One Time Close Construction Loan To Permanent Financing For Build To Rent Investors

-

Up to 87.5% LTC For Construction

Funding For 100% Of Construction

Close In 2 Weeks Or less

Up To 80% LTV For Refinance

No Secondary Closing After Completion

0 Point Program & Deferred Point Program Available

Direct Lender, No Hidden Fees

No Pre-Payment Penalty

Available In 47 States

Let’s Build Something Together. Get Started Today.

Single Close Construction To Permanent Rental Financing Loans

Innovative Loans For Forward-Thinking Investors.

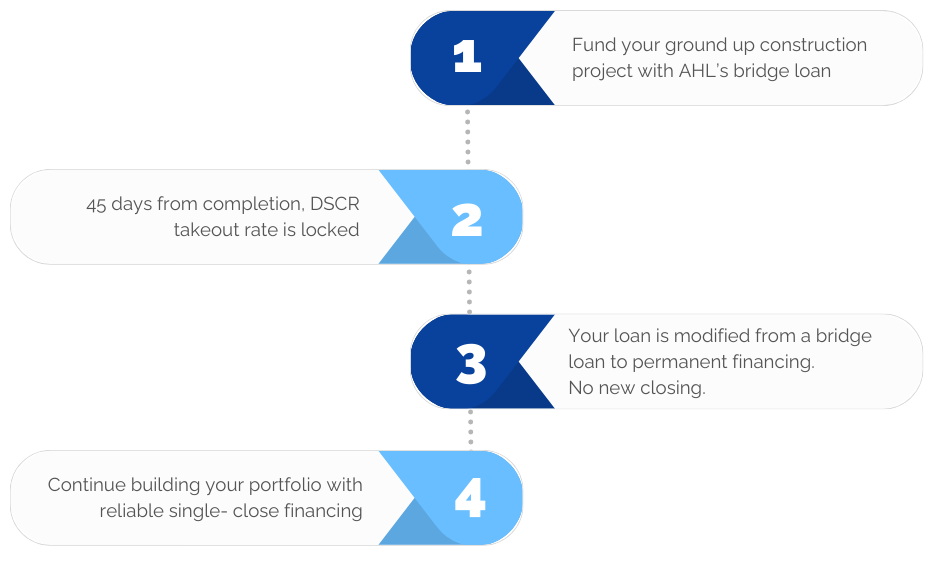

Introducing the One-Time Close Construction to Permanent Loan—a game-changing solution designed for visionary real estate investors and developers. This innovative financing product simplifies the process of funding your construction projects, offering a seamless and comprehensive solution that takes you from blueprint to completion without the headaches of traditional financing.

With the One-Time Close Construction to Permanent Loan, you combine the power of construction and permanent financing into a single, streamlined package. No need for multiple loan applications, approvals, or redundant paperwork—just one easy, efficient loan to cover the entire project from start to finish.

Same Day Prequalification

There For You Wherever You Need Us

Indicates Available Business Purpose Lending

The Importance of Private Lenders in Construction Lending

Private lenders are a vital part of the real estate industry, particularly for investors involved in ground-up construction projects. While traditional banks are typically focused on long-term, low-risk financing options, private lenders like American Heritage Lending offer flexible, customized loan products designed specifically to meet the unique demands of real estate investors. When it comes to financing construction, private lenders stand out as a preferred choice due to their ability to act quickly, offer flexible loan structures, and provide financing for projects that may not meet the stringent requirements of conventional lending institutions.

Flexibility to Meet Investor Needs

One of the biggest advantages of working with private lenders is their ability to offer flexible financing terms. Unlike traditional lenders that may impose rigid requirements based on credit scores, income verification, and lengthy underwriting processes, private lenders take a more holistic approach to evaluating the viability of a construction project. With products like American Heritage Lending’s One-Time Close Construction to Permanent (C-to-P) Loan, the focus shifts from borrower-specific metrics to the value of the project itself and its potential as an investment.

This flexibility allows real estate investors to secure financing even for more complex construction projects, such as those involving distressed properties or multifamily units. With private lenders, you can tailor loan structures that better fit your investment strategy, including features like DSCR (Debt Service Coverage Ratio) loans. DSCR loans base their approval on the income-generating potential of the property, making them an excellent option for rental property investors who may not have traditional income streams.

Speed and Convenience

Time is of the essence in the real estate industry, especially for ground-up construction projects. Delays in financing can lead to increased costs, missed opportunities, and a slow start to the project. Private lenders, like American Heritage Lending, offer quick approvals and fast funding, often within days or weeks, in contrast to the months-long process of conventional lenders. This accelerated timeline is crucial when bidding on properties, purchasing materials, or paying contractors to keep construction on track.

According to BuildZoom, the average time to complete a ground-up single-family home project is between 7 and 12 months. Securing quick financing can help investors complete projects more efficiently and capture profits faster, making private lenders an attractive option for investors focused on maximizing their returns in a competitive market.

Growing Demand for New Construction

Ground-up construction is becoming an increasingly popular choice for real estate investors. According to the National Association of Home Builders (NAHB), single-family home construction accounted for 12.5% of home sales in 2022. The demand for new housing continues to rise, driven by a shortage of inventory in many regions and the increasing popularity of custom-built homes. As rental demand also increases, investors see significant opportunities to build and hold newly constructed properties.

By choosing a private lender like American Heritage Lending, investors can quickly secure the capital they need to break ground on projects in these high-demand areas, offering both short-term profits from sales or long-term returns from rental income.

The Benefits of In-House Takeout Financing

Another unique advantage of working with American Heritage Lending is their ability to provide in-house takeout financing. In the world of construction financing, takeout financing refers to the loan that replaces the initial construction loan with a permanent mortgage after the project is complete. Traditionally, this would require investors to refinance and go through an entirely new loan approval process, which can be time-consuming and costly.

By providing in-house takeout financing, American Heritage Lending eliminates the need for investors to secure financing from a new lender after construction. This brings several key benefits:

Seamless Transition from Construction to Permanent Loan

With American Heritage Lending’s in-house takeout financing, you avoid the need to re-apply for a separate mortgage at the end of construction. The loan automatically converts from a construction loan to a permanent mortgage, ensuring a smooth, seamless transition. This saves time and prevents any potential delays in securing permanent financing, allowing investors to focus on completing their projects and moving on to the next opportunity.

Reduced Costs

When investors have to refinance their construction loans into permanent loans through another lender, they often face two rounds of closing costs. According to Zillow, typical closing costs for a mortgage range from 2% to 5% of the loan amount. By bundling construction and permanent financing into one loan, investors only pay closing costs once, resulting in significant savings that can be reinvested into the project or the next investment.

The Uniqueness of the One-Time Close Product

One of the most significant advantages offered by American Heritage Lending is the One-Time Close Construction to Permanent Loan. This product combines the construction and permanent financing into one loan, requiring only a single closing. This is a game-changer for real estate investors, offering several distinct benefits over traditional loan products.

One Loan, One Closing

The One-Time Close Construction to Permanent Loan eliminates the need for two separate loan applications, approvals, and closings. Instead, investors complete the financing process in a single step, covering both the construction and permanent phases with one loan. This means fewer hassles, less paperwork, and reduced stress for investors.

Loan Modification vs. Refinance

Traditional construction loans require refinancing once the project is completed, which involves going through another full loan approval process. This includes a new appraisal, re-qualification of the borrower’s income, and additional fees. With American Heritage Lending’s One-Time Close product, the loan is simply modified, not refinanced, after the construction phase.

Predictable Terms and Costs

The One-Time Close Construction to Permanent Loan provides investors with predictable terms and costs, which is critical for accurate budgeting. By locking in both the construction and permanent loan terms from the start, investors have a clear understanding of their financing costs and can plan accordingly. This eliminates the uncertainty that comes with unexpected refinancing fees.

Growing Popularity of Ground-Up Construction and DSCR Loans

The rise in demand for new housing and rental properties has made ground-up construction an increasingly attractive investment strategy. The National Association of Realtors (NAR) reports that inventory shortages across the country are fueling demand for newly built homes, giving investors a lucrative opportunity to fill this gap through new construction.

Similarly, DSCR loans have become an essential tool for real estate investors focused on rental properties. These loans allow investors to qualify based on the rental income the property generates, rather than relying solely on personal income. According to ATTOM Data Solutions, investor activity in the housing market has continued to rise, with many leveraging DSCR loans to expand their portfolios without needing to meet the traditional income documentation requirements of conventional loans.

Choosing the Right Lender for Construction Financing

Selecting the right lender for your construction project is crucial. Investors need a lender that understands the complexities of ground-up construction and can provide flexible, tailored solutions. American Heritage Lending offers a One-Time Close Construction to Perm Loan that combines all of these essential features into one easy, streamlined process.

Access to Scalable, Stable Capital

When it comes to construction lending, you want to work with a lender that has access to scalable and stable capital. This ensures that you’ll have access to additional funds if your portfolio expands or your financing needs change. Additionally, stable capital means the lender can continue to fund projects, even in changing market conditions. American Heritage Lending provides reliable capital solutions that allow investors to complete their projects with confidence, regardless of market fluctuations.

In conclusion, the One-Time Close Construction to Permanent Loan from American Heritage Lending is a cutting-edge product that simplifies the financing process for real estate investors. With in-house takeout financing, streamlined loan modifications, and the ability to lock in interest rates, this product offers unparalleled benefits for investors looking to complete ground-up construction projects efficiently and cost-effectively. Whether you’re building a rental property or your next investment project, American Heritage Lending provides the tools and support to help you succeed.