BANK STATEMENT LOANS

Our BANK STATEMENT RATES & TERMS:

Property Types

Loan Amounts

$75,000 – $3,000,000

Term

30 year fixed with interest-only loans available.

Loans Available

Bank statement loans are for self-employed individuals who prefer to use their bank statements to prove their qualifying income and eligibility for financing. Self-employed borrowers include those with a 25% or greater ownership interest in a business/entity or are paid using the IRS form 1099. Bank statement loans do not require you to share your tax returns or W2s.

Single or multiple rental properties

Up to 80% of the value

$75,000 – $2 million

Purchase or Refinance

Fixed or Adjustable options on 30-year terms

Bank statement loan financing is available from Non-QM lenders but not from traditional lenders such as banks. Financing a property with bank statement loans is a quick and straightforward process for an experienced lender like American Heritage Lending.

Bank Statement-BASED FINANCING

Bank Statement loans are for self-employed borrowers and those with multiple income sources. Common business structures that may be eligible for bank statement loans include:

- Sole proprietorships

- Limited Liability Company (LLC)

- Partnerships

- S-Corporation

- Corporation

Not everyone qualifies for a traditional loan. Self employed people are creative and ambitious and their compensation comes in many forms. American Heritage Lending helps its self employed clients qualify for loans without the traditional income qualification standards.

WHY CHOOSE A Bank Statement LOAN?

If you’re self-employed or report income on a 1099, you are likely to have difficulty getting a loan through a traditional lender like a bank or credit union. With American Heritage Lending, you don’t have to show your tax returns or W2 to get approved for a loan, just your bank statements.

We understand the need to move quickly when opportunities arise. Our application, appraisal, and approval process can be accomplished in just a few days to ensure you can negotiate effectively with the property holder.

USE OUR BANK STATEMENT LOANS WHEN TRADITIONAL LENDING SOLUTIONS ARE NOT AVAILABLE

Traditional banks will often disqualify self-employed borrowers wanting to use their bank statement to qualify for a loan or charge them a high rate. This barrier is because lenders calculate your “qualifying” income based on your taxable income. Business owners and self-employed individuals write off many of their business expenses, reducing their taxable income and their “qualifying” income.

American Heritage Lending caters to the self-employed with bank statement-based lending options. Qualifying income for our lending services is the borrower’s 12 or 24 monthly average income. These flexible lending options allow self-employed borrowers the same financing abilities as those using their taxes to prove qualifying income.

BANK STATEMENT LOAN SCENARIOS WE COMMONLY ASSIST WITH BUT ARE NOT LIMITED TO:

- Business owners

- Contractors

- Gig jobs

- Seasonal work

Two-year employment history is required for the income to be considered stable and used for qualifying. When the borrower has less than a two-year history of receiving income, the borrower must provide a written analysis to justify the stability of the income used to qualify the borrower. It is essential to establish your income as ongoing to be eligible for a loan.

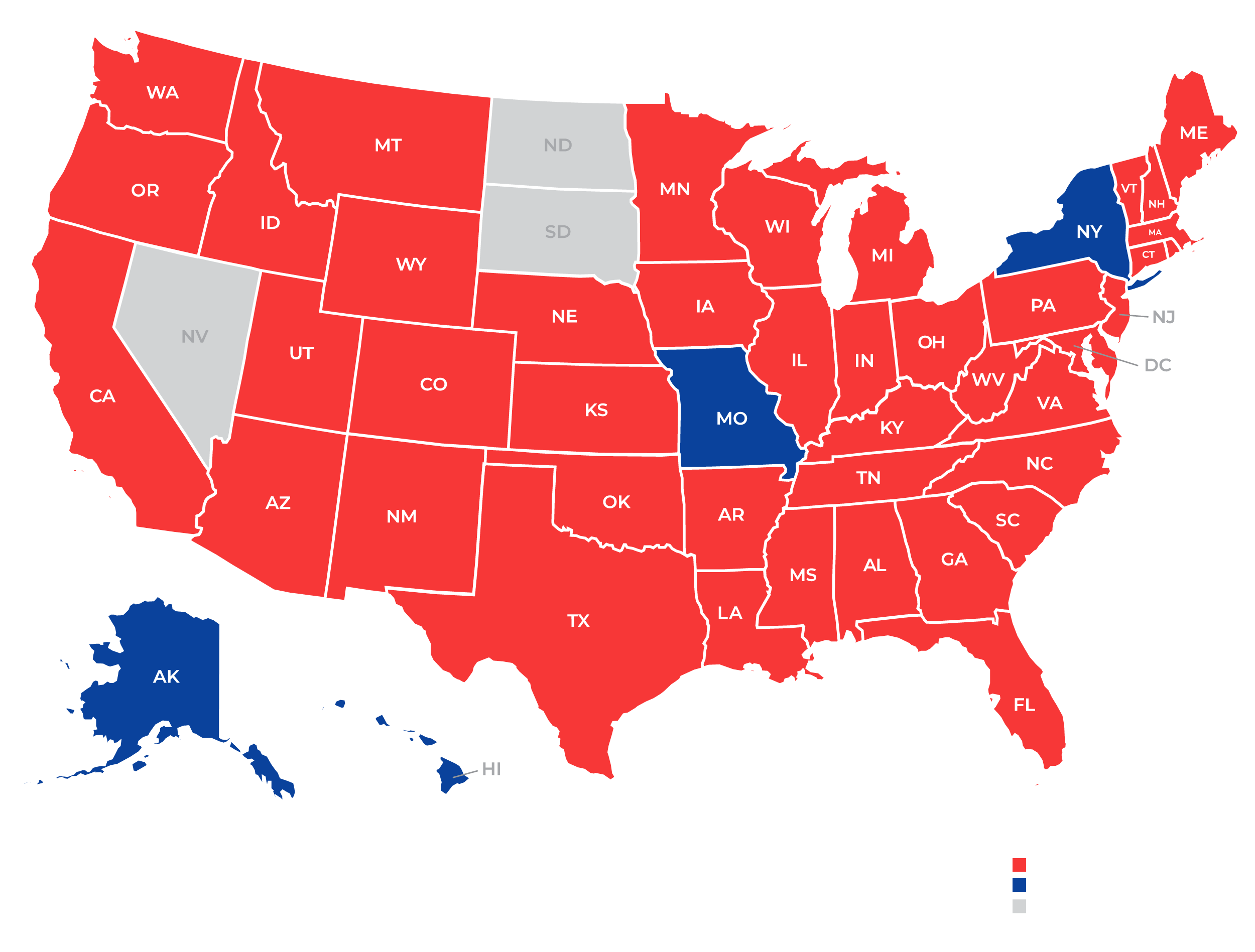

States We Lend In