franklinton and the Near East Side are seeing significant gentrification and rental demand from young professionals and students.- Cincinnati: Ranked among the nation’s top-performing rental markets in Q1 2024, Cincinnati saw a 2.5% rent increase with absorption of over 220 units in just the first quarter. Its metro-wide vacancy rate declined to 5.2%—down from 5.5% the year prior—signaling a tightening market. The job base is anchored by Fortune 500 companies (Procter & Gamble, Kroger), a growing logistics sector, and strong demand from healthcare and education tenants. Areas like Over-the-Rhine and Walnut Hills are seeing renewed interest from investors thanks to public/private investment, historic property conversions, and walkable amenities.

- Cleveland: Once undervalued and overlooked, Cleveland is gaining investor recognition with rising rents and limited new supply. In Q3 2024, average rents reached $1,199, up 3.6% year-over-year, with Class A units experiencing the strongest absorption. The city’s downtown core now accounts for over one-third of new multifamily inventory. Emerging neighborhoods like Detroit-Shoreway, Tremont, and Old Brooklyn offer vintage housing stock ripe for value-add strategies. Strong healthcare employers (Cleveland Clinic, University Hospitals) provide a stable tenant base, while the city’s aggressive tax abatement program continues to attract long-term investor capital.

- Dayton: Known for affordability and stability, Dayton’s rental market is competitive with average rents of $1,237—nearly 38% below the national average. Vacancy remains low, and rents have risen by over 54% in the last decade. Key employers like Wright-Patterson Air Force Base and Premier Health anchor economic activity. Home values have appreciated 110% over the past 10 years, offering dual appeal for both income and appreciation-focused investors. Submarkets like Kettering and Beavercreek are growing in popularity, and Dayton’s compact metro allows for efficient property management across multiple neighborhoods.

- Toledo: With average rents climbing 4% year-over-year in 2024 and vacancy dropping below 2.5%, Toledo’s rental market is gaining strength. Single-family rentals and smaller multifamily units near the University of Toledo and downtown are in high demand. The limited pipeline of new development, paired with an influx of working-class renters, makes Toledo a hidden gem for investors targeting affordability and high occupancy. Local property managers report waiting lists for renovated rentals under $1,200/month.

- Akron & Youngstown: These tertiary markets may not be sexy, but they deliver results. Akron saw home price appreciation over 11% year-over-year in 2024, while rents hovered in the $1,100–$1,200/month range. Youngstown is drawing interest from institutional and regional buyers focused on workforce housing. Though economic growth is slower, investor-friendly pricing and moderate rent growth still allow for strong DSCR margins. Seasoned investors who understand the local landscape can assemble portfolios for under $100K per door with strong 1.3+ DSCR ratios.

Taken together, these markets form the core of Ohio’s investment opportunity set. Whether you’re chasing appreciation in Columbus, cap rate in Cleveland, or BRRRR velocity in Dayton, Ohio’s rental market—backed by DSCR flexibility—gives you the sandbox to build real wealth at scale.

DSCR Loans in Action: Why Ohio Investors Love Them

Let’s break down a real-world scenario. Say you snag a duplex in Akron for $150,000. It rents for $1,500/month. With a 75% LTV DSCR loan at 7.25%, your monthly PITI (principal, interest, taxes, insurance) might run about $950. That’s a DSCR of 1.58. Not only does the deal cash flow, it qualifies easily without touching your tax returns or pay stubs.

This is the bread-and-butter math that makes Ohio irresistible to DSCR-driven investors.

And here’s the cherry on top: DSCR lenders are thriving in Ohio. Many offer 30-year fixed rates, interest-only payment options, and allow properties to be held in an LLC—a huge plus for investors thinking long-term. Some lenders even offer cash-out refinances that consider market rents and after-repair values, giving BRRRR investors a smooth exit.

Oh, and about that fine print? Ohio law prohibits prepayment penalties on loans under ~$112,000. So if you’re executing a fast flip or refinancing early, you’re not hit with extra costs just for being efficient.

DSCR financing removes traditional hurdles, speeds up closings, and simplifies scaling. Whether you’re buying your fifth rental or your fifteenth, it makes portfolio growth more accessible.

Why Ohio Beats the Sun Belt (For Now)

Everyone loves a good Florida flip or Texas turnkey—until the insurance premium triples, the HVAC dies in August, and your rent-to-price ratio falls apart faster than a sandcastle in a thunderstorm.

- Higher Cap Rates: In Ohio, 6-10% cap rates are realistic, not mythical.

- Lower Insurance Costs: With no hurricanes, no coastal flooding, and fewer wildfires, insurance premiums are a fraction of what they are in Florida or California.

- Stable Rents: While Sun Belt markets are seeing some softness post-2021 surge, Ohio rents continue to rise modestly and predictably.

- Less Institutional Competition: Unlike Phoenix or Atlanta, you’re not bidding against hedge funds and iBuyers in most Ohio markets.

- Economic Diversity: Ohio’s economy is more than cornfields and Buckeyes. It boasts robust healthcare, manufacturing, education, and growing tech sectors.

Yes, Ohio winters can be intense. Snow shovels and salt are part of the lifestyle. But so is stable, year-round tenant demand and high occupancy. And let’s face it, that $130K fourplex in Cleveland doesn’t have to be beachfront when it’s producing $800 in net cash flow every month.

Closing Thoughts: Is Ohio Your Next Investment Market?

Ohio might not have splashy real estate headlines, but it has what savvy investors crave: cash flow, stability, affordability, and scale. With DSCR financing, it becomes even more powerful.

You don’t need to be a billionaire or a spreadsheet wizard to win here. You just need to understand the fundamentals, buy right, and use the right financing tools.

At American Heritage Lending, we specialize in DSCR financing for real estate investors who want to grow smarter and faster. Whether you’re picking up your first duplex in Dayton or refinancing a 10-door portfolio in Columbus, we have the expertise, products, and speed to help you make it happen.

Ohio might not be flashy. But it’s cash-y.

And that, dear investor, is what long-term wealth is made of.

Frequently Asked Questions

Why are real estate investors increasingly choosing Ohio for DSCR rental properties?

Ohio has become a favorite among cash-flow investors thanks to affordable home prices, rising rents, high occupancy, and stable job markets. With average home values around $235K and occupancy rates above 95% in major metros, investors can achieve stronger DSCR ratios and better monthly margins compared to many Sun Belt markets.

Which Ohio cities offer the best opportunities for DSCR-backed investments?

Columbus, Cincinnati, and Cleveland lead the state with strong rent growth, job expansion, and tight vacancies. Secondary markets like Dayton, Toledo, Akron, and Youngstown provide even higher yields and lower entry costs, making them ideal for BRRRR strategies and cash-flow portfolios.

Why do DSCR loans work so well in the Ohio rental market?

Ohio’s combination of low property prices and steady rental demand produces healthy DSCR ratios, even with higher interest rates. DSCR loans allow investors to qualify using property income instead of tax returns or DTI, making it easy to scale portfolios with 1–4 unit rentals, duplexes, and small multifamily properties across the state.

How does Ohio compare to Sun Belt markets like Florida, Arizona, or Texas for rental investing?

Ohio offers higher cap rates, lower insurance costs, and more stable rent growth than many overheated Sun Belt metros. While markets like Phoenix and Austin face oversupply and regulatory pressure, Ohio cities continue to deliver predictable rents, low vacancy, and minimal natural-disaster risk, making long-term DSCR performance easier to maintain.

Sources

-

MMG Real Estate Advisors (Columbus, Cleveland, and Cincinnati market reports)

-

Colliers (Columbus multifamily trends)

-

Matthews Real Estate Investment Services (Cleveland multifamily insights)

-

Cushman & Wakefield (Cincinnati MarketBeat reports)

-

RealWealth Network (Dayton real estate market overview)

-

Luxion Homes (Toledo market performance analysis)

-

RKG Commercial (Toledo rental trends)

-

Zillow (Ohio housing value data)

-

U.S. Census Bureau (Median rent and rent-to-income ratios)

-

American Heritage Lending internal DSCR lending data (2023–2024 trends)